Grocon administrators advise against liquidation, large creditors to get 3c in the dollar under proposed plan

Grocon administrators have revealed the construction group was insolvent since February 2019 but advised against putting it into liquidation.

Grocon’s administrators have advised against winding up the collapsed construction giant after revealing the complex group has been insolvent since February 2019, deeming a deed of company arrangement in the best interests of creditors.

Grocon has placed 88 subsidiaries - many of them dormant - in the hands of KordaMentha, blaming its plight on the Central Barangaroo project in Sydney, dominated by Crown Resorts’ new casino.

Grocon alleges rival Lendlease and Crown Resorts reached a secret deal with Infrastructure NSW on building heights in 2019, protecting the rights of Crown tower – Sydney’s tallest building – to unobstructed views of the harbour.

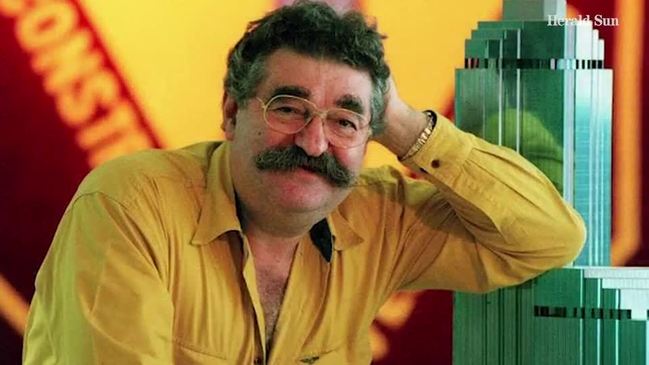

Grocon is now embroiled in litigation with the state government, seeking compensation in the NSW Supreme Court, with chief executive Daniel Grollo claiming the agreement killed off his group’s plans to build smaller commercial and residential towers nearby.

Grocon last month said it needed to take the dramatic step to place the subsidiaries in administration to preserve cash for the bitter court battle.

On Tuesday, KordaMentha’s 1500-plus page report following the second meeting of creditors became available, revealing the companies had greater liabilities than assets and could not pay their debts when due.

“However ... it is our view that the immediate winding up of the companies would not commercially be in the interests of the companies’ creditors,” the administrators said.

KordaMentha said its investigations were not concluded, but it held the opinion that Mr Grollo would likely be able to rely on the protections of Safe Harbour provisions with respect of any insolvent trading claims.

The laws are aimed at encouraging the pursuit of rescue plans, offering a protection if the director can show that the debts incurred while insolvent were part of a course of action that was reasonably likely to result in a better outcome than if an administrator or liquidator was appointed.

KordaMentha said it was not aware of any serious offences that may have been committed and accordingly has not reported to the Australian Securities and Investments Commission.

As previously flagged, the administrators have recommended entering into a DOCA rather than wind up Grocon.

The report showed employees were owed $7.4m while the value of the claim in the Barangaroo stoush was believed to be at least $200m.

Employees would get 100 per cent of what they’re owed under the recommended plan, versus 42 cents in the dollar under liquidation.

KordaMentha estimates large creditors and bond providers would receive just 3 cents in the dollar under the pooled DOCA versus nil under liquidation.

Mr Grollo has previously said that if the case against iNSW was successful, he intended to pay out creditors in full and the companies could be revived.

KordaMentha said it was not appropriate to comment on the prospects of a court win, but the claim was being considered in a bona fide and responsible manner, noting Grocon had secured an agreement with a reputable litigation funder.

The group, which is bound up in inter-company loans, was founded as a concreting business by Mr Grollo’s grandfather Luigi in 1940.