Government bails out 77 financially ruined homeowners at defective apartment block

The email spelled disaster for 77 homeowners, and now, years later, it’s come back to bite the government.

A group of 77 apartment owners thought they were financially ruined and facing a lifetime of debt – but the government has extended them a rare lifeline.

News.com.au previously reported that an apartment complex in Melbourne was so riddled with defects that its owners were left to foot a $4.5 million bill.

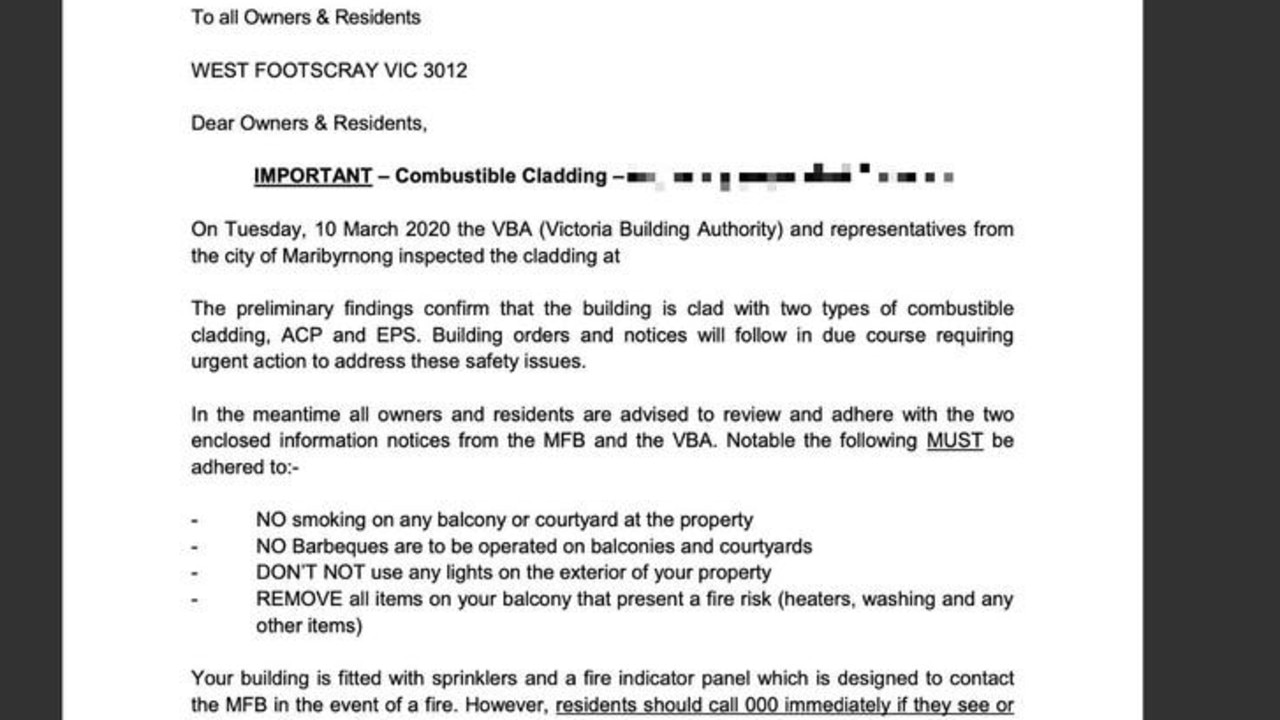

It all started in 2020 when they received an email from their strata firm warning them that the block might go up in flames because combustible cladding had been installed. It turned out to be the first of many defects.

Residents at the West Footscray block, mostly made up of first home buyers and retirees, had begun a lawsuit against the building company responsible, Shangri-La Construction when it went bust last year.

The true horror of their situation soon sunk in, as a blind spot in the law meant that apartments higher than three storeys are not automatically insured if their builder goes under, leaving its residents with no way to recover the money needed to carry out the rectification works for the West Footscray apartment.

“You can’t come back from this, it’s a life sentence,” 32-year-old Andrew John, one of the residents, told news.com.au.

But earlier this year, after media attention and advocacy from its tenants, they received a one-off $5 million payment.

The group of apartment owners had been lobbying their local member Katie Hall for the help they desperately needed.

News.com.au spoke to 11 apartment owners, some of whom had had to move back in with their parents and still aren’t breaking even. Others are more than $10,000 behind in payments. One person says they are suicidal. A few were left unable to even inhabit their apartment block due to serious defects, including leaking and mould issues and one instance where a woman had to deal with a waterfall in her living room.

The strata company managing the West Footscray block secured a loan to pay off the defects estimated to take 15 years to pay off.

Annual strata fees had spiralled to about $10,000 a year, more than people’s mortgages in some cases.

As of the end of July last year, when news.com.au first reported on their plight, 18 out of the 77 owners were in arrears on their strata payments. In total, the block was $86,000 behind in strata payments.

In May, the Victorian government stepped in by providing $5 million to repay the owners corporation for the loan taken out.

“The funds provided went beyond the costs to rectify substantial latent defects and included reimbursement for expenses such as legal costs, non-critical maintenance works (for example painting) and interest fees that had occurred on the loan,” one letter from the government read.

“We’re pretty chuffed to get the $5 million,” Mr John said.

However, he also pointed out that it was a government oversight in the first place that left residents in such a dire situation, so it should be up to them to rectify the situation, he added.

“We traced this back to the fact that the government’s own poor legislation allowed these builders to operate without insurance” Mr John lamented.

“If we had insurance, we would have been eligible for compensation under DBI (Domestic Building Insurance).

"We’re still very resentful that the government took so long to look into mandatory insurance requirements and making builders accountable.”

The Victorian government pledged to reform its building industry laws last year to better protect consumers in light of the collapse of major construction firm Porter Davis Homes, which left nearly 1000 homeowners out of pocket.

At the end of last year, an expert panel made 14 recommendations which included protection for apartment owners moving into a multistorey block.

The report is calling for the government to introduce a Developer Bond Scheme for residential apartment buildings higher than three storeys or a project deemed “high risk”.

This would mean that developers have to pay a bond to a government authority and it would be held there as a kind of surety.

“The bond would be held for a fixed period to cover the costs of rectifying specified defects,” the report states.

“The bond would be set as a percentage of the contract price and be returned to the developer should no defects be found before the fixed period expires.”

A similar rule is already in place in NSW.

alex.turner-cohen@news.com.au