Victorian government cracks down on bizarre three-storey rule after 77 apartment owners ruined

The Victorian government is considering a major change to the process of building apartment blocks after multiple homeowners were stung by a blind spot in the law.

The Victorian government is considering a major change to the process of building apartment blocks after multiple homeowners were stung by a blind spot in the law.

In September, news.com.au reported that a loophole had left 77 Melbourne apartment owners financially ruined.

Apartment complexes more than three storeys high are not covered by Domestic Building Insurance (DBI) under Victorian law, which means if the builder goes bust, those buildings have no insurance to automatically pay to fix defects.

This was certainly the case for the 77 residents at a four-storey block in West Footscray, inner Melbourne, who were left to foot the $4.5 million defect bill themselves.

Their builder, Shangri-La Construction, went into liquidation earlier this year after residents had begun a lawsuit against the building firm, leaving them with no recourse.

This caused many to find themselves tens of thousands of dollars in debt and forced some to move in with parents, and in one case, a resident was left suicidal.

But on Tuesday, the Victorian government announced a slew of changes to better regulate the building industry and protect future homeowners who might find themselves in the same predicament.

The expert panel’s report has 14 recommendations which includes protection for apartment owners moving into a multistorey block.

Earlier this year the Victorian government pledged to reform its building industry laws to better protect consumers in light of the collapse of major construction firm Porter Davis Homes, which left nearly 1000 homeowners out of pocket.

It released phase one of an expert panel’s recommendations and announced another 14 possible changes on Tuesday.

The report is calling for the government to introduce a Developer Bond Scheme for residential apartment buildings higher than three storeys or a project deemed “high risk”.

This would mean that developers have to pay a bond to a government authority and it would be held there as a kind of surety.

“The bond would be held for a fixed period to cover the costs of rectifying specified defects,” the report states.

“The bond would be set as a percentage of the contract price and be returned to the developer should no defects be found before the fixed period expires.”

A similar rule is already in place in NSW.

Other recommendations in the report included punishing builders who had failed to take out insurance before accepting deposits from customers.

Penalties of up to $96,000 will apply for an individual or $480,000 for a company.

Unfortunately, these changes have come too late for the residents at the West Footscray block, but they are hopeful it will stop other Australians feeling their pain.

"It's good to see Labor making an attempt at reform but too little too late for us already severely indebted being swept under the rug," Andrew John, one of the residents, told news.com.au in the wake of the decision.

Residents at the West Footscray block dread receiving their quarterly strata fees, which has spiralled to be about $10,000 a year, more than people’s mortgages in some cases, and is expected to take 15 years to pay off due to the many defects.

A strata levy dated 2015 for a two-bed, two-bath apartment required $1134 to be paid per quarter.

But by 2018 in the same period, this had climbed to $1729.

The most recent levy, sent out on August 1, amounts to $2926.50, to pay down the substantial debt residents have taken on to fix the defects that have been identified by independent building reports.

“You can’t come back from this, it’s a life sentence,” Mr John, 32, previously told news.com.au.

“There’s people who are retiring, people with disabilities, we’re all stuck. You walk past people here, no one smiles, no one talks to you. We’re at our wit’s end.”

Zoe Muller, 47, has been forced to move back in with her mother as she drowns in debt. She is $6000 behind in payments.

“Half my wage goes to strata fees, the other 25 per cent goes to mortgage, I have hardly any left over,” she told news.com.au.

“That’s the reason I decided to move (into my mum’s), I couldn’t afford to live anymore really.”

Another resident, Jessi*, only managed to save $200 last year amid the rising costs in the apartment.

“Essentially I’m working to live,” the teacher told news.com.au.

Others are struggling to accumulate savings, including Maria de Leon, 29, telling news.com.au: “I didn’t save at all last year. I was eating into my savings.”

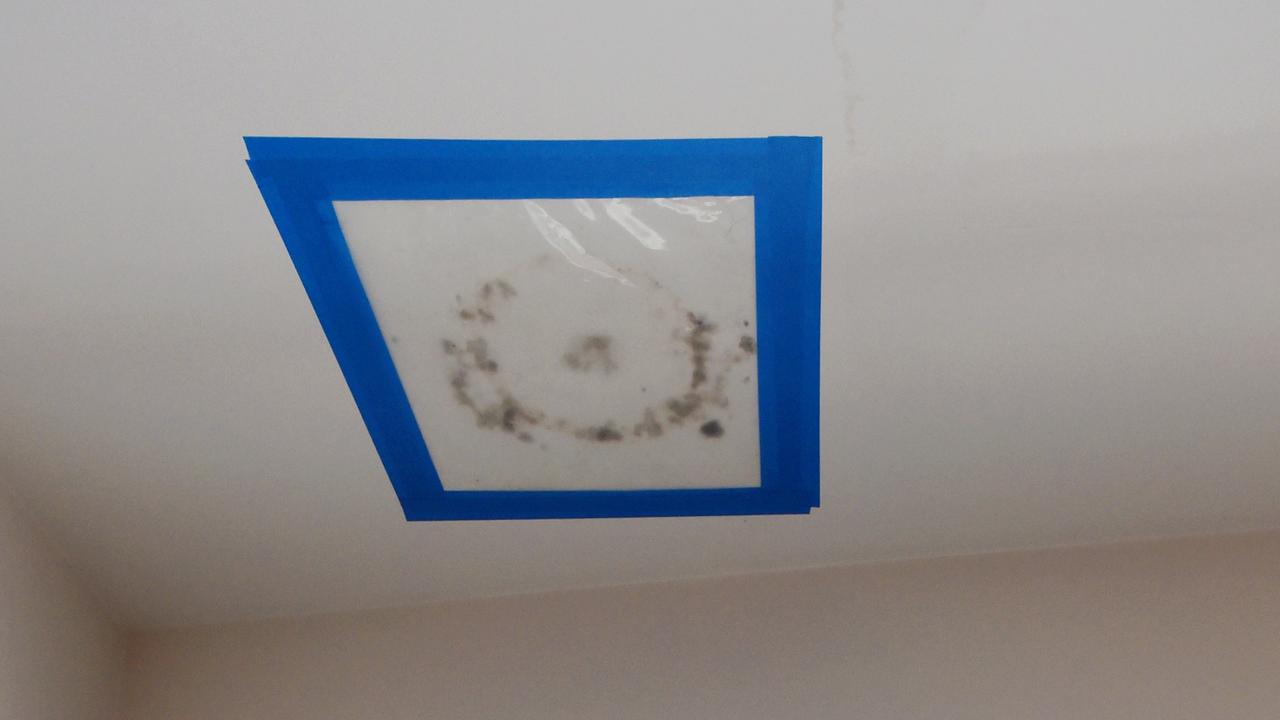

According to the Australian Apartment Advocacy, between 50 and 60 per cent of apartment owners have “critical defects” in their block such as structural cracking or water penetration problems.

An academic paper published in 2019 puts that figure even higher.

A whopping 85 per cent of all the buildings analysed had at least one defect across multiple locations, according to the report, authored by Nicole Johnston and Sacha Reid of Deakin University and Griffith University.

In another concerning revelation, the academics found that there are more issues in taller residential buildings, even though these are the ones with no insurance protection.

“More defects are located in higher density housing as a result of inferior materials, a lack of worker motivation (due to repetitive work) and tighter time schedules forcing workers to rush,” the report noted.

The issue is only set to get worse as more Australians turn to high density housing.

Samantha Reece, the CEO of The Australian Apartment Advocacy, has been calling for a change to the three-storey rule for some time.

“We want insurance protection to be equitable whether you buy a single storey house or on the 33rd floor in an apartment building,” Ms Reece said.

“Anyone in Australia living in four storeys or higher does not have home warranty insurance protection if their builder goes bust.

“That means that owners are having to pay a defect bill, sometimes as much as $9 million. How is that fair?”

At the crux of the problem is a decision the government made in 2003 which now, two decades later, has left homeowners high and dry.

That year, a new ministerial order was passed for the Domestic Building Contracts Act which introduced Builders Warranty Insurance nationwide.

The insurance has different names in each state — with the exception of Tasmania where there is no scheme — and requires the builder to take out insurance that covers homeowners in the event that the builder dies or disappears, or the building company goes bust.

But according to Ms Reece, the last resort scheme caused a stir from large developers, leading to a significant amendment.

The scheme was broken down into separate phases, for any residential building below the three storey threshold, and then for construction projects four storeys or higher.

The only problem was, the government never rolled out the second phase.

“It got pushed to the wayside and no-one made a fuss,” Ms Reece said.

“There’s no use building apartments if there’s no community confidence.”