Builder St Hilliers collapses with $40m owed, 19 projects in limbo

The full scale of the collapse of a failed construction giant has been revealed, with $40 million owed to creditors.

Failed construction giant St Hilliers owes $40 million to creditors, including $10 million to subcontractors and suppliers and $2 million to staff as the full scale of its collapse has been revealed.

Administrators Glenn Livingstone and Alan Walker of WLP Restructuring, who took charge of the construction division of St Hilliers last week, confirmed the liabilities following a creditor’s meeting today.

Know more? | michelle.bowes@news.com.au

The administrators are working to get 19 projects restarted so that subcontractors and suppliers can be paid, after all activity by the company was brought to a halt last week.

Work on one Queensland project is set to recommence as soon as today, however St Hilliers’ contracts for two other Queensland-based projects have been terminated.

As a result, six staff have been made redundant by the company.

At the time of its collapse on February 5, the company owed $2 million in employee entitlements to 22 staff that had already been made redundant, and if the company were to fail, it is understood that the amount owed to another 76 employees would increase to $4.3 million.

There were also $16.6 million in potential retention claims owing and $13.5 million in cash-backed bank guarantees held for clients, the administrators confirmed.

Retention claims relate to a percentage of project payments that are held until the completion of the project in case defects need to be fixed.

A combination of wet weather delays, fixed-price contracts, rising interest rates and increasing costs are understood to be responsible for the company’s decline.

The administrators are seeking an extension of up to three months from creditors, who have the power to force the company into liquidation, and Mr Livingstone told The Australian that if work does restart on some of the company’s projects, funds would be held in trust accounts to ensure subcontractors are paid.

“We will need to look after these people if we are to be successful in getting projects done,” he said.

Of the projects that are in limbo, 10 are for the Department of Defence.

St Hilliers director and founder Tim Casey is also understood to be planning to submit a Deed of Company Arrangement (DOCA) proposal prior to the second meeting of creditors.

Under a DOCA, creditors typically receive cents in the dollar on outstanding debts while the company’s debts are wiped and they are able to continue to trade.

According to financial documents filed with the Australian Securities and Investments Commission (ASIC), the group reported revenue of $164 million in 2023, but made a loss of $8.9 million in the last financial year and a loss of $3.1 million the previous year.

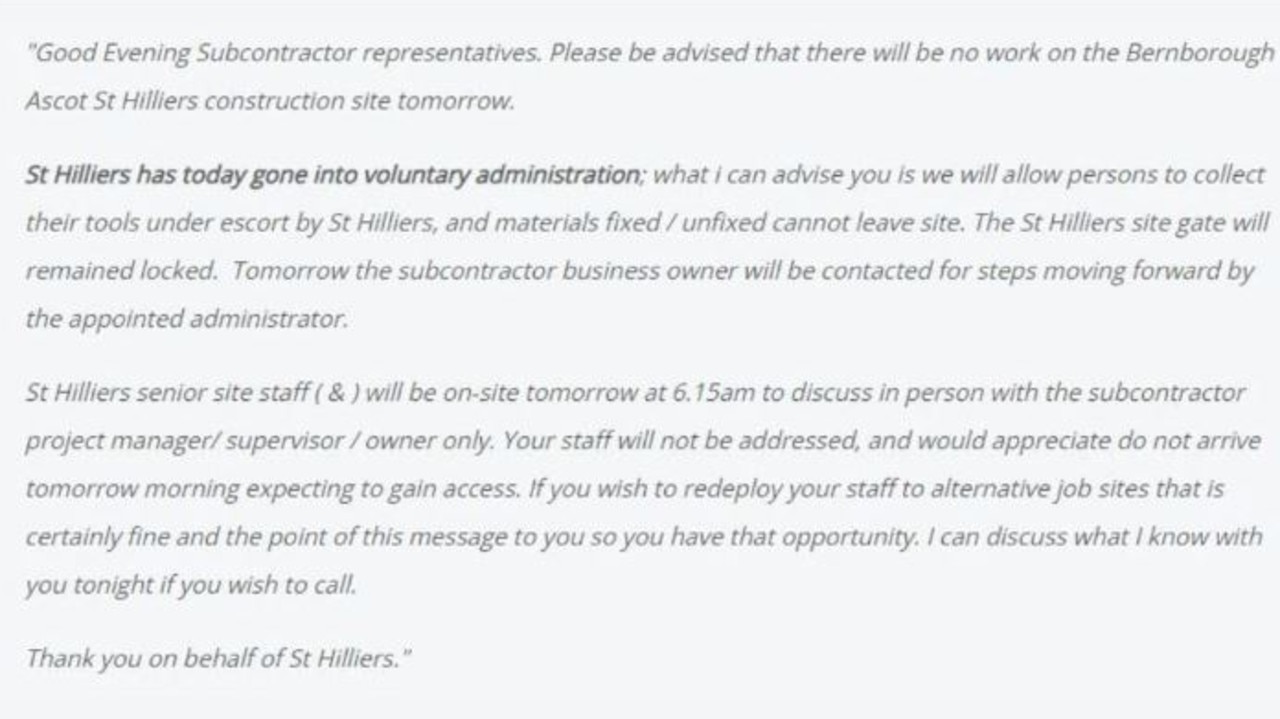

Among the projects affected by the Sydney group’s administration are the Bernborough retirement village in the Brisbane suburb of Ascot and the Thornton Central development in Penrith, in Sydney’s outer west.

Mr Livingstone and Mr Walker said their appointment “relates only to some entities within St Hilliers construction division, known as St Hilliers Contracting, while its property development and investment division, St Hilliers Property, remains unaffected”.

The seven businesses in administration are ST Holdings Pty Limited, St Hilliers Pty Limited, St Hilliers Contracting Pty Limited, STH Bonding Pty Limited, SHC Civil Pty Limited, St Hilliers Inventive Pty Limited, and SH Newstead Pty Limited.

Know more? | michelle.bowes@news.com.au