Aussie man loses $105k from Celsius crypto exchange going bankrupt

The Melbourne man says his partner is furious he invested the money, and there’s very little chance of ever recovering it.

A Melbourne man has issued a warning after losing $105,000 due to crypto platform Celsius filing for bankruptcy.

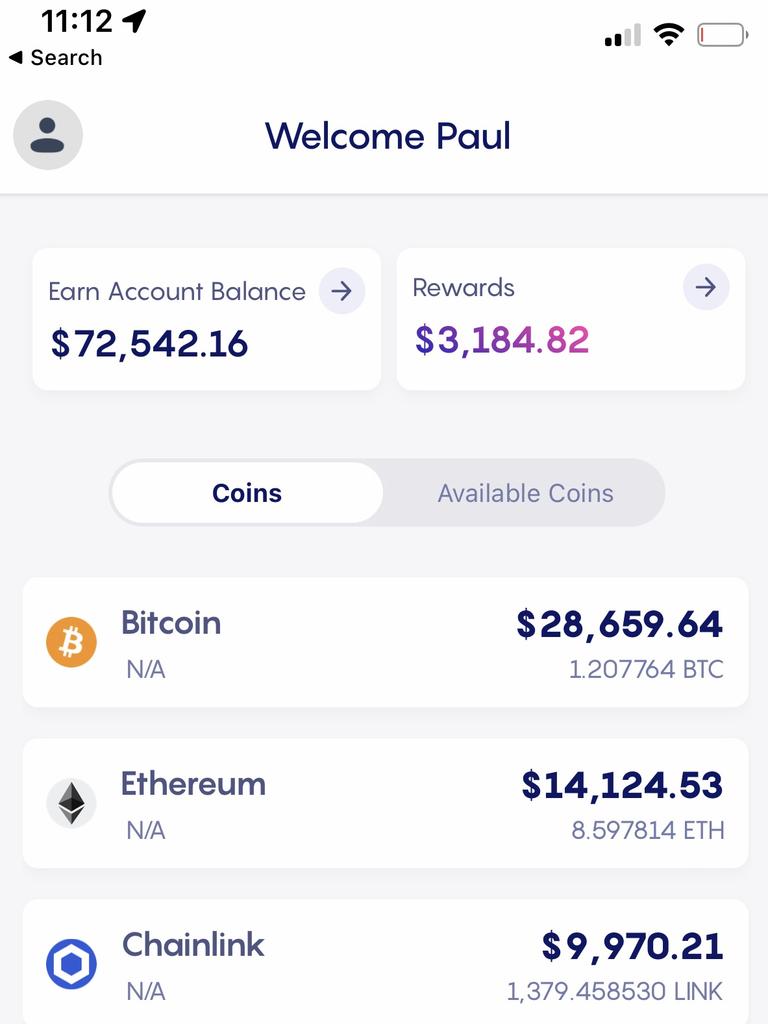

IT worker Paul Winnell had a crypto portfolio worth $700,000 at its peak and a large portion of that sat with the Celsius exchange.

The value of his tokens invested in Celsius had declined to US$72,500 (A$105,000) when in July last year the company collapsed.

It’s now been seven months since Celsius went bankrupt but creditors like Mr Winnell are still no closer to knowing if they will get a cent back for their losses.

He said he fell for a “Ponzi scheme” as more information has emerged from the court-appointed examiner forensically going through the accounts of Celsius, including that the company had never turned over any profit.

“I’ve written it (the missing money) off, in my mind it’s gone,” Mr Winnell, 51, said.

“If something comes back that’s a nice bonus.”

The Celsius crash has left behind a trail of devastation, with more than 100,000 creditors owed money.

Celsius owes its customers an eye-watering US$4.7 billion, according to its Chapter 11 bankruptcy filing.

Every customer, like Mr Winnell, is essentially an unsecured creditor to the company because money they put into the platform counted as a loan.

The firm’s CEO Alex Mashinsky has copped criticism for outright “lying” to customers and spruiking the company in a target media campaign which turned out to be false.

Documents from the New York State Supreme Court, which is suing Mr Mashinsky for civil fraud charges, says that the the chief executive “engaged in a scheme to defraud hundreds of thousands of investors … by using false and misleading representations to induce them to deposit billions of dollars in digital assets with his cryptocurrency lending company”.

A former employee claimed that Celsius had never been solvent because they would invest customer funds in risky ventures.

Whenever a customer asked for their funds back, the company would scramble to buy assets to acquire the necessary funds.

They often had to buy assets on the open market at a premium rate, leading to more financial losses.

“I definitely feel burnt,” Mr Winnell said.

He said the amount of money he lost “didn’t ruin his life” but added that his partner was “very upset” to learn of the amount of cash that the pair are unlikely to ever get back.

“It hasn’t ruined my retirement,“ he insisted.

“There were people that stuck far more money than I did, it’s shocking, it really is. I hope we do see some return.”

Mr Winnell said he first came across the concept of cryptocurrency in 2016 and invested then. By the time the market spiked in 2017, he made $50,000 in profit.

“That piqued my interest in crypto,” he said. “I started to invest a bit more heavily in it.”

It was here he came across Celsius and invested a large chunk of his fortune in the exchange, as well as 25 other investments.

“I invested about $60,000 (in crypto), that grew to well over $700,000 to me (at its peak),” Mr Winnell added.

“I considered getting out at $550,000 and stupidly didn’t.”

Five months after Celsius collapsed, another major exchanged called FTX also went nakrupt, plunging the crypto industry into disarray.

alex.turner-cohen@news.com.au