Sydney dad keeping $102k secret from wife

An Australian man has lost $102,000 from the sensational collapse of cryptocurrency exchange FTX – even though he didn’t even invest anything with the company.

An Australian man is devastated after losing an eye-watering $102,000 from the sensational collapse of cryptocurrency exchange FTX – even though he didn’t even invest a single dollar with the company.

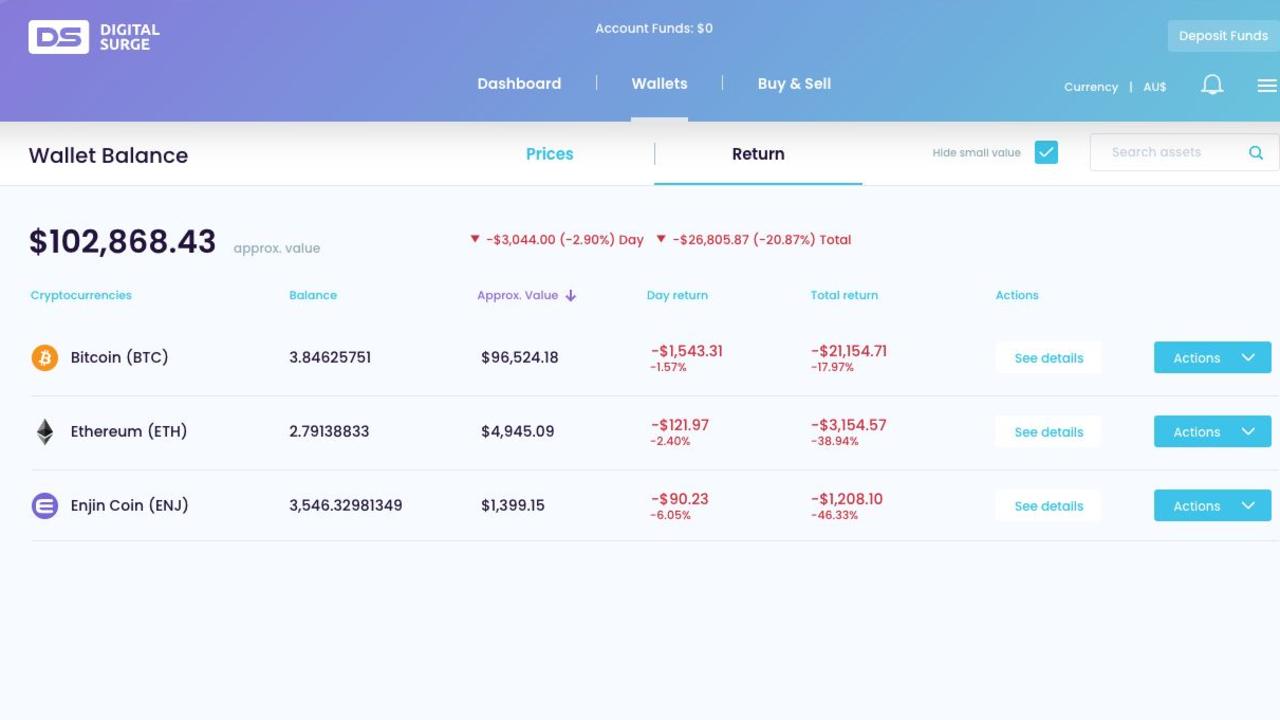

Danny*, who asked for his last name to be withheld, invested money with Australian crypto platform Digital Surge.

Unfortunately, Digital Surge went into administration last month, because of its exposure to FTX, having transferred $33 million of its liquidity to the failed Bahamas-based firm.

Danny, 42, is now one of the victims in a phenomena that has been dubbed as the FTX contagion as other crypto exchanges topple like dominoes around the world following the news.

Danny is yet to tell his wife that most of their retirement plans have gone up in smoke.

“About $102,000 worth of my crypto has been locked from withdrawal and possibly lost forever,” Danny told news.com.au.

Danny thought he was taking charge of his future when he started a self-managed super account for himself and his wife.

The Sydney dad-of-two was then notified that he could put his retirement funds into cryptocurrency if it was through a verified Australian exchange called Digital Surge and leapt at the opportunity.

So he poured his funds – at the time $250,000 – into he and his wife’s new superannuation fund in 2020, mostly focusing on bitcoin, ethereum and a few altcoins.

In the years since then, crypto tokens have lost their worth, and the value of his portfolio had waned to $102,000.

This didn’t bother Danny though; he planned to hold and ride the highs and lows as he was in it for the long run.

But that all came crashing down in November last year.

Three months ago, FTX, valued at $32 billion at its peak, imploded after it emerged it was little more than a Ponzi scheme and the company’s founder, Sam Bankman-Fried, has been criminally charged over his handling of the company.

Danny immediately started researching options to put his investment into a hardware wallet – which would mean he could bypass exchanges entirely and reduce the risk of other exchanges falling.

However, when he tried to withdraw his crypto assets from Digital Surge, he couldn’t, while at the same time his account funds showed up as zero.

A week later, Digital Surge notified its customers that they had halted withdrawals and revealed the firm had some “exposure” to FTX but indicated there was no need to panic.

“I was a bit worried but I didn’t think too much of it,” Danny admitted.

Then, on December 8, he read a news.com.au article that revealed Digital Surge had gone into administration.

“That’s when I had a heart attack,” he said.

He estimates that 90 per cent of his superannuation lay with his investment through the Digital Surge platform.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

Danny found himself in limbo along with 22,000 other Australians whose accounts had been locked with no indication when, or if, they would ever be able to recoup their funds.

John Mouawad, David Johnstone and Scott Langdon from Australian insolvency firm KordaMentha were appointed as the administrators of Digital Surge. KordaMentha is also overseeing FTX’s administration.

According to an administrator’s report on Digital Surge obtained by news.com.au that was released last week, a company called Digico will be propping up the firm with a $1.25 million loan. Digital Surge will also continue trading.

And customers are also set to receive a portion of their missing money back under the deal.

Customers who have invested less than $250 through the exchange are set to get all their money back.

As for the others, they will receive back 55 per cent of their original investment.

That means all that is left of Danny’s original $250,000 investment will be $56,000.

All profits from Digital Surge will be credited to customer accounts moving forward and this will cease after a period of five years or until their lost money is paid back in full.

Administrator David Johnstone said in a statement to news.com.au that this outcome was in the creditors’ best interests and was better than winding up the company and placing it into liquidation.

The trading platform, set up in 2017 and headquartered in Brisbane, allowed customers to access more than 300 different digital currencies before its collapse.