Adani Enterprises’ massive $A127 billion disaster after ‘fraud’ allegations

The firm behind Australia’s most hated mine is facing a nightmare scenario after it was rocked by bombshell “fraud” claims.

One dramatic picture has summed up the nightmare scenario facing the man behind Australia’s most hated mine.

Adani Enterprises was rocked by bombshell allegations it had been committing fraud for years on end last week, according to several years of painstaking investigations by US activist investment group Hindenburg Research.

“We have uncovered evidence of brazen accounting fraud, stock manipulation and money laundering at Adani, taking place over the course of decades,” Hindenburg said in a note.

At the time, Adani strenuously denied the allegations, slamming them as “a malicious combination of selective misinformation and stale, baseless and discredited allegations that have been tested and rejected by India’s highest courts” in a furious statement.

Hindenburg also revealed it had taken a short position in Adani Group – meaning it was betting that the company’s stock price will plunge.

That came to pass almost immediately, with the company – which is behind Australia’s controversial Carmichael coalmine in Queensland’s Galilee Basin – watching its value nosedive by more than $US90 billion ($A127 billion) in the days since the report first dropped.

And on Wednesday, chairman Gautam Adani faced another major blow after abruptly ditching the company’s $US2.5 billion ($A3.5 billion) share sale.

The major sale had closed successfully earlier this week, however, after the firm faced a fresh multibillion-dollar stock bloodbath on Wednesday, it was forced into an embarrassing backflip.

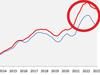

Adani’s stock crashed by a staggering 30 per cent in just 24 hours on Wednesday, with a dramatic picture perfectly illustrating the extent of the wipe-out.

“Today the market has been unprecedented, and our stock price has fluctuated over the course of the day,” Adani said in a statement regarding the share sale disaster.

“Given these extraordinary circumstances, the company’s board felt that going ahead with the [share] issue will not be morally correct,” he added, with Adani now planning to refund investors who had signed up.

“It’s unusual for a secondary offering like this to be cancelled,” Ben Silverman, director of research at VerityData, told Bloomberg.

“Pulling an offering at the last minute doesn’t inspire a lot of confidence right now.”

This is not AMC, GameStop or even Bed Bath & Beyond. It’s Adani Enterprises, a $2.5 trillion company down 30% in a single session pic.twitter.com/ykjitL8C2L

— Not Jerome Powell (@alifarhat79) February 1, 2023

Richest man’s brutal downfall

At one point last year, Gautam Adani, 60, was the second-richest man on earth, only trailing behind Elon Musk.

Today, his personal fortune has plummeted along with his company’s value, with the Forbes real-time billionaires list placing him as the 15th richest person in the world, a sharp drop form the third spot he held just last week.

According to Forbes, he is now worth $US74.7 billion ($A104.7 billion), representing a $US14 billion ($A19.6 billion) fall.

Meanwhile, Bloomberg’s Billionaire’s Index ranks Mr Adani as the world’s 10th richest individual, estimating his fortune to be $US84.5 billion ($A118 billion), and a drop of $US36 billion ($A50 billion).

Adani mine ‘an outrage’

Adani Enterprises is run by billionaire Gautam Adani, who was previously the richest man in Asia and the third-richest on the planet – is known for being the backer of the $US21 billion ($A29 billion) Carmichael coalmine in Queensland’s Galilee Basin.

After nearly a decade of fierce debates, protests and uncertainty, environmental approval for the Adani coal mine was finally passed in 2019.

Adani had claimed the mine would deliver “thousands” of jobs in Queensland, and would also help to safeguard the Great Barrier Reef – despite claims by environmentalists to the contrary.

However, the mine faced serious opposition over the years, with entrepreneur and philanthropist Michael Myer, of the prominent Myer retailing family, telling news.com.au in 2017 that the mine was “an outrage”.

Over the years, a slew of companies withdrew their support from Adani after being targeted by protesters, with the well-known #StopAdani campaign claiming the project would destroy the ancestral lands of Indigenous people, increase traffic around the Great Barrier Reef and add billions of tonnes of carbon pollution to the atmosphere.