‘Financial nightmare’: ‘Very dangerous truth’ about owning a franchise

They’re sold as a dream opportunity to get rich and be your own boss – but the reality is a “financial nightmare” most people never recover from.

COMMENT

Remember Grill’d, the Aussie burger chain that seemed tastier and healthier and cooler than the other burger chains? Well, it turned out Grill’d is kinda the same as all the others. Only about 30 of its outlets are franchises, and if there’s been a lesson from the last few years, it’s that franchises are places where bad things tend to happen.

The most recent revelations about Grill’d are that it underpaid staff, forged liquor licences, and drove some franchise owners to the wall with questionable decisions.

Franchises have become famous as places where staff are underpaid. We’ve seen it at 7-Eleven, Subway, Chatime, Domino’s, Michel’s Patisserie and many more.

We’ve been angry about what’s happening for years now. It’s time we understood why it hasn’t stopped. The reason is simple. The people that own the franchise are sometimes screwing their staff because they are in turn getting screwed by the franchise company.

OWN YOUR OWN SMALL BUSINESS

A franchise is a small business. A big franchising company sells you the right to use their brand and follow their rules.

People who buy a franchise do so because they want to own their own business but with less risk. They think using someone else’s business idea reduces the risk of losing a lot of money.

Owning a franchise makes some people rich and very happy. But for most? They absolutely hate it.

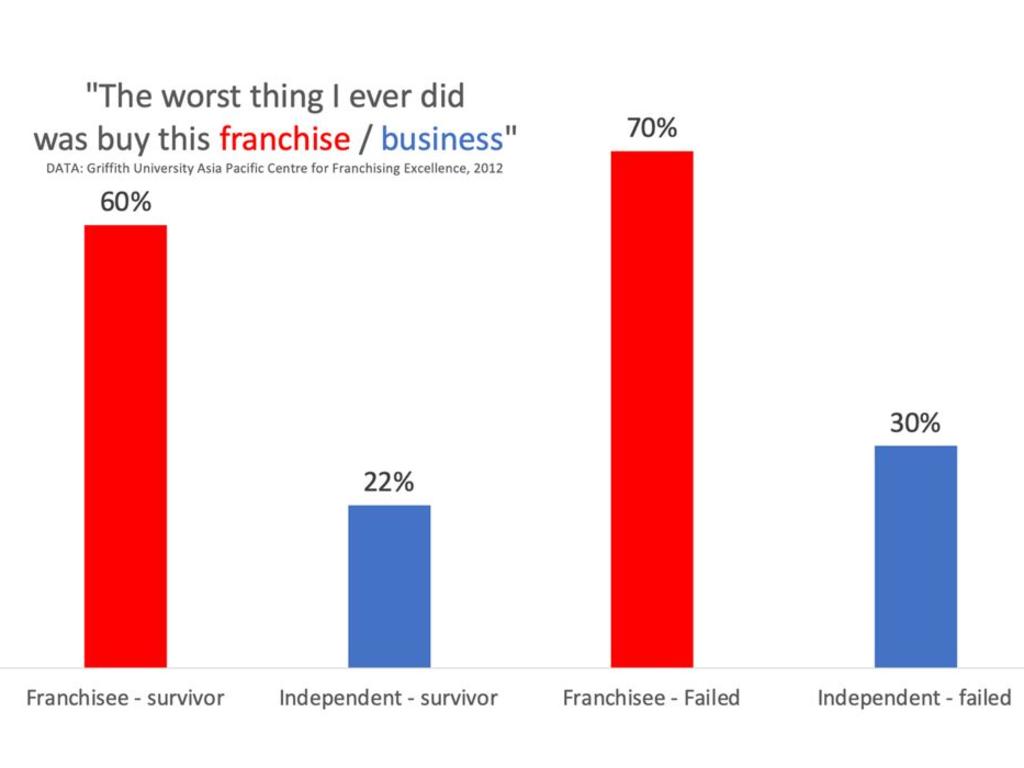

This next graph reveals what people really think of franchising. It shows the results of a major study on more than 1000 franchise owners and business owners by Griffith University. They asked the business owners many questions, but the most interesting one is this: Do you believe buying this franchise (or business, if they owned an independent business) was the worst thing you ever did?

Very few owners of a non-franchise business said it was their worst life decision – even if the business failed. But franchise owners? A huge majority of them said it was the worst decision of their life – even if the business survived.

This blows my mind. It’s obvious there is something very, very dangerous about owning a franchise.

When you hear Boost Juice owner Janine Allis say “you’re three times more likely to be successful with a franchise than you are going to be on your own”, think about the above graph. If this was true, why do more franchisees regret their decision than people who go into business on their own?

That “three times more likely” number, if you try to find a source for it, is probably a myth. In fact, it’s really hard to get good figures on the true rate of franchise survival in Australia. Some data sources from the US say they actually do worse than private businesses. It’s hard to know the truth about survival. But what we do know is lots and lots of them keep starting up.

THE RISE OF FRANCHISING IN AUSTRALIA

I blame Boost Juice. Janine Allis came up with the Boost Juice concept and became one of Australia’s richest self-made women with it. The first Boost Juice store opened in 2000, and they had hundreds within a few years. The secret ingredient? Franchising. As the brand became extremely well-known in an extremely short space of time, the business community learned franchising was a great way to open stores very fast and get rich in the process.

Boost Juice has been successful. There aren’t many complaints. But the flood of businesses that followed it? Yikes. Franchises fail, and when they do, they hurt people. Here’s a quote from a franchisee who failed, taken from the Griffith University study that provided that data:

“I’m great with people, but I just couldn’t make it work. And you know, since I’ve lost the business, I’m seeing a psychologist. I’ve suffered agoraphobia, anxiety attacks and depression … I don’t really understand this as I have always been such a strong person. We had two houses, an investment property and a good lifestyle. We have nothing now. I’ve gone bankrupt and this is after working so hard … so many hours trying to make things work … I really regret my decision to buy (franchise name).”

IT WORKS EVERY TIME, 80 PER CENT OF THE TIME

Owning a successful franchise can be a way to get modestly rich, if you are hardworking and lucky. But when the franchise is unsuccessful, it’s a uniquely nightmarish experience. The franchise owner is usually not allowed to change the way the business works.

For example, you can have a pie franchise with no customers but you still have to keep the shelves stocked high with fresh treats at every hour of the day, according to franchise rules. And of course if they’re heated up and put on display they later have to be thrown out uneaten. There’s no good way to cut costs without breaking franchise rules or labour laws.

What a business owner can’t do is try to swim with the tide a bit, to try something different, like a non-franchise would do, especially if they see the writing on the wall.

If business turns bad, they are stuck implementing the failing business model they paid for and it’s usually around this time that head office starts “helping”, which sometimes involves making sure the owner is implementing the business model perfectly, even if it costs a fortune. This makes owning a struggling franchise one of the least pleasant activities in modern capitalism.

What’s worst is the Franchising Council of Australia – the peak body for the sector – likes to frame this as a psychological issue. They cite research saying “independents were more willing to take responsibility for failure or setbacks than franchisees, who tended to attribute blame to external factors”.

I wonder why independent business owners don’t blame external factors? Could it be because they get to run the business however they damn well choose?

The structure of a franchise business – where profits have to be split between the franchise owner and the franchising company, means there’s less money to go around. And the lack of flexibility to run the business as you see fit means a lack of customers can turn into a financial nightmare pretty quickly.

No wonder franchisees are so unhappy. And no wonder they sometimes try to cut corners by underpaying their employees.

Jason Murphy is an economist | @jasemurphy. He is the author of the new book Incentivology.