Town’s fury at ‘disgraceful’ Westpac move

Residents of a booming outback Queensland mining town are furious after a “disgraceful” email from Westpac to the town’s council.

Residents of a booming outback Queensland mining town are furious at the “disgraceful” decision by Westpac to close its branch there, amid warnings regional bank closures are reaching “crisis” levels.

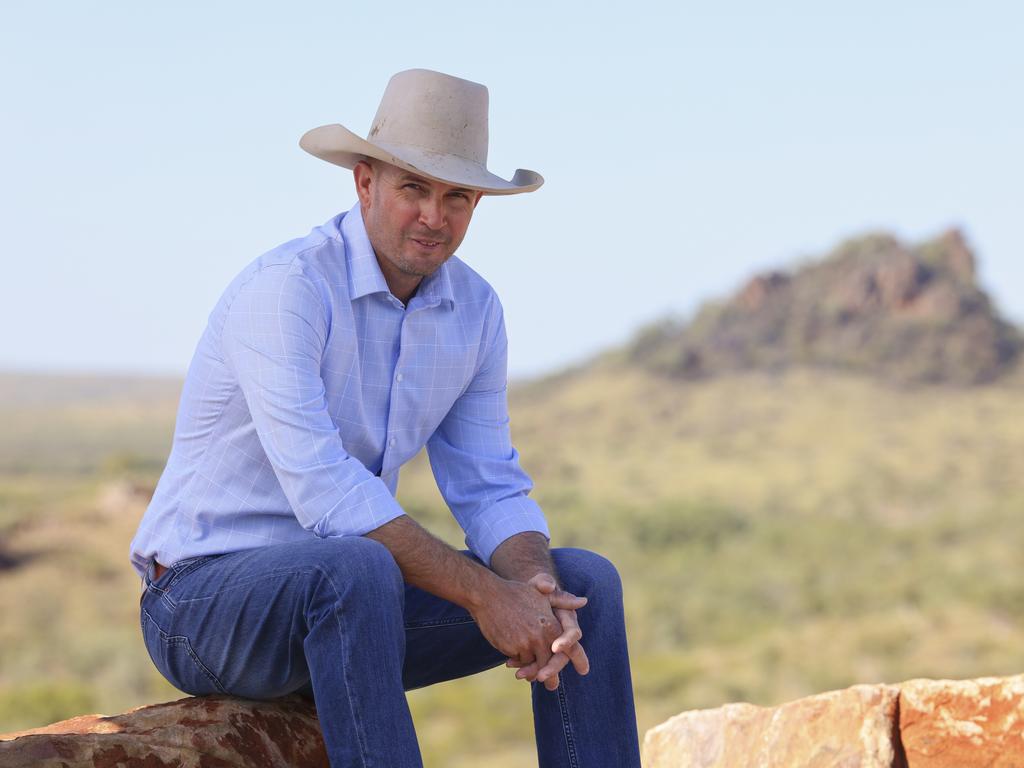

Cloncurry in northwestern Queensland, located 120km east of Mount Isa and 780km west of Townsville — the birthplace of the Royal Flying Doctor Service — is home to 3700 people and a red-hot economy with hundreds of jobs to be filled, according to Mayor Greg Campbell.

“There’s a mine general manager job which could be $500,000, down to checkout operator at BWS and everything in between,” he said.

“Doctors, nurses, mining engineers, teachers, plumbers, electricians, truck drivers, train drivers, drone pilots. There’s a new cafe opening, they’re looking for a barista. This is an area that’s booming and has massive potential — but if a financial institution like Westpac essentially turns their back on us, what tone does that set?”

Last Friday, the banking giant informed the Cloncurry Shire Council via email that its branch — which originally opened in 1905 — would be closing on May 19, leaving residents facing the prospect of a 240km round trip to Mount Isa to access face-to-face banking.

In an open letter to Westpac, the council slammed the move as “unacceptable”.

“Westpac employees who have recently relocated to Cloncurry are now left wanting answers, and jobs, following the shock announcement from Westpac, which reported a bottom-line net profit of $5.7 billion in November 2022,” the letter said.

“Westpac has been grooming customers for many years to do their job, moving away from face-to-face banking and to online, faceless interactions — meaning profits are up, but foot traffic is down. But instead of reinvesting staff resources in supporting customers with more personalised banking services and wealth creation options, the bank is shutting its doors. And that’s not right.”

Cloncurry’s population grew by nearly 20 per cent between the 2016 and 2020 Census, but Mr Campbell believes the true population is actually closer to 5000, with local businesses in mining, transport and agriculture contributing billions to the Queensland economy.

“It is disgraceful that big business, who our community have supported for decades, has turned its back on us,” the letter said.

“We are concerned for the many elderly residents, community groups and businesses, that rely on the branch for face-to-face assistance. The role that personal face-to-face banking plays for our region cannot be underestimated — in times of drought, flood, fire and indeed all rural crises, it’s the local bank manager who becomes a lifeline, a face and a voice to be relied on. Someone who is always there. Not anymore.”

The council said it would reconsider its banking relationship with Westpac if the branch closes.

“Our greatest fear is that this decision will give other vital services the precedent to withdraw more services from Cloncurry and regional Queensland,” the letter said. “We deserve better.”

Mr Campbell said there were still a number of businesses that handle “a lot of cash” and Westpac had, in a “sloppy and lazy way”, said “well the post office can do it”.

“I estimate it would only cost $1 million, if that, to run this branch in lease fees, electricity, staff wages — I can’t see how, with the business going through this branch, even if foot traffic has dropped off it still isn’t profitable,” he said.

“Then you look at that in the context of a $5 billion profit. Even if the economics stacked up, the local customers get disadvantaged by their branch closing and that $1 million year-on-year saving probably goes back into paying a bonus to the executive that put a red line through the towns.”

Writing directly to Westpac chief executive Peter King in a scathing letter on Wednesday, Mr Campbell said the bank was “displaying complete ignorance and short sightedness” with its decision.

“Last year Evolution Mining purchased the Ernest Henry Mine from Glencore for $1 billion,” he wrote.

“Harmony Gold (South Africa’s biggest gold producer) has recently purchased an undeveloped copper project for $400 million. Incitec Pivot, Chinova, Rio Tinto, South 32 and Anglo are all active in the Shire, as are a plethora of junior miners. The Westpac Cloncurry branch is the local branch of some of the most successful grazing family businesses in the country, notably MDH, Daniels and McMillans. You are turning your back on them.”

He told Mr King it was “unquestionable that the Cloncurry Shire is without peer in respect of economic performance and potential for the state and the nation and your decision to close the branch is not only disrespectful to your customers but even more so looks incompetent to be turning your back on such a guaranteed high growth area”.

“I see it as a decision that you will regret, and I would welcome a reversal of the decision,” he wrote.

It comes as the Finance Sector Union warns bank branch closures are reaching “crisis point”, with the big four closing more than 550 branches across Australia since January 2020.

From the Opal mining town of Coober Pedy in South Australia to Berrigan near the NSW-Victorian border, regional residents have seen a drastic reduction in banking access.

The Australian Prudential Regulation Authority said 575 regional banks closed between mid-2017 and mid-2021.

This week, the Senate passed a motion to hold Australia first parliamentary inquiry into regional bank closures in nearly two decades.

The inquiry, which has been referred to the Rural and Regional Affairs and Transport References Committee, will report back to parliament by December 1.

It will investigate the reasons given for branch closures, the economic and welfare impacts on customers in regional communities, and the effect of the removal of face-to-face cash services, among other things.

Mr Campbell said he would be requesting a hearing of the committee be held in Cloncurry.

The Mayor, who is due to meet with Katter’s Australian Party leader Robbie Katter this week, has called for federal legislation to guarantee banking services for regional towns.

“There should be some sort of universal service obligation similar to the telecommunications industry, that every town over a certain size has at least one bank,” he said.

In a statement, a Westpac spokesman said there had “never been more ways to bank with the Westpac Group”.

“Westpac has more than five million digitally active customers and we know their expectations are changing,” he said.

“Our customers are using branches less, for fewer reasons, and choosing to use digital banking more often. Our service approach is responding to customer preference. That’s why we’re investing in digital services so our customers can bank with us anywhere, at any time.”

Westpac recently signed a 10-year agreement with Australia Post to provide Bank@Post over-the-counter transaction services at 3500 locations, including 1700 in regional areas.

“In Cloncurry, we are closing our branch and transitioning these services to Bank@Post at Cloncurry LPO, only a 350m walk from our current branch,” he said.

“ Our Agribusiness and Business customers will continue to be supported by their existing relationship management teams. Our Remote Services Team will also be implementing a program of on-the-ground support in Cloncurry. This service supports Australia’s most remote communities and assists First Nations customers.”