Sneaky scam robbing hundreds of millions from Aussies

While all eyes are on a new viral WhatsApp scam dubbed “Hi Mum”, another type of scam has also been wreaking havoc.

While all eyes are on a new viral WhatsApp scam dubbed “Hi Mum”, another type of scam has been flying under the radar.

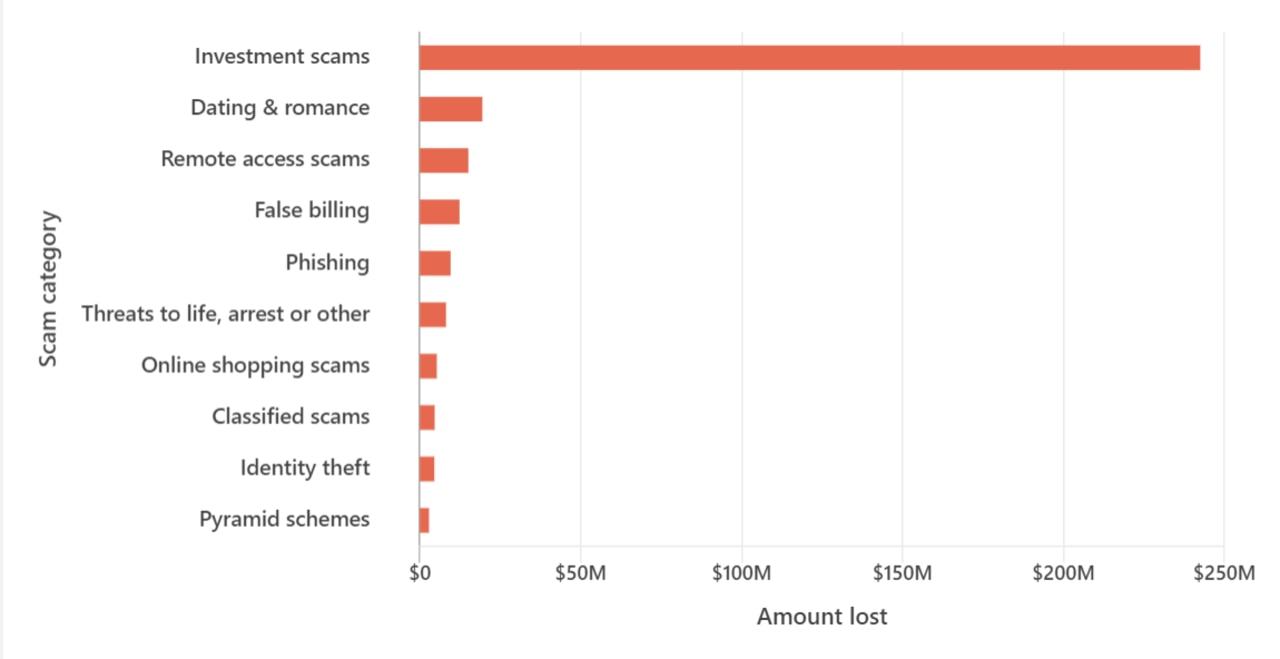

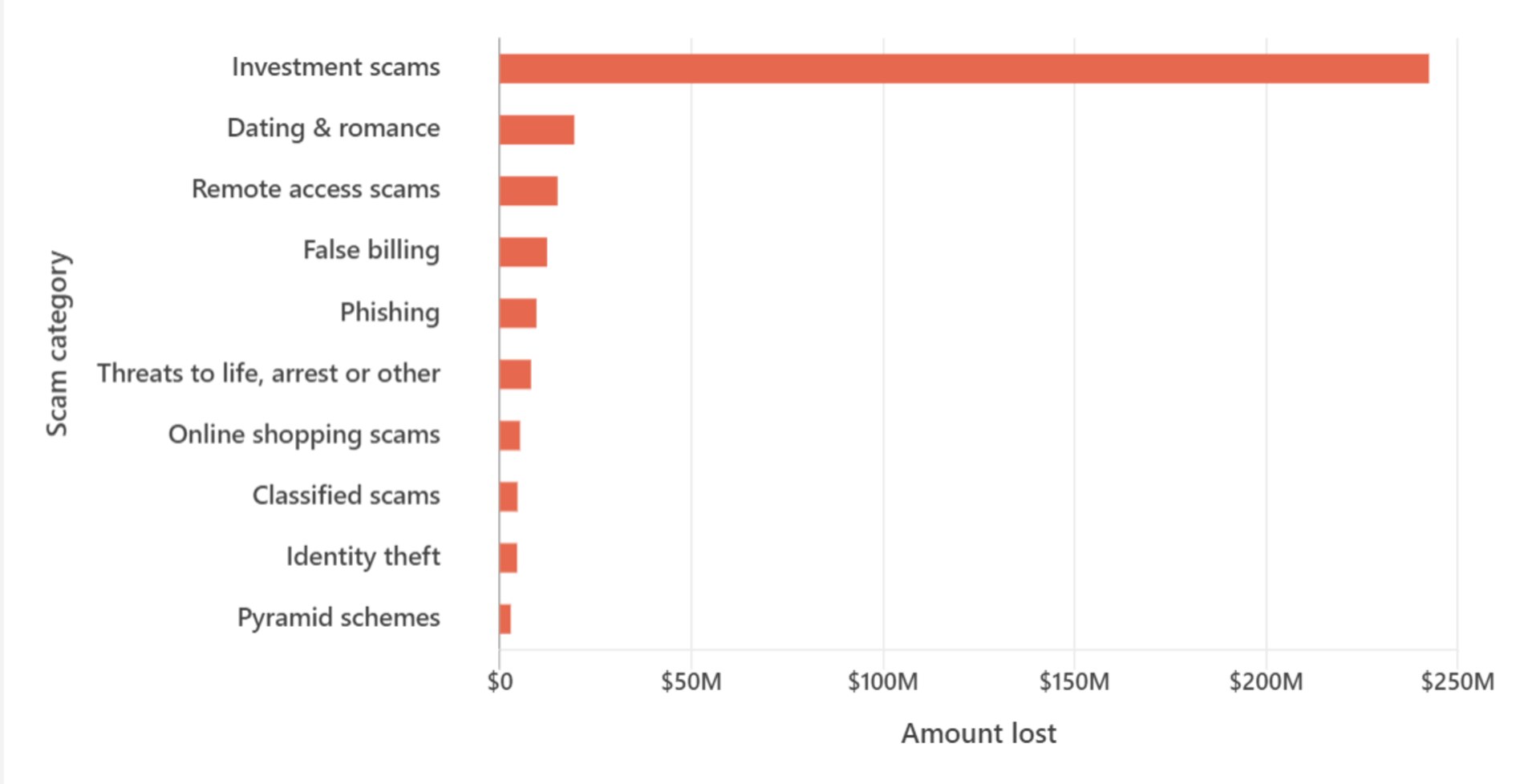

Investment scams make up over two-thirds of reported losses from all scam types combined so far in 2022.

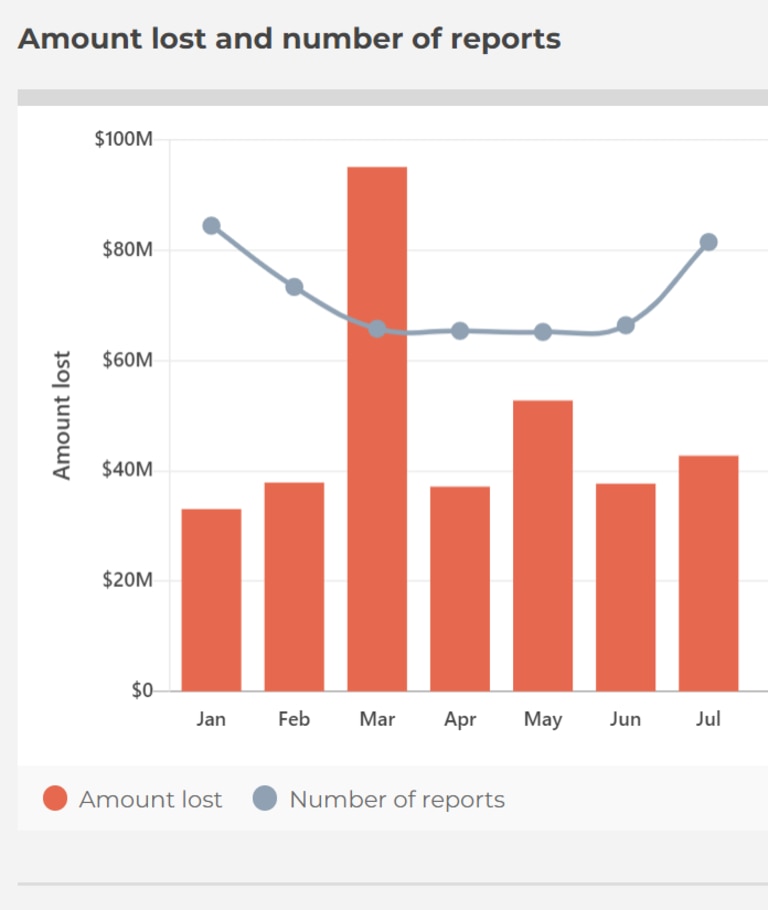

The scam has seen a monstrous spike this year, costing victims more than $242 million – a massive rise on last year’s total of $177 million lost for the entire year.

It is thought, however, that the real amount lost to these scams is much higher, with research showing that only 13 per cent of Australians report their losses to Scamwatch.

One of the most common types of investment scams involves a random individual or group contacting their victim via phone, email or social media offering the chance to invest in a “once-in-a-lifetime opportunity”.

They might pretend to be someone you know, such as your fund manager, financial adviser, bank, or even a friend, as they offer you guaranteed or unrealistic high returns on an investment.

Aaron Bugal, Sophos’ Global Solutions Engineer, said scammers are using text messaging to gain access to personal information, passwords and credit card details more than ever.

“Scammers are getting more brazen, and personal, preying on people’s trust, emotions and curiosity more than ever,” he told NCA NewsWire.

“Scammers will continue to look for innovative ways to make contact with victims, using alternative messaging systems within mobile applications and popular online games, with the trend to continue into whatever else becomes popular.”

Working adults, primarily in the 25-44 age bracket, are the main victims of investment scams, which are usually (27.9 per cent) carried out through a phone call, with 19 per cent coming via email and 18.5 per cent through social networking.

Mr Bugal said scams are becoming more personalised and harder to spot.

“General spray and pray tactics, while still popular, are being replaced with targeted attacks which are tailored to the individual,” he said.

“Scammers are doing their research and accessing their victims’ data before making contact, more effectively lulling them into a false sense of security.”

He said people should expect cyber criminals to leverage any data you put onto the public internet against you.

“Scammers use a sense of urgency to get people to act quickly and without thinking,” he said.

“If you receive a text, phone call or email that doesn’t seem right, call the alleged sender directly via verifiable contact details.”

If you find yourself receiving a suspicious call, you should always take precautions,” Mr Bugal said.

“If someone contacts you from your bank or similar institution, pause for a moment, state that you’re in the middle of something important (meal, meeting, shopping, anything – just get off the phone) and say that you will call them back,” he said.

“Do not use the phone number that was displayed on your phone’s call history; this may in fact be the scammer’s line”

The investment scam expert said it was important to report scams so that government bodies can learn more about new tactics being used.

To report a scam, please go to scamwatch.gov.au