New claim surfaces after couple claim CBA lost $90k of savings

A new theory on what happened to an Australian couple’s missing property deposit worth $90,000 has been floated by a family member.

A relative of the couple at the centre of a tense saga with Commonwealth Bank over a supposedly missing sum of $90,000 has made an extraordinary new claim about what happened to the money.

Ellie Houston, 21, and her partner Trae Murphy, 23, have claimed the funds disappeared from their CBA account when they attempted to pay a deposit on land in Yarrawonga, a small country town near the NSW and Victoria border.

The bank however said there was never any trace of the money — with the institution claiming the couple never had the money to begin with and the receipts and account numbers didn’t match up.

Ms Houston’s sister, Tori Lancaster, has since raised a new argument in favour of the couple in response to somebody questioning the couple’s version of events on a local Facebook group.

She claimed there was no record of the account containing the money because it was deleted swiftly after the large sum was removed.

“It’s as simple as this, the money was in their account as per the transaction records. The money has been taken and the account deleted, gone, can’t see it,” she told the social media critic.

“Which is why their receipts and statements don’t line up with Commonwealth Bank. There has been no foul play and they have been working their a***s off for years.”

Ms Lancaster told the commenter to “pull your head in”.

“Next time it could be your mum, sister or daughter so pull your head in,” Ms Lancaster wrote.

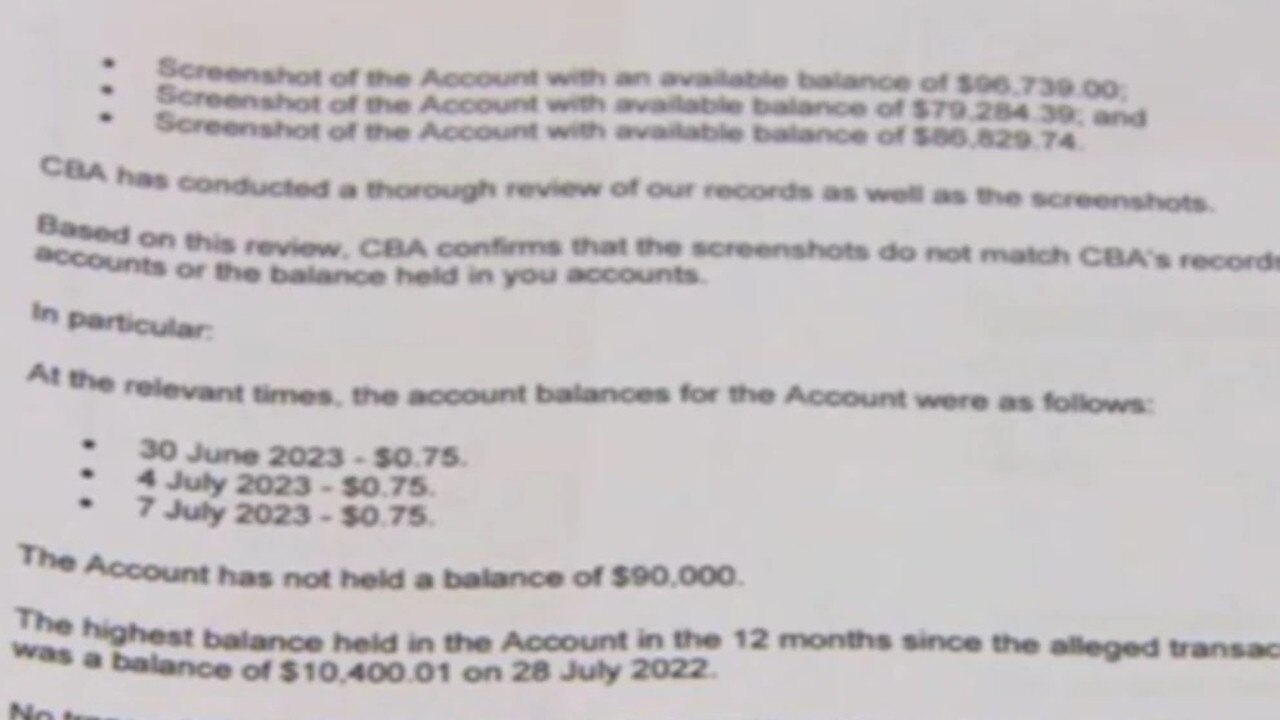

CBA has previously said that “the account in question (or any other account held by Mr Murphy) did not have a balance of $96,000 (or an amount close to it) at the time of the relevant transfers or the 12 months prior.”

Ms Houston earlier this week claimed in an interview with 3AW that she had screenshots and receipts tracking the money between the accounts, and that they could see the money while they were in Bali in July.

A CBA spokesperson however said that following an investigation, the couple were informed the receipt numbers they provided did “not exist in CBA records”.

“On examination of the images of the receipts provided, the documents appear to​ differ from genuine CBA receipts and the receipt numbers do not exist in CBA records,” the statement read.

The bank added its own records did not match the information provided by the couple, including “changes to balances and a receipt for a transaction which cannot be made from a savings account”.

The account also hadn’t had a balance that high in the last 12 months, the bank said.

“The account in question (or any other account held by Mr Murphy) did not have a balance of $96,000 (or an amount close to it) at the time of the relevant transfers or the 12 months prior,” its statement read.

The bank added the account in question was a NetBank Saver, “which only permits transfers to another CBA account and is unable to process transfers to another financial institution”.

Mr Murphy had, according to CBA, complained and asked it to investigate after two failed transfers to the Bank of Melbourne, claiming the balance should have been $96,000.

The bank said it would make further inquiries should it receive additional information from Mr Murphy.

Ms Houston told 3AW on Monday she and her partner were left with just $0.75 in their CBA bank account after the two failed transfers.

“Our money bounced back into our CBA account because both our names weren’t approved yet on the Bank of Melbourne account,” she said.

She claimed they tried sending the money again on July 4, before jetting to Bali the next day.

Three days later, on July 7, the money bounced back into their Commonwealth Bank account once more.

Being in Bali, she said they weren’t able to settle the land while overseas because the sum of money was too big.

When they returned to Australia on July 20, they went straight into a Commonwealth Bank branch and discovered they only had $0.75 in their account.

“No money in our account, $0.75. They can’t tell us where it’s gone, nothing,” Ms Houston said.

“My partner and I have been together since we were 15 years old, we’ve saved for so long for this land, and our goal was always to pay the land off before we put a house on it, so we could then travel.

“And now everything, everything got taken from under us.”

– With Clareese Packer

Do you know more or have a similar story? Continue the conversation | brooke.rolfe@news.com.au