Melbourne mum scammed out of $200,000 after $210 deposit appeared on bank account

A Melbourne mother was left desperate after a curious $210 credit to her bank account left her $200,000 worse off.

A mother has spoken of how she was left desperate after what appeared to be a mistaken $210 credit to her account led her $200,000 life savings to vanish.

Donna Brain, from Melbourne, had planned to put the money towards a new home following a painful divorce.

“I don’t even know how it happened. After everything I’ve gone through, I just wanted a nice house to live in,” a tearful Ms Brain told Channel 7.

The incident has highlighted just how sophisticated scammers have become.

Ms Brain was all set to move into a new home following her marriage break-up when a curious transaction occurred on her Commonwealth Bank account.

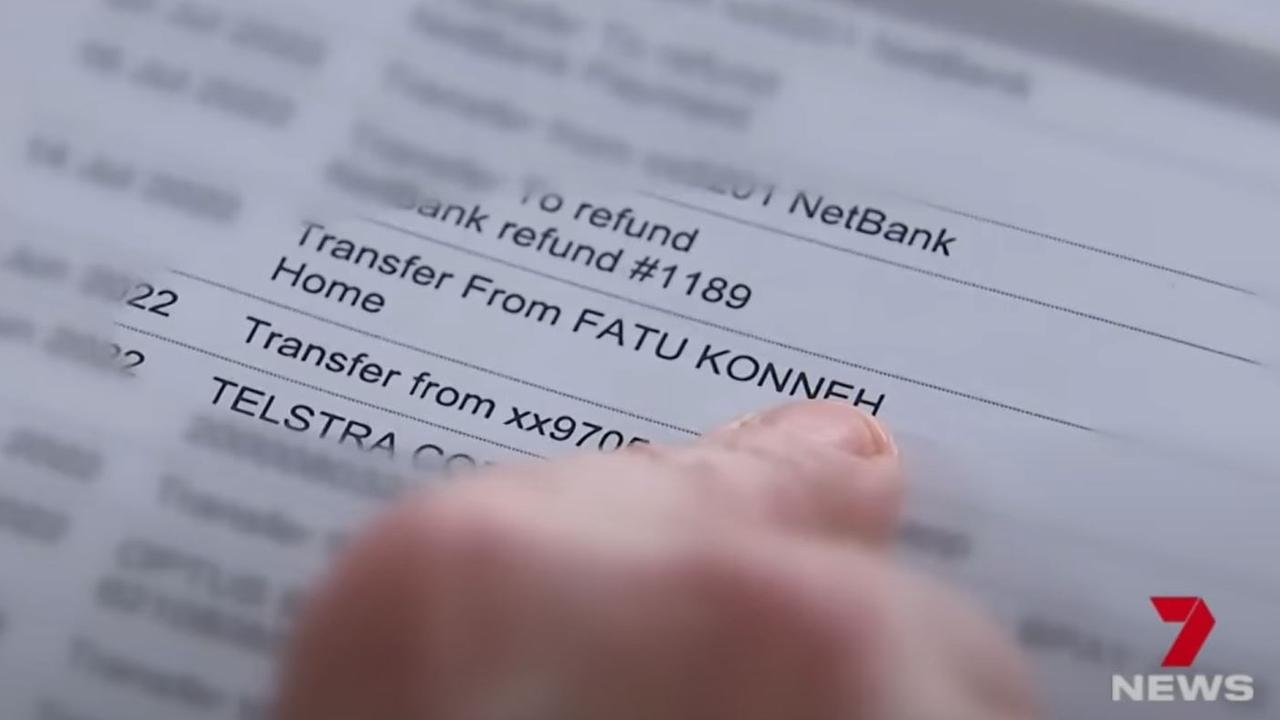

A sum of $210 was transferred to the 56-year-old nurse’s account under a mysterious name that she didn’t recognise.

Then came a phone call, purportedly from her bank, where Ms Brain was asked to return the $210 which – it was claimed – had been sent to her by accident.

“They didn’t ask for any NetBank numbers or passwords,” she said.

But the information the criminals now had was enough.

Initially a withdrawal of $500 was made from Ms Brain’s account. When they went through successfully, more withdrawals followed.

“They transferred six lots of $20,000 and then $80,000,” she said.

According to the Australian Competition and Consumer Commission (ACCC), more than $2 billion was robbed from people last year through scams.

Reported losses to all organisations totalled almost $1.8 billion, but as one-third of victims do not report scams the ACCC estimated actual losses were well over $2 billion.

“Scammers are the most opportunistic of all criminals: they pose as charities after a natural disaster, health departments during a pandemic, and love interests every day,” ACCC deputy chair Delia Rickard said last month.

“The true cost of scams is more than a dollar figure as they also cause serious emotional harm to individuals, families, and businesses.”

Those aged 65 and over reported the highest losses, and reported losses steadily increased with age.

Bank scams are on the rise with dodgy phone calls, suspect emails and even fake websites that mimic the sites of established banks and are there to fool you into handing over you passwords and account details.

People should always be wary if someone they don’t know or even someone saying they are form a company they’ve head of pressures them into making a payment or handing over any personal information.

Commonwealth Bank refunded Ms Brain’s $200,000 and her house move is back on.

However, banks have warned that they are not always able to pay back cash that has been stolen from accounts by scammers. So people should always stop and think if that unsolicited call from the bank, unexpected email or strange transaction is all above board.