ME Bank slammed for insulting customers with mortgage debt redraw policy changes

“Absolutely disgusting”: ME Bank and the Commonwealth Bank have come under fire for surprising clients with changes.

Melbourne-based lender ME Bank has been accused of patronising their clients and forced to issue an apology after it moved money out of customers’ accounts without permission.

The Members Equity Bank, owned by industry super funds, changed policy for 20,000 borrowers that removed funds from redraw accounts to pay down home loans last week without proper notification.

Redraw accounts linked to a mortgage usually consist of money overpaid on the loan and can be withdrawn by the borrower at any stage.

But from last week, ME Bank used redraw accounts directly to pay down home loans as fears arise borrowers will struggle to service loans amid the coronavirus-induced financial crisis, infuriating customers.

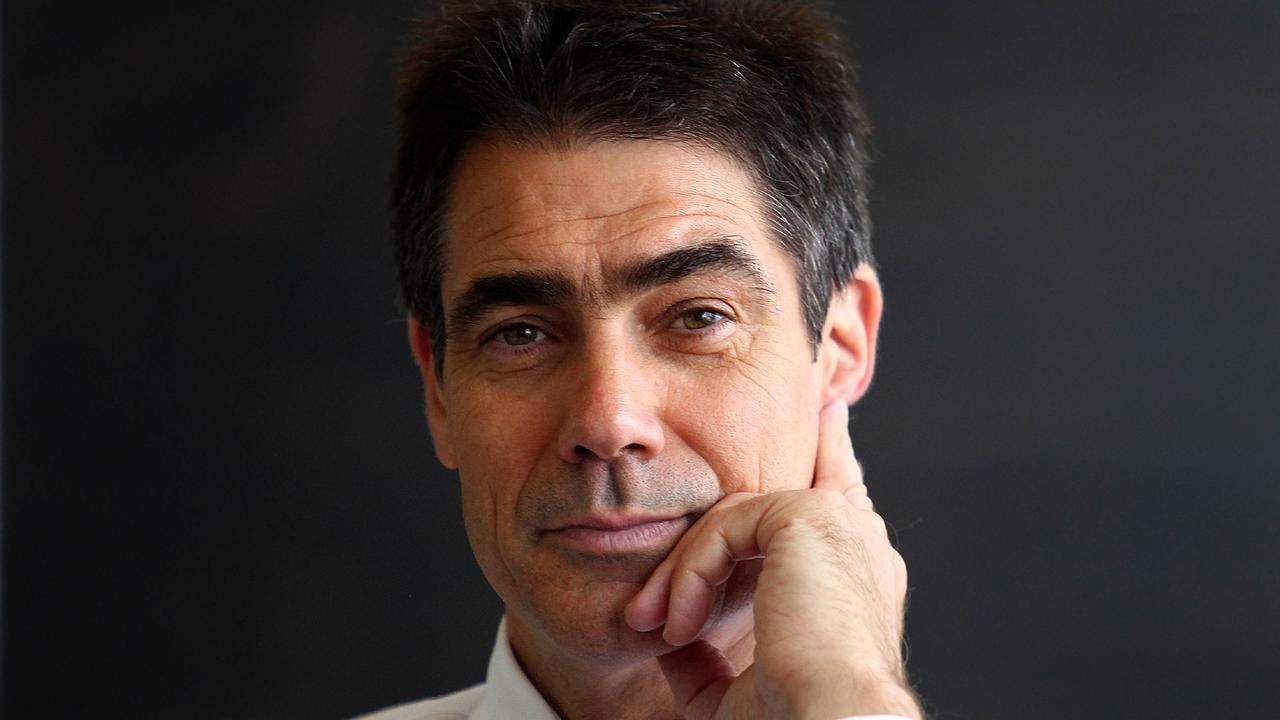

“We are sorry,” chief executive Jamie McPhee said in a statement released on its website, who explained the change was made on one of the lender’s legacy home loan products.

“This change was made with the best of intentions – to protect some customers from the risk of redrawing too much money, which could have inadvertently put them behind their repayment schedule.

“We made the decision to adjust the redraw of customers after analysis showed a group of customers on this older home loan product were at risk of going above their scheduled home loan balance, if they were to activate the full redraw facility.

“But we messed up.”

The controversial move by ME Bank invoked a steady stream of abuse from furious customers sharing their frustration on the company’s Facebook page.

“Absolutely disgusting treatment by a bank, helped yourself to our redraw with no communication whatsoever,” one user said.

And another: “What a disgrace changing my redraw account without letting me even know. I’ll be leaving as soon as my fixed period is finished. Do not use this bank.”

The chief executive of the peak body for financial counsellors, Fiona Guthrie, said the lender had breached the trust of its customers.

“The bank has done it in a patronising way,” she told news.com.au.

“It has looked at an issue with those accounts and not given people the opportunity to engage with them about what’s the best option for those clients and their particular financial situation.”

Ms Guthrie said growing redraw accounts through making payments above the loan requirement was a responsible avenue to build up funds for access during leaner times, such as a pandemic-induced economic crisis.

“The whole point of a redraw is it gives people flexibility,” she said.

“Banks market this in the good times as providing that so you can’t just turn it off when the situation arises where you would think this would be useful for people.

“Even though they legally have the right to do that but ethically and in terms of community expectations, it just doesn’t stack up.”

Financial Rights Legal Centre’s director of casework Alexandra Kelly said the bank’s timing and behaviour has been “appalling”.

“Firstly the communication has not been fair, timely or appropriate – most of it has been after the fact,” she said in a statement to news.com.au.

“Notifying consumers after the event of closing access to what consumers believe is their money is insulting, particularly in these challenging times.”

Ms Kelly said the legal centre has been contacted by ME Bank customers who were encouraged to put lump sums in their redraw with assurances it could be accessed in the event of emergencies or future needs.

“Now that need has arisen the safety net has seemingly been pulled from under them,” she said.

The controversial move comes after the Commonwealth Bank automatically reduced 750,000 home loan customers to the minimum repayment required, meaning those who had set up to pay more as a strategy to pay off the mortgage more quickly and save thousands of dollars in interest were disadvantaged.

“With the current uncertainty surrounding coronavirus, we’re taking steps to continue providing the financial support our customers need,” the lender said in an email to its borrowers.

“By paying the minimum, you’ll have access to extra money should you need it.”

Customers can opt-out of this change but Ms Guthrie said it should have been on an opt-in basis, saying she sees the merit in supporting customers by freeing up cash during times of financial hardship but the major bank should have allowed customers to decide how they would proceed with their repayments.

“The people who still have employment and are still able to afford it, it’s a really good financial strategy,” she said.

Ms Kelly agreed, saying some borrowers might have missed the change and are unwittingly extending the life and cost of their loan.

“In future, they could be quite disappointed that they were not reducing the debt as fast as they could have been or wanted,” she said.