Major alert issued by Commonwealth Bank to ‘immediately delete’ new text scam claiming to be security alert

One of Australia’s major banks has urged customers to “immediately” do this one thing if they get this message, which purports to be from the bank themselves.

A warning has been issued by Commonwealth Bank amid a mass text message scam purporting to be a “security alert” asking people to secure their account.

The latest alert follows recently-released financial statistics revealing Aussies lost more than $455m to scams over 2023, most of them targeting people over 65.

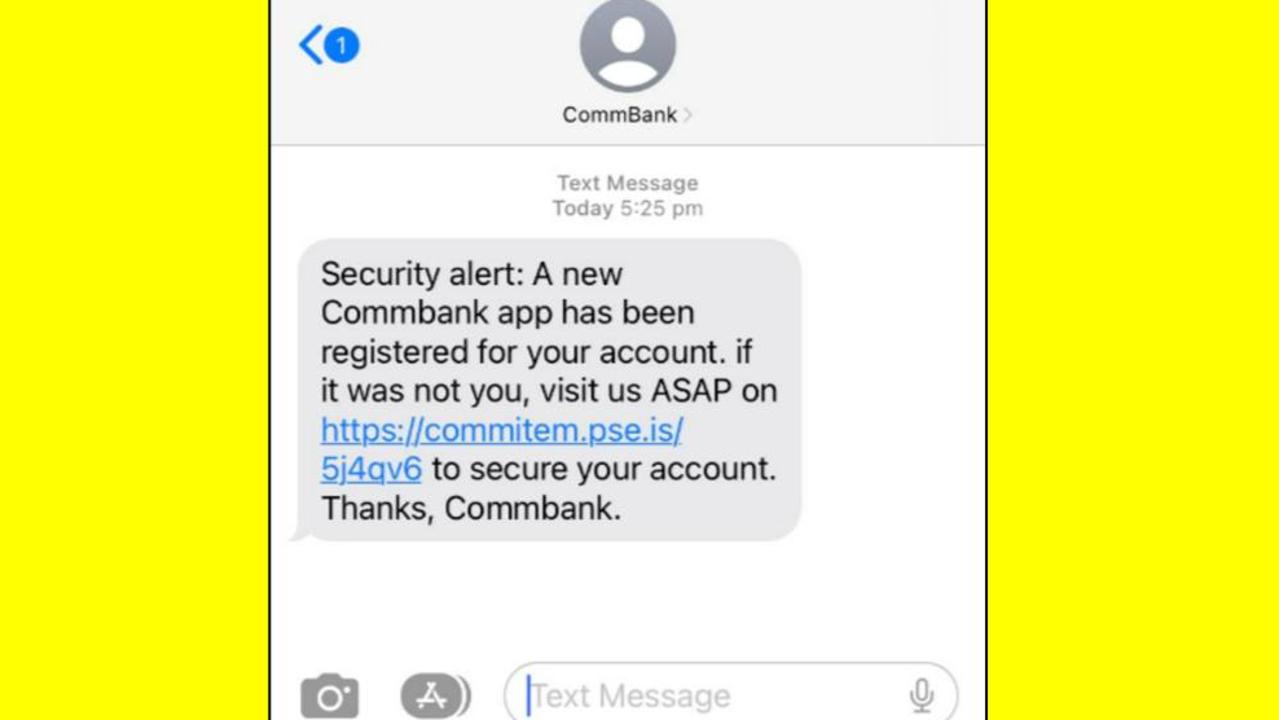

The latest text scam, purporting to be from Commonwealth Bank Australia (CBA) officials, requests people to click on a suspicious link in order to “secure” their account, claiming “a new CommBank App” had been registered for their account.

A CBA spokesman said the link was not a legitimate communication from the bank.

“The bank would never ask customers to log on or provide sensitive info via a link in an email or text,” the spokesman said.

“Customers should immediately delete any of those messages received.”

The CBA spokesman urged customers to protect themselves by turning on notifications in their banking app, or enabling security features.

Statistics from ScamWatch, run by the Australian Competition and Consumer Commission (ACCC), reveals Australians lost $455,436,239 to scams over 2023.

More than $275m was lost to investment scams, the most out of any category.

There were 99,736 reports made to banks and financial institutions for phishing scams, followed by 36,645 for false billing scams and 19,565 for online shopping scams.

In total, there were more than 280,000 reports made for scams.

Last week, NAB revealed it was monitoring an emerging type of voice impersonation scams which used AI to dupe people into sending money.

Said scams can be created with as little as “three seconds” of audio from social media, voicemail or video on a website, NAB’s Advisory Awareness Manager Laura Hartley said.

More Coverage

“The loved one might claim they’ve been beaten up or kidnapped and won’t be freed unless the person sends money,” Ms Hartley said.

“While these scams use readily available technology, they do require criminals to find a link between the person receiving the phone call and the person in ‘distress’ so they’re harder to scale than other scams.”

Common red flags to look out for include unexpected phone calls from a purported “loved one” in “distress”, urgency in asking for a payment and requests for secrecy not to tell anyone else what’s happened.