CommBank and Vodafone team up to fight SMS scams

The Commonwealth Bank and Vodafone are piloting a new “intelligence sharing” initiative to help protect customers from the rising number of text message scams.

EXCLUSIVE

The Commonwealth Bank of Australia (CBA) and Vodafone are piloting a new “intelligence sharing” initiative to help protect customers from the rising number of text message scams.

Under the pilot, the two companies will share scam-related intelligence, which James Roberts, general manager of group fraud at CBA said would allow the bank to “proactively investigate and analyse the latest SMS scams in near real-time to ultimately help disrupt, detect and proactively block fraudulent payments”.

He said that text and email scams are the “number one scam trend impacting our customers”.

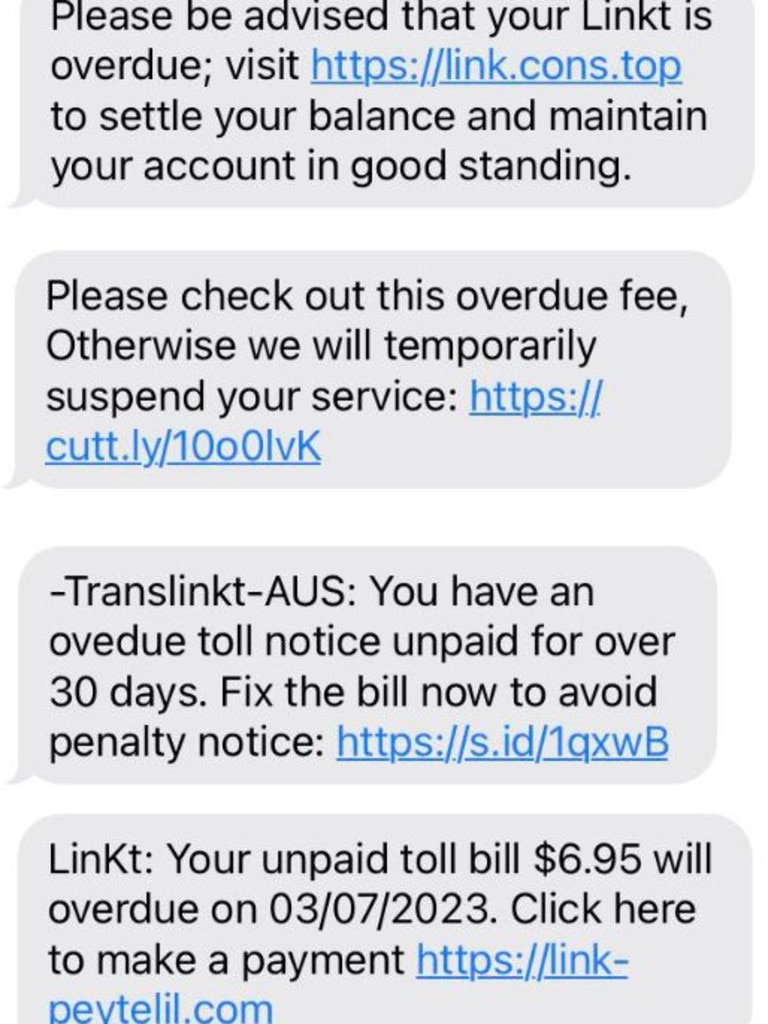

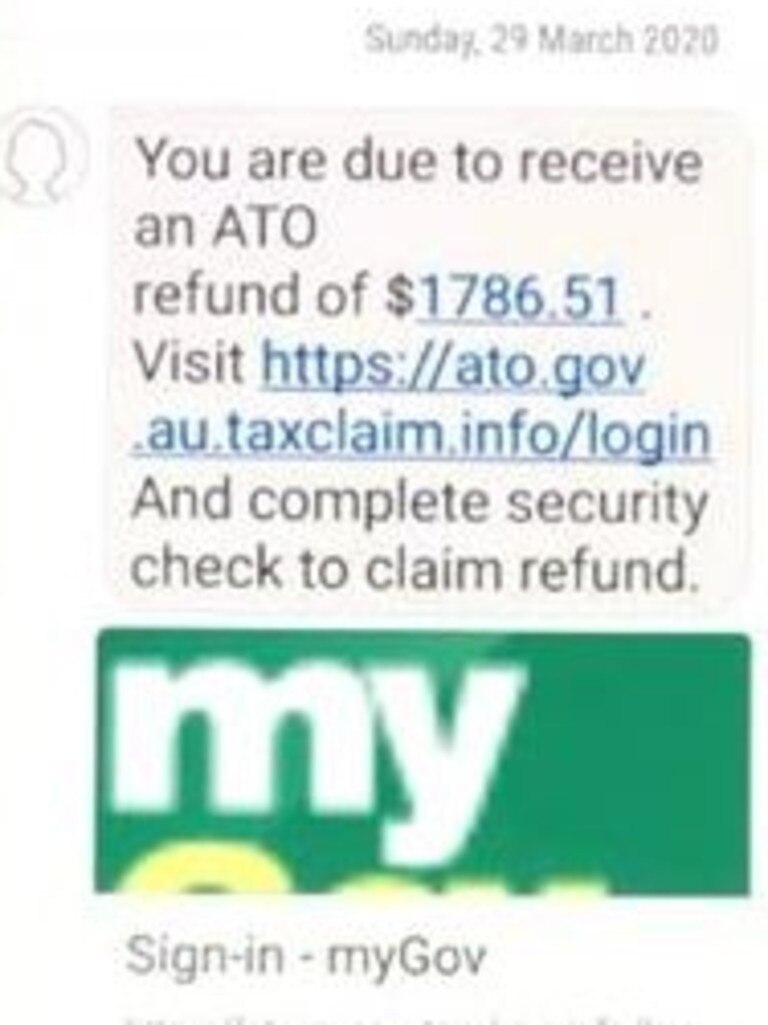

“This phenomenon, otherwise known as ‘phishing’, involves fraudsters tricking unsuspecting customers to click on an embedded link and share their online banking and card details, as well as personal information.”

Simone Sant, general counsel and general manager corporate security at Vodafone said that this year alone, the teleco has blocked more than 67.8 million text scams, with 17.6 million blocked in September and October, a 45 per cent increase compared to the previous year.

The latest scam statistics published by Australia’s National Anti-Scam Centre show that text messages are the most common contact method used by scammers.

More than $24.5 million has been lost to text scams so far this year, with over 65s losing the most money.

Mr Roberts added that people needed to be particularly cautious at present with Christmas typically bringing an increase in scam activity.

“We tend to see an uptick in attempted and successful scams at certain times of the year, such as the festive season,” he said. “With this heightened risk, we recommend people remain alert for potential scams, including those delivered via SMS with messages imitating major courier or postal companies.”

Mr Roberts said a collaborative and cross-industry approach, such as that being piloted by CBA and Vodafone, is essential to fight scammers who are “becoming increasingly sophisticated”.

The pilot follows news of a new Scam-Safe Accord launched by Australian banks late last month with the aim of putting “scammers out of business in Australia”.

At the heart of the accord is a $100 million investment by the banking industry in a new confirmation of payee system to be rolled out across all Australian banks.

Confirmation of payee will help reduce scams by ensuring people can confirm they are transferring money to the person they intend to.

Earlier this year CBA commenced a similar pilot with Telstra, Scam Indicator, to detect high-risk scam situations in real time.

Read related topics:Commonwealth Bank