Banks need to stop targeting kids

MANY Aussie kids had a Dollarmite account growing up. And CommBank’s strategy worked — thousands of us just stuck with our childhood bank.

OPINION

THE Commonwealth Bank has had a rollercoaster few months, image-wise.

In August, news that the bank was being charged with more than 53,000 counts of breaching anti-money laundering laws triggered public outrage and sealed the fate of chief executive Ian Narev, who announced he will retire at the end of the financial year shortly after news of the scandal broke. The Big Four banks have weathered a seemingly unending series of crises over the last few years, with public trust in banking institutions at a low ebb and calls for a royal commission into the banking sector gaining momentum.

In September, the Commonwealth Bank’s surprise announcement that it would scrap its $2 ATM fees for customers of other banks gave it a much-needed PR boost, drawing people to its machines and quickly prompting the other three major banks to follow suit. The Big Four opposed legislative efforts to outlaw ATM fees for years, and ATMs owned by Commonwealth Bank and NAB subsidiaries have mysteriously been left out of the new arrangement, but that hasn’t stopped the banks from taking credit in TV and radio ads.

Even scrapping ATM fees might not be enough to distract from the banks’ latest indiscretion, though. Last week, consumer advocacy group Choice called for school banking initiatives like the Commonwealth Bank’s Dollarmites program to be banned, with Choice CEO Alan Kirkland saying bank-run financial literacy programs in schools ”give banks unfettered access to market their brand to schoolchildren”.

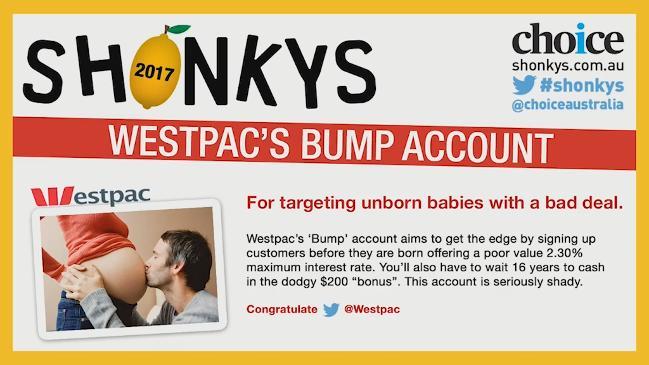

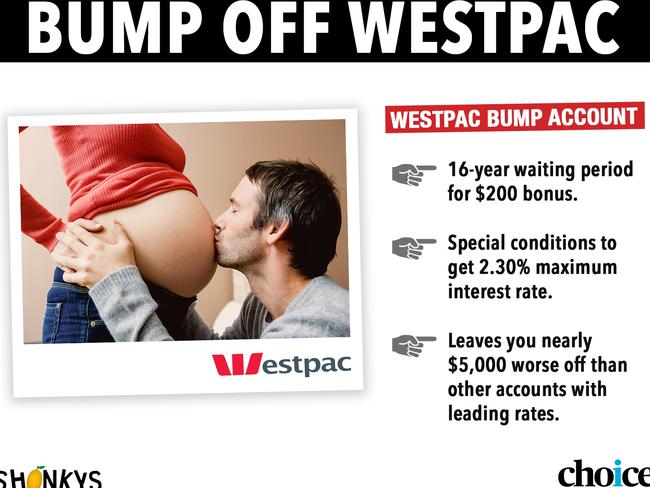

Choice also went after Westpac over its Bump Account package, which offers future parents the opportunity to open an account for their unborn child. Besides what Choice calls the “downright creepiness” of trying to sell people products before they actually exist, the Bump Account is also a bad deal. It only offers clients a maximum 2.3 per cent interest rate and requires kids to wait 16 years to access an advertised $200 bonus credit.

The two controversies have highlighted a practise the major banks have been increasingly using in recent years to snap up new customers: going after kids. The Commonwealth Bank, in particular, has had a foot in classroom doors for decades. The Dollarmites program has run for 85 years, and is so firmly lodged in Australians’ consciousness, it’s assumed the status of a treasured childhood memory. Generations of schoolkids were first exposed to the concept of banking and saving in the form of the Dollarmites, cuddly cartoon characters that adorn the bouncy balls, pencil cases and earphones the bank gifts kids when they open an account.

I was a Dollarmites kid. Like everyone else in kindergarten, I jumped at the chance to get a grown-up chequebook and a piggy bank when a smiling Commonwealth Bank representative came to class. Most people don’t switch banks once they’ve picked one, and that’s especially true if you signed up very young. When something has been with you since early childhood, you don’t even think about it — it’s just a part of your life.

The Commonwealth Bank knows that, and has aggressively expanded its School Banking and StartSmart financial literacy programs in the last few years. In 2015, Mr Narev announced a $50 million expansion of StartSmart that has turned it into the largest bank-run schools outreach program in the world, reaching more than 500,000 kids a year. The old Dollarmite cheque books have been replaced with the CommBank Youth app, which encourages kids to regularly deposit money into their accounts, as well as a raffle sending loyal Youthsaver account holders to Tokyo Disneyland.

None of this is cheap. The Commonwealth Bank spent $2.3 million last year paying schools that participated in its programs, offering schools $5 for each account kids signed up for. But all that generosity really pays off when the Dollarmites grow up. A 2015 Senate inquiry heard the Commonwealth Bank celebrates the transition of its youngest customers to adulthood by sending letters inviting 18-year-olds to take out “their very first credit card”.

Like Westpac’s Bump Account, those credit cards often offer poor customer value and rope financially vulnerable people into agreements they shouldn’t be taking. But the Commonwealth Bank is committed enough to its “cradle-to-grave” banking strategy to aggressively offer such deals. They were certainly aggressive enough when they tried to sign me up for a credit card at the age of 19, despite my repeated refusals.

The Commonwealth Bank has moved quickly to defuse this latest controversy, announcing it would stop tying school payments to the value of students’ deposits. But the problem of banks in schools runs deeper than that. It offends the instinctive notion that we should let kids be kids; that, in a world where children are already saturated with targeted advertising, corporations should be kept out of the classroom. In the United States, 80 per cent of public schools have contracts to let Coca-Cola and Pepsi install vending machines and snack bars, while 30 per cent serve branded fast food in their cafeterias.

As Mr Narev said last week, a business relies on its customers’ trust above all else. Parents once trusted banks to teach their kids about money. If that trust is gone, the Commonwealth Bank has a lot more than losing some school-age customers to worry about.