‘Banks have failed us’: Scam victims call for banks to reimburse customers

It’s costing Australians nearly $3 billion every year, and the key to solving it might lie with our British mates.

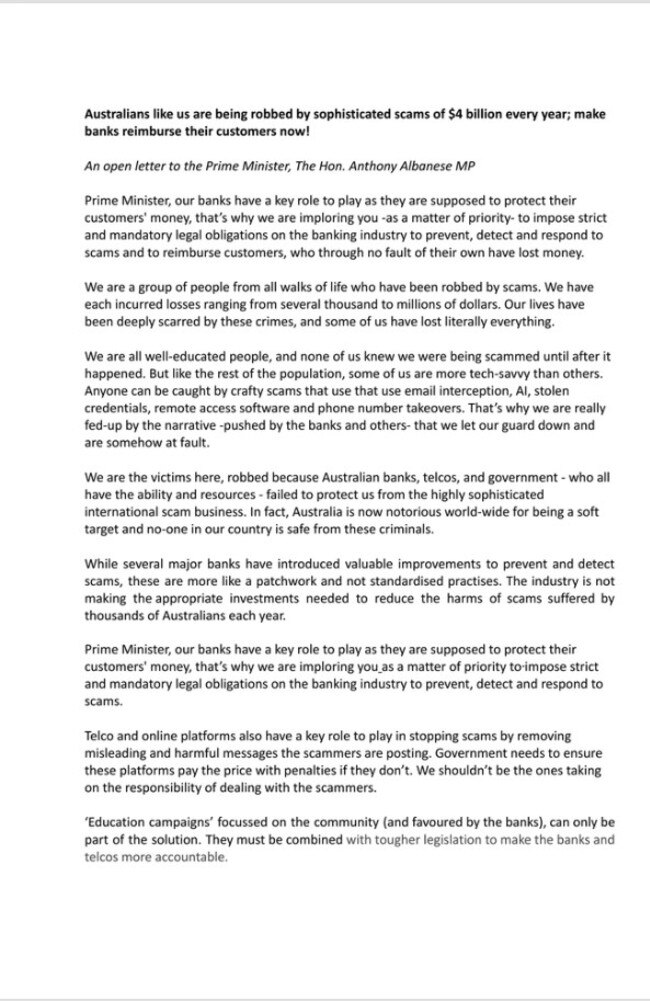

Bank scam victims – one of whom lost $220,000 – have written to the Prime Minister urging him to bring in legislation to follow the UK’s lead and save everyday Australians from losing billions each year.

They implore Anthony Albanese to mandate legal obligations on banks to prevent, detect, and respond to scams – and to reimburse victims in full when they lose money to scammers.

The group emphasised the severe financial losses, ranging from thousands to millions of dollars, and the emotional toll suffered by victims unaware of the scams.

The victims challenged the narrative that places blame on them or saying that only the elderly fall victim, asserting that anyone can fall prey to scams using advanced techniques.

The banking industry, telcos, and the government all came under fire for failing to protect citizens, making Australia a global target.

While acknowledging some improvements, the victims argued that the industry’s “patchwork” practices are insufficient, calling for standardised measures and increased investment.

They highlighted the need for strict legislation, citing the UK as an example, and urged Mr Albanese to introduce a legal framework promoting industry uniformity and incentivising effective scam prevention systems.

The victims rejected reliance on community education campaigns alone and stressed the urgency of legislative action to deal with the ever-increasing sophistication of those scamming.

One of the letters’ signatures belonged to British expat Tim Watkins, who has called Australia home for more than a decade.

He detailed how persuasive scammers fleeced him of $220,000 – and how blurred the lines of legitimacy came.

Mr Watkins said it all started with a text message in a thread with other legitimate correspondence from his bank saying $850 had been withdrawn from his account.

It shared a number to call if he didn’t make the transaction - so he did.

He followed instructions from who he believed to be a bank representative to protect his account.

Not long after, the huge sum was drained over 10 transactions.

“The feeling when I realised what happened is indescribable,” Mr Watkins, told The Guardian.

“It’s this horrible feeling in the pit of your stomach. I had to dig into my mortgage to pay my staff and my suppliers. I naively thought I’d get the money back.”

He was reimbursed just $30,000 from his bank.

The group signed off the letter to Mr Albanese lamenting: “Banks and industry have failed us, and thousands of our fellow Australians, Prime Minister.”

“In the midst of a once-in-a generation cost-of-living crisis, billions more of our community money is at serious risk. It’s time for you to act,” they insisted.

Starting this year, UK laws require that sending and receiving banks will share the cost of reimbursing scam victims.

The banks will have to reimburse customers unless they acted fraudulently or were grossly negligent.

However, Australian banks have opposed the introduction of such requirements.

In the corner of Mr Watkins and others, it seems, is federal independent crossbencher Andrew Wilkie, who used his time in parliament on Wednesday to share bank scam losses of two Hobart constituents- totalling more than $350,000.

“These losses are growing, not because Australians are somehow becoming more stupid as banks seem to imply, but because scams are becoming increasingly complex and difficult for our protections to combat and for ordinary Australians to identify,” he stated.

“Banks used to be a safe place to put your money, but their drive towards online services and frictionless payments has pushed many of the risks and responsibilities back onto their customers.

“Moreover, the banks now often engage in scam victim blaming and take no responsibility themselves. Indeed a recent ASIC report found that in 2021/22 the big four banks only reimbursed about 11 per cent of scam victims, and at a rate of between two and five per cent of the losses.”

He too called for better preventive measures and UK-inspired regulation in the sector that mandates reimbursements.

“Good grief, the banks are more than happy to raise interest rates, close branches, reduce services and push customers online,” Mr Wilkie stated.

“But they are stubbornly unwilling to invest in adequate scam protections or to support the vast majority of their regular customers who fall victim to increasingly skilled scammers.

“To fix this the government must act decisively and place a meaningful positive obligation on banks and other industries to raise their standards in scam prevention and to reimburse victims of scams where these victims were not grossly negligent or involved in fraud.”

According to the Australian Competition and Consumer Commission, Australians lost a record $3.1 billion to scams last year, which is an increase from $2 billion in 2021. The average amount that individuals were scammed out of also increased. On Scamwatch, the reported losses per person averaged at $19,654, which is up by 54 per cent from $12,742 in 2021.