ANZ may buy Volt, Bannister Law investigating class action against bank

There has been an unlikely lifeline after an Australian bank with 140 staff, 6000 customers and investors who had poured $212 million collapsed.

A class action law firm is investigating an Australian bank that collapsed last week to see if they have a case on behalf of investors.

On Thursday, news.com.au reported that digital bank Volt had stopped trading, leaving 140 staff members and 6000 customers out in the cold as well as investors who had poured $212 million into the venture.

Volt Bank Limited had been seeking to raise $200 million since February, but said the pandemic and the current challenging global economic climate had hampered those efforts.

The company’s eight board members voted to shut down the company because it had failed to raise enough funds to support its plans to write mortgages.

It was a decision that left the Volt co-founder and CEO Steve Weston, “gutted”.

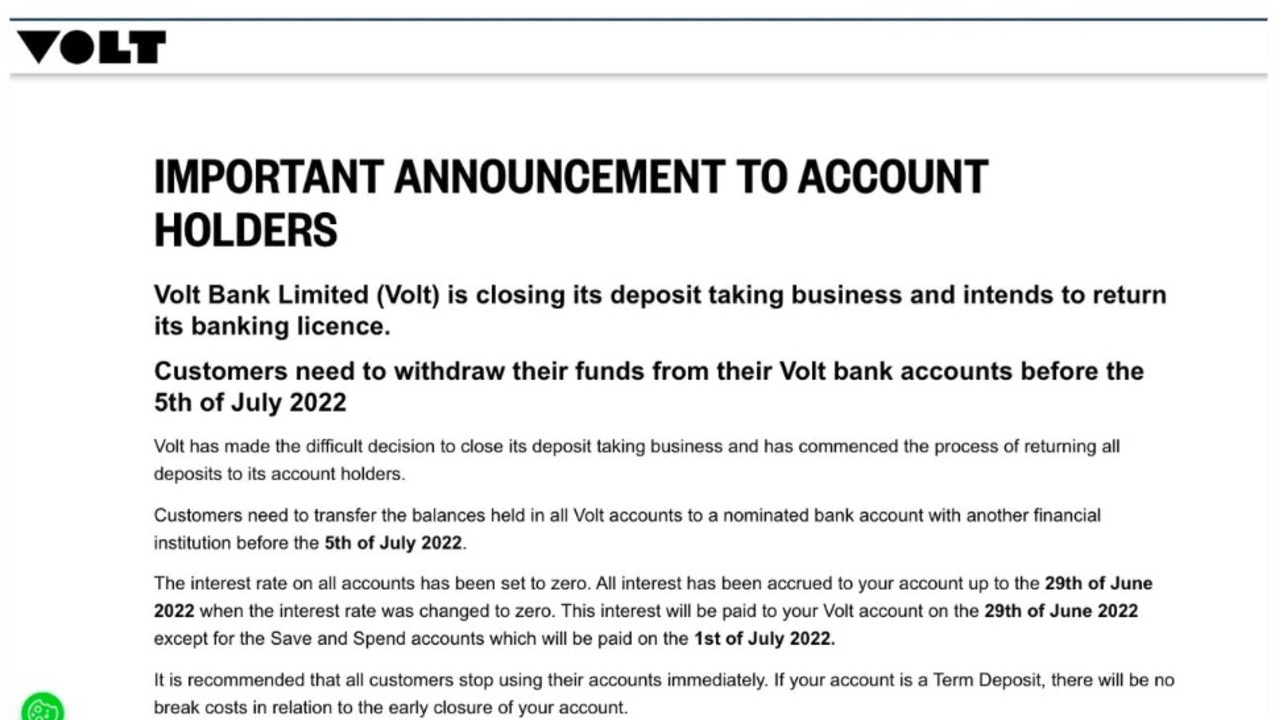

The bank urged its customers to withdraw $100 million worth of deposits and began closing accounts on Tuesday.

Volt, which had its offices in North Sydney, handed back its banking licence to the regulator on Wednesday.

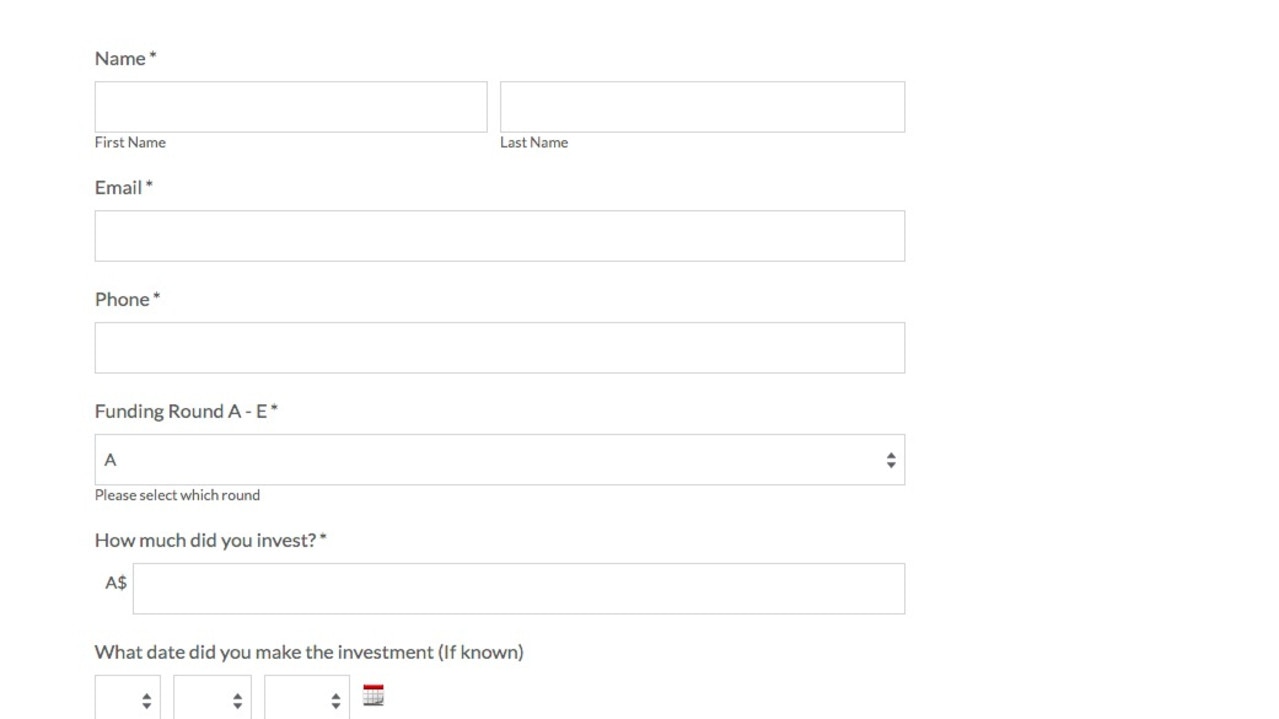

But now Bannister Law is asking for investors to get in touch to help with their investigations into the embattled bank.

It also emerged late on Tuesday that ANZ might offer the crumbling company a lifeline, with rumours circulating that the big bank is looking to buy its smaller counterpart.

Stream more business news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

In a statement to news.com.au, Bannister Law said it was “investigating the conduct of management, forecasts and representations made to investors in the company surrounding the company’s Series A – F equity funding rounds”.

The class action law firm added: “Although investors had high hopes for the company many may stand to lose significant sums of money …

“Selling remaining assets may yield a return to investors.”

Bannister Law called on Volt investors to register their details to aid their investigations so they could “gain a full picture of what has transpired”.

But at the same time that Volt might be facing an impending lawsuit, hope may have come from an unlikely ally: ANZ.

The Australian reported on Tuesday afternoon that ANZ was engaged in talks as it was considering buying Volt.

It’s understood Volt’s technology could be the reason for the big bank’s interest in the company, as ANZ’s own technology is not as advanced.

In a statement to news.com.au, Volt said: “Volt is running a sale process through Rothschild & Co on a confidential basis.

“There are a number of parties who have registered their interest, but we will not be commenting further at this time.”

In regards to the possible class action, the bank said it had “not received any claim”.

News.com.au has contacted ANZ for comment.

Volt’s collapse has extended beyond its staff, customers and investors; a debt collection company has also been impacted.

Collection House gave $8.5 million to Volt in its very early stages in January 2019 and used that investment as an asset to borrow against, according to Business News Australia.

As a result, when Volt went under, so too did Collection House.

Its initial $8.5 million injection had plunged in value to $4.86 million by mid 2020. A year later, it was worth less than half of the original investment, at $3.5 million.

The debt collection company went into voluntary administration last Thursday and had big clients including Telstra and Westpac.

John Park, Ben Campbell and Kelly-Anne Trenfield of FTI Consulting have been appointed as external administrators.

Bannister Law is also investigating Collection House over concerns about its shareholders.

Volt launched in 2017 as the first start-up to gain the banking licence in January 2019 after the government sought to increase competition in the sector.

The company had been seeking to raise $200 million but failed to do so.

It had previously raised $212 million over seven private rounds since its inception.

Most of Volt’s website has been closed down leaving just a statement and a list of answers to questions.

It said it had adequate funds to return customer’s money and to ease the transition of money to a different bank account quickly Volt had increased the daily transfer limits to $250,000, it told customers.

Australia’s financial safety regulator, APRA said it will closely monitor the process to ensure funds are returned to Volt customers in an orderly and timely manner.

Volt CEO Mr Weston said: “I feel gutted for our team and customers who have supported the business.

“It just rips your heart out because we know we’ve built an outstanding banking platform.”