‘Crying’: 37yo reveals horror tax bill reality

A young Aussie has revealed the huge tax bill that left him worried he wouldn’t be able to pay his mortgage.

Comedian Christian Hull had never felt richer until he was hit with a $170,000 tax bill that left him worrying about how he was going to pay his mortgage.

Mr Hull, 37, was running a novelty goods business and doing his comedy online during the pandemic in 2020 when his finances spiralled out of control.

The comedian, who purchased a two-bedroom, two-bathroom apartment in Brisbane in 2019 with a $100,000 deposit and a little help from mum and dad, had previously always lived within his means.

That was when he was an employee. His tax was being taken out automatically, and he didn’t need to know heaps about financial stuff to avoid getting in trouble.

During the pandemic, he pivoted from touring to selling novelty items and making comedy content. He was thrilled with the income he was able to generate.

He started making more, and naturally, he started spending more.

The comedian is the first to admit that some of his purchases weren’t sensible, like the $20,000 he sunk at the local antique store buying items he describes as very “sixties with nice vibes.”

He also renovated his two bathrooms, which he stands by because they looked like they were straight from a budget hotel before he spent $50,000 sprucing them up.

“My place is stunning! But I am in a lot of debt,” he admitted.

When tax time rolled around in June he wasn’t just surprised by his bill. He was crippled by it.

In fact, four years later, he has only just paid it off.

“I am starting at zero dollars. I’ve got a little bit in my off-set account,” he told news.com.au.

Mr Hull said he “pulled so much” from his offset account to try to pay off some of his debts, and he started paying interest only on his mortgage.

Paying less off on his mortgage was only a small financial break because rising interest rates had made it far more expensive.

When he purchased his apartment in 2019, the interest was only $800 a month, but it has now ballooned to $2000 a month.

This all made his debt overwhelming, and Mr Hull didn’t feel financially equipped to deal with it.

Mr Hull said there were plenty of moments where he thought, “Oh s**t, this is really difficult to pay back.”

He stayed disciplined mostly because he didn’t have a choice.

“I was like, okay, I’m making so much money, and I’ll work out how not to spend it all. I had to be really smart with money,” he explained.

What made it difficult was now he was starting to put money aside for tax on his income. He was paying back his tax debt on an income that was much less than the one he’d previously thought he had.

He knows it sounds “stupid” not to know about these things before selling items online, but he said he isn’t a business-minded person — he is a creative person who needs to make a living.

“Creatives are not money people. Some of us might be motivated to earn money but we don’t understand it,” he said.

Mr Hull said it is always in the back of his mind that he could sell his apartment, which he bought for $500,000 and would now be valued at north of $800,000, but he couldn’t do it.

“I did think I could sell and go back to renting but I just made sure I was really good with my money going forward and I started to monetise every possible avenue I could,”

The whole experience has been a big lesson, and he is happy to talk about it. He knows people get “scared” to talk about money stuff, but he wants to share how easily things can snowball.

“I can get paid $12000 for a sponsored TikTok but take 50 per cent off for tax, take off commission, take off GST and it isn’t 12,000 anymore.”

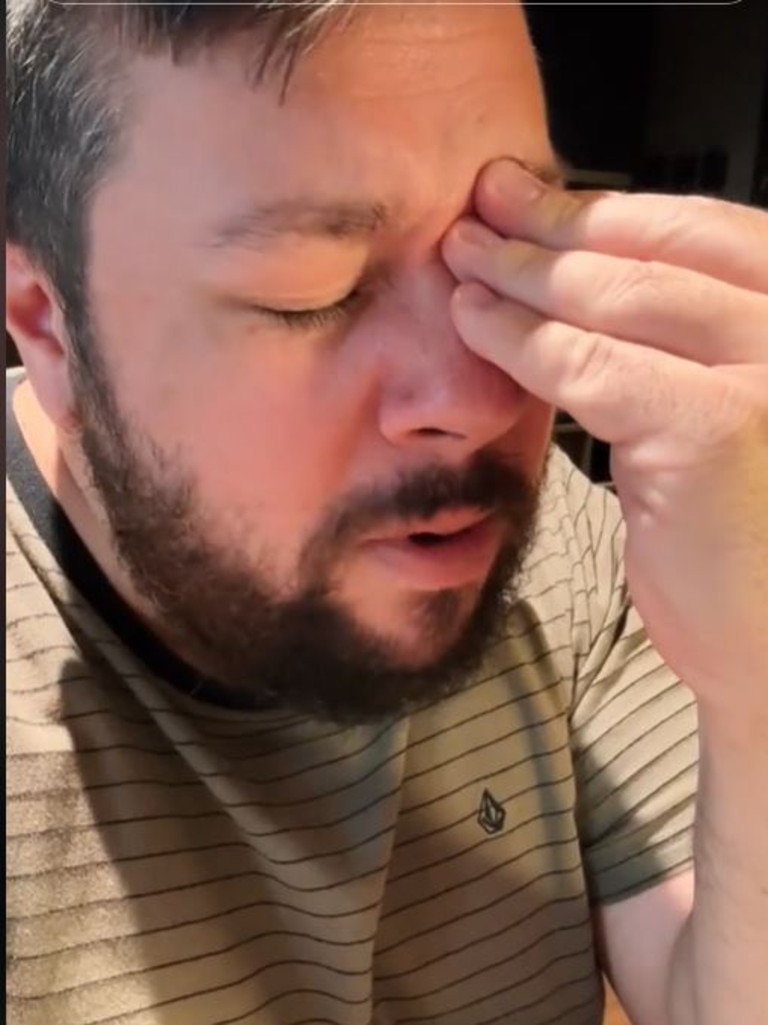

Mr Hull said people think he is sitting on a goldmine, but the reality is more like, “I’m crying and checking my banking app.”

Even now, he is officially debt-free, but he can’t help but worry it’ll happen again.

“I’m now scared and huddled in the corner. A bill can come out of nowhere. When you run a business, bills always come out of nowhere.”

Mark Chapman, director of tax communication at H&R Block, said Mr Hull’s mistake isn’t uncommon.

“Taxpayers, especially in the small business space, often fail to take account of tax payments during the course of the year. They receive money from their business but rather than setting aside a proportion of that to deal with their taxes, they spend it all,” he said.

“When they come to complete their tax return for the year, they have potentially made a profit and have a tax liability… with no cash available to pay it! That results in a tax debt which they are unable to pay.”

Mr Chapman said the best thing to do if you find yourself with a tax bill you can’t pay is to be proactive.

“Make a payment arrangement with the ATO. This is very straightforward and can even be done online. A payment plan allows you to break down your payment into smaller amounts made via instalments and spread over the shortest possible fixed period of time,” he said.

“Make sure that once you have set up a payment plan, you stick to it. Ignoring your tax debt and hoping that the ATO will go away is a disastrous strategy. They won’t go way and the amount of penalties and interest charged will only increase, possibly leading to the use of a debt collection agency if you ignore the debt for too long.”