‘Hyper stupidity’: Kochie lashed for TV interview on superannuation tax with Jim Chalmers

Sunrise star David Koch has come under fire following the TV host’s wild interview with the Treasurer about changes to tax on superannuation.

Wayne Swan has slammed a morning TV host in a passionate defence of Treasurer Jim Chalmers during an interview with a rival network.

The former Treasurer and current Labor president took to Nine on Friday morning to hit back at critics of the government’s move to double tax on super earnings for balances of more than $3m.

Mr Swan said the government’s estimate would affect about 80,000 people but claimed they were doing “what every Treasurer has done” before.

“Well I think it’s a modest proposal. It’s been turned into the end to the world in the sorts of stories that are out there today,” he told Today.

“Every other Treasurer before him would have handled the announcements the way he has.

“The difference here is hyper stupidity in the media and some of the stories that have beaten it up to the point it's not even recognisable as the original proposal.”

Mr Swan lashed out at Sunrise host David Koch after he cornered the Treasurer in a trainwreck interview on Wednesday morning.

That appearance resulted a slapdown from the Prime Minister and a mea culpa just hours later.

“Some of the coverage that we have seen, particularly on one of your rival channels … that performance was disgraceful,” the former treasurer said.

Mr Swan was the longtime boss of Dr Chalmers, working alongside him during the Global Financial Crisis.

He wasn’t the only Labor man sent out to defend the Treasurer on Friday morning.

Current Deputy Prime Minister Richard Marles also lined up on the Today show to spruik the government’s plan.

Things soon turned curly for Mr Marles as host Karl Stefanovic gave him three chances to explain if Labor was going after unrealised capital gains.

“How are you going to tax the increased paper value of an asset that hasn't been sold?” the Nine host quipped.

“This goes to the question of earnings, in super funds with more than $3m and the way it is put in place,” Mr Marles started, seemingly unable to recall the answer.

Mr Marles’ answer didn’t satisfy Stefanovic, nor the Minister’s regular sparring partner, Opposition Leader Peter Dutton.

“You are the Deputy Prime Minister. You are on the Expenditure Review Committee. You agreed to this crazy plan,” the Opposition Leader pushed.

“If you don't understand the detail, how on earth can the Australian public understand what it is you are proposing?

“It is a basic question.”

Mr Marles said he understood the detail, clarifying a process would be put in place to assess superannuation earnings.

“An assessment is going to be made in relation to super funds and their earnings. So there is a tax applied to those earnings. And that is what will occur,” he said.

“What you’re now talking about goes to people who are in self-managed super funds and a process will occur in order to enable that assessment to be undertaken on an ongoing basis.

“But, again, this doesn‘t apply unless you have got $3m in your super.”

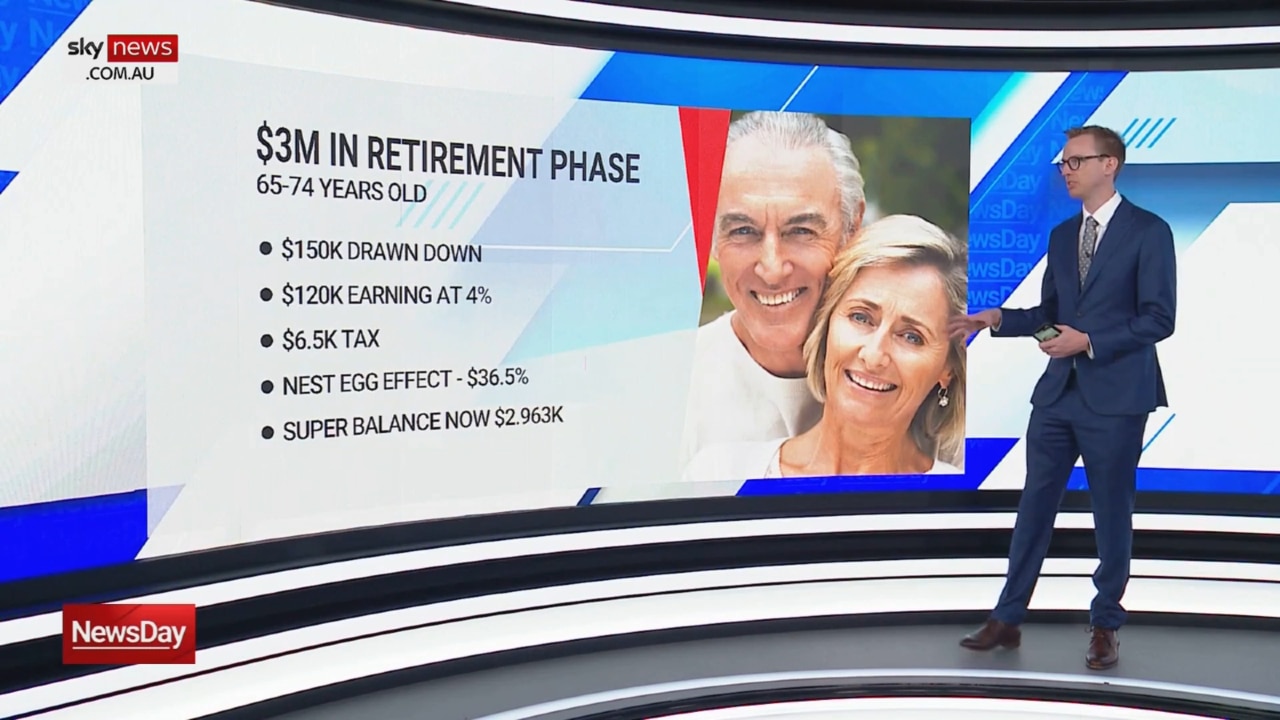

Australia’s Treasury on Tuesday revealed it would include “all notional gains and losses” in its calculation of earnings under the superannuation tax concession crackdown.

Earnings would be calculated as the annual difference in the fund’s value at the end of each financial year and largely affect people with self managed super funds.