Naamtech owner Amin Naaman missing as investors owed millions

A high tech start-up guru has sparked a gangland feud after his failed business enterprise cost some of western Sydney’s most notorious underworld figures more than $100 million.

True Crime

Don't miss out on the headlines from True Crime. Followed categories will be added to My News.

He’s the tech start-up guru who has sparked a gangland feud after his failed business enterprise cost some of western Sydney’s most notorious underworld figures more than $100 million.

And they aren’t prepared to cut their losses.

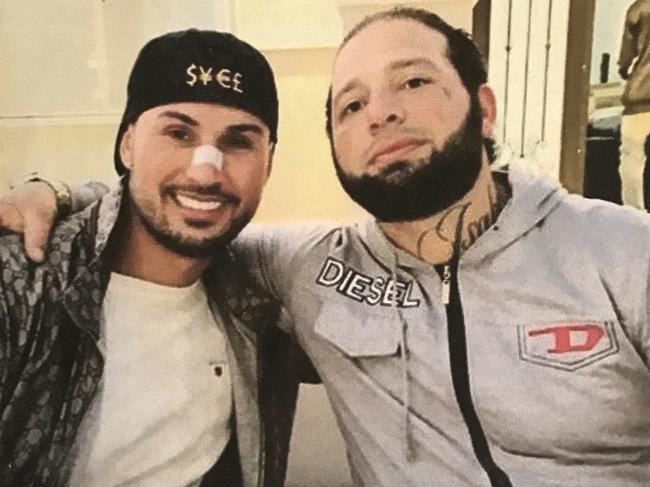

The man at the centre of the failed venture – Bankstown figure Amin Naaman – is missing in action so some disgruntled investors have turned on each other.

Ahmed Zaoud, 36, turned up to hospital on October 1 this year after being shot in the back of the leg in Auburn.

The former member of the Muslim Brotherhood Movement street gang refused to tell police what had happened.

“Despite extensive inquiries, police have not located those responsible for the shooting,” a police spokeswoman said.

But police sources suggest Zaoud was shot because he received a return on his investment from Naaman while other disgruntled investors didn’t.

While former staff, police, legal figures and investors agree the amount of money invested – and sought after – is huge, the exact figure fluctuates between $130 million and $200 million.

On face value, self-styled entrepreneur Naaman’s business, Naamtech Pty Ltd, seemed promising.

It occupied an office in Rhodes in Sydney’s north and employed a staff of about 20, recruited to making Naaman’s passion project come true – to develop a suite of apps.

But interviews with a former employee, investors, police sources and court and business documents provide an insight into an ambitious tech vision that sounded too good to be true.

MORE FROM AVA BENNY-MORRISON:

Mehajer’s mate charged with selling Nike knock-offs

Special report: Why men think a swipe right is consent for sex

Speaking on the basis of anonymity, the staffer said the team worked on developing a food ordering app, a peer-to-peer lending app for construction projects and an e-sports gambling platform.

The app names – Devtown, Banktown and Smart Table – are also businesses registered under the name of Naaman’s brother, Jalal. The siblings, who are not alleged to have been involved in organised crime, were co-directors of Naamtech.

“I got told Amin made his money in property and on the stock market, Naamtech was just a side (project),” the staffer said.

One app was designed to show investors what property their money was being invested in.

“The reality is the figures weren’t linked to any data,” the former employee, an experienced IT professional who ended up with a job at the embattled business through a recruiter, said.

Employees started to get suspicious when it emerged there was no financial licence for the gambling app and Amin Naaman suggested giving Ferraris away instead of money.

“The weird thing was they thought they could award physical prizes rather than money so it made it a competition,” he said.

“But I thought hang on a second, if this is a global gaming platform what about the logistics of getting these prizes to people?”

By the start of this year, staff wages weren’t being paid on time and superannuation hadn’t been deposited either.

Approached about the outstanding wages, Naaman claimed he’d been audited by the Australian Taxation Office and “fined $5 million”, the former staffer alleged.

Complaints were made to the Australian Securities and Investments Commission and Fair Work Ombudsman, he stressed, but nothing changed.

He started looking for a way out and left the company mid-year.

“By this point, Naaman had stop coming into the office altogether,’ he said.

Traces of Naaman on the internet also began to disappear, even a Google Earth image that previously showed a white Lamborghini in the driveway was changed, the staffer claimed.

In another twist, the directorship of Jalal’s company, In Capital Investment, was also transferred to Pezh Moradi, a successful Sydney-based tech investor, in February.

In September, Naamtech’s former chief operating officer, Tyrone Hazell, who is not accused of any wrongdoing, took action to have the company wound up in the NSW Supreme Court.

The court ordered liquidator Benjamin Carson, who did not return calls on Friday, appointed to try and recoup funds for creditors.

Mr Hazel and his lawyer did not return calls either.

But it wasn’t just employees chasing Naaman, who registered his businesses to a family home in Greenacre, for money.

According to an investigative source, Naaman had taken investments from the who’s who of southwest Sydney, including well-known crime families,

One underworld source with knowledge of the operation explained Naaman had offered investors a “very good interest rate on money invested with him”.

“So every six weeks or so, if you gave him say $500,000, you will get back $50,000. People were paid on time and no fuss,” he said.

Word spread through the community that there was money to be earned with Naaman and more people signed up, the source explained.

“Then two years later, start of 2019, the ATO froze his bank account and he couldn’t pay anyone,” he said.

“When people tried to pull out that’s when they realised no one had access to the money.”

A spokesman for the ATO said the department doesn’t comment on individual cases for privacy reasons.

Naaman could not be contacted before publication.

His mobile was off and emails sent to three addresses were unanswered or bounced back.

Originally published as Naamtech owner Amin Naaman missing as investors owed millions