Property slump: Sydney prices fall by up to $330k amid signs of market recovery

There have been some truly staggering price drops in parts of Sydney, but things are beginning to look up for the market and some regions are in line to grow, new figures show.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Home prices have recorded spectacular falls of up to $330,000 in some parts of Sydney over the past year – but there are growing signs the worst of the downturn has passed.

PropTrack’s latest Home Price Index released Thursday showed the market has improved since winter when a series of interest rate hikes plunged the city into its deepest housing downturn in decades.

Prices fell by an average of 0.14 per cent over November – the smallest monthly fall since the Reserve Bank’s first cash rate rise in May.

November’s smaller fall followed moderate price drops over September and October that were about a third the rate of decreases over June and July.

Housing experts said the rate of decline was slowing because the market had adjusted to the initial “shock” of rate rises and buyers were becoming more accustomed to higher rates.

Property listing activity was also more subdued than expected over spring and the lower supply of available properties put a brake on the falling market.

Greater Sydney’s median property price, based on sales of units, townhouses and houses, is now $980,000 – about 7 per cent lower than it was in February.

PropTrack economist Eleanor Creagh said the strong likelihood of further rate rises and buyers’ reduced borrowing capacity suggested more price falls were coming, but they would likely be gradual.

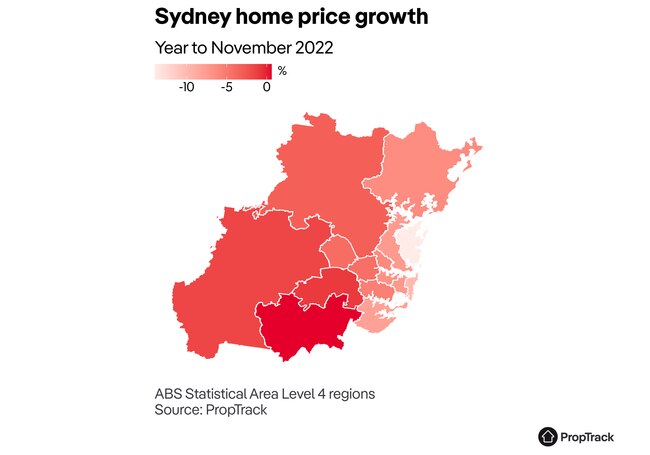

She added that PropTrack’s index showed a wide disparity in price movements across Sydney’s cheapest and priciest markets.

Falls were the highest on the northern beaches, where home values dropped by an average of about 14 per cent, or nearly $330,000 over the past year.

The northern beaches had been Sydney’s strongest market last year, recording the biggest price rises during the early Covid-era boom.

Eastern suburbs prices fell by an average of about 10 per cent over the year, or $180,000, while the drop across the north shore was 9 per cent, or $130,000.

Prices inched up in Sydney’s outer southwest – the city’s cheapest market – with the annual rise at 0.61 per cent, or about $5000.

Ms Creagh said the better performance of cheaper markets was due to the buyers’ being less affected by interest rate hikes. There was also a flight to cheaper housing as rates rose, she said.

SQM Research director Louis Christopher said a housing market collapse was unlikely in Sydney because a strong city economy and rising overseas migration were boosting buyer demand.

The market would be in worse shape if there was a sudden spike in unemployment next year that led to a mass of forced sales next year, but Mr Christopher said this scenario was unlikely.

SQM earlier this week released forecasts showing prices could rise in the second half of next year if the Reserve Bank keeps inflation under control. Growth was projected at 5-9 per cent.

Mr Christopher said parts of the Sydney housing market appeared to already be on the road to recovery.

“There have been signals that Sydney’s eastern suburbs has entered into this recovery, particularly for freestanding houses.

“It is also noted, that on SQM’s leading indicators, there has been a moderate rise in the auction clearance rate for Sydney, particularly for Sydney’s eastern suburbs.”

PropTrack head of economic research Cameron Kusher said Sydney prices were still about 20 per cent higher than they were at the start of 2020, despite the recent falls.

Homeowners who were the most impacted by the declining market were those who purchased during the boom for an inflated price, Mr Kusher said.

“There were a lot of buyers who got swept up in the FOMO (fear of missing out) last year,” he said. “These owners may have overcapitalised on their properties and may struggle to sell them for the same prices they paid.”

AVERAGE PROPERTY PRICE CHANGES BY SYDNEY REGION (ANNUAL)

Northern Beaches -$328,394

Eastern Suburbs -$180,125

North Shore -$129,267

Sutherland -$121,198

Inner West -$97,521

Ryde -$88,183

City and Inner South -$80,482

Inner South West -$59,366

Central Coast -$56,862

Hills District -$54,191

Parramatta -$39,163

Blacktown -$38,480

Outer West and Blue Mountains -$14,416

South West -$9,795

Outer South West +$5,129

Source: PropTrack

More Coverage

Originally published as Property slump: Sydney prices fall by up to $330k amid signs of market recovery