Does your home earn more than you? Search every Melbourne postcode

Homes in 145 Melbourne postcodes are earning more than their owners annually on average — in some cases, by hundreds of thousands of dollars. SEARCH EVERY POSTCODE.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Homes in 145 Melbourne postcodes are earning more than their owners on average – in some cases, by hundreds of thousands of dollars a year.

A typical Somers resident is raking in six times more from their house than their employer, according to realestate.com.au research supplied exclusively to the Herald Sun.

And houses in Blairgowrie, Brunswick East and Toorak earned triple the average income of residents, according to the data, which shows many residences are generating more wealth each year than highly paid professionals like doctors and lawyers.

RELATED: Victoria’s real estate market now worth $2.56 trillion

APRA lifts interest rate test in a move to combat soaring house prices

Toorak house price record smashed by $40m-plus sale

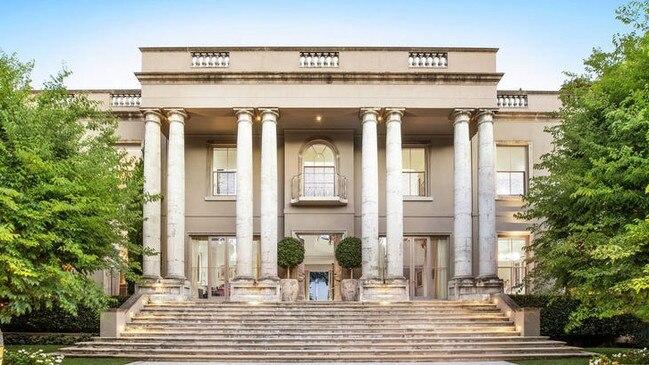

Top music promoter sells $30m Toorak mansion

REA Group economist Paul Ryan said while these findings were welcome news for homeowners across Melbourne, they reflected a concerning increasing divide between “the ‘haves’, people in the market, and the ‘have nots’, people who aren’t in the market”.

The research compared a postcode’s average annual property price gains with the average annual salary of its residents to answer the question: “does your home earn more than you?”

The verdict was a resounding yes in Somers on the Mornington Peninsula, where house prices have soared an average of $423,500 each year between 2018-19 and 2020-21, while residents reported a typical $70,066 pre-tax wage to the Australian Taxation Office 2018-19.

In Melbourne’s most expensive suburb, Toorak, the substantial $213,429 average wage still paled in comparison to the $646,250 house price gains.

MORE: Is your suburb’s property market rising?

Regional Victorian areas where houses earn more than jobs

Property price growth more than doubled residents’ income in dozens of other suburbs.

For houses, this included Box Hill, Canterbury, Balwyn North, Mt Martha, Elsternwick, and Blackburn North, and for units, Brighton East and Clayton.

Units in the more affordable postcode 3020, comprising suburbs like St Albans, Sunshine and Albion, also outpaced their owners’ earnings by 1.5 times.

Mr Ryan named record-low borrowing costs as the “chief driver” behind home price growth leaving wages in the dust.

Covid had also contributed by triggering stimulus schemes like the federal government’s HomeBuilder grant and boosting buyer demand, in particular for sea-change havens like the Mornington Peninsula.

“Covid was also the main reasons interest rates have fallen, (which has meant) people can service a much larger debt,” he said. “That’s a reason we’ve seen prices rise so quickly.

“But potentially, that signals property prices aren’t going to grow as fast in the future, as they won’t have that free kick from interest rates.”

This week, the Australian Prudential Regulation Authority also announced changes to home loans aimed at reducing a typical person’s maximum borrowing capacity by about 5 per cent. Mr Ryan expected this move to have the desired effect of cooling the market – despite causing initial pain for first-home buyers.

“It affects anyone who is at the limit of their borrowing capacity, which is often people like first-home buyers,” he said. “But price growth is already slowing, and this will help further.”

In the meantime, more first-home buyers were having to rely on financial help from their parents, as saving a deposit in the rising market became like trying to catch a runaway train.

“It should put more pressure on the government to expand schemes like the First Home Loan Deposit Scheme,” Mr Ryan said.

Fletchers Blackburn director Robert Sheahan said persistent low housing supply throughout the pandemic had also contributed to the price boom, by leaving buyers to compete over fewer properties.

“I’m at about 30 per cent of (the level of stock) I’d normally have at this time of year,” he said.

Realestate.com.au found property prices had jumped an average of $167,750 annually in recent years in Blackburn, Blackburn South and Blackburn North. This was 2.47 times the area’s typical income of $67,823.

Mr Sheahan said the postcodes had benefited from rush of buyers priced out of nearby suburbs like Surrey Hills and Box Hill, and drawn to perks like the railway station, freeway access and larger blocks starting at 600sq m.

“The lockdowns have actually helped create a buzz around the market,” he added.

MORE: Century-old Somers homestead seeking $30m sale

Toorak apartment block set to make unit owners instant millionaires

Owners reject highest offer for basic Bacchus Marsh house, still top reserve by $620K

House a big earner for savvy couple

By the time Lucy Scott and Darren Chan had sold their Blackburn North home, it had earned them more than $100,000 a year.

The savvy couple paid $1.12m for the Simon St property in 2015 and sold it less than six years later for $1.77m.

On top of this, they raked in about $400 per week renting out, via Airbnb, a self-contained studio they added to the 706sq m block.

Ms Scott said they purposely bought a property they could add value to, to ensure they were “maximising our investment”.

“We completely cosmetically renovated the place,” she said.

“That involved adding a new kitchen, new bathrooms, converting one of the bedrooms into an ensuite for a master suite.

“We created an alfresco area, as we like to dine outside, and maximised the use of the land – there was a lot of dead space.”

The pair also identified Blackburn North as a more affordable alternative to nearby Surrey Hills, Box Hill and Blackburn, and therefore as a suburb with room to grow.

“It has definitely increased in value – the market has gone crazy,” Ms Scott said.

“It also had everything we needed and proximity to the freeway, plus it felt like there was more of a community feel there. It was great for young families.”

Ms Scott said she and her partner were using the proceeds of the sale to buy two investment properties, which they also planned to renovate.

“That’s what I’m doing professionally now as well, helping people add value to their properties by renovating,” she said.