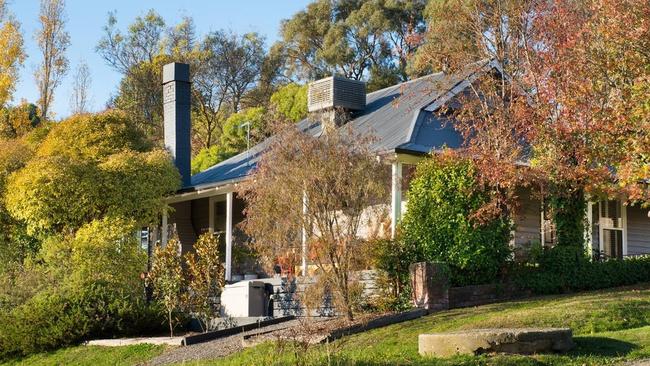

Daylesford and Wonthaggi dubbed worst investor ‘no go zones’ in Australia

Two attractive Victorian towns are now considered the worst “disaster areas” in the country that property investors should steer clear of buying in.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Two attractive Victorian towns are now considered “disaster areas” property investors should steer clear of buying in, after going gangbusters during the pandemic.

Daylesford has been dubbed the worst investor “no go zone” in the entire country, and Wonthaggi No. 2, among eight Victorian suburbs in DSR Group’s national top 30.

The research group reviewed every suburb in Australia based on 17 metrics that determine strong and weak locations for investors.

RELATED: Fight to get a rental like ‘The Hunger Games’

Where home values are up $1m+ post pandemic

Victoria’s surprising new first-home buyer change

Stock on market, online demand sales volumes, market cycle, and auction clearance rates are some of the metrics used to determine each market’s score out of 100.

Anything less than 30 was considered “disastrous”, with Daylesford scoring the worst in Australia with 19, and Wonthaggi, just 20.

DSR Score analyst Jeremy Sheppard said all 30 locations were “no go zones” and Daylesford and Wonthaggi were outright “disaster areas” for investors.

“A lot of people were leaving Melbourne for the scenic lifestyle change (in Daylesford) during the pandemic and prices rose,” he said.

“Given the recent rise in interest rates, it might seem harder now to afford or even justify the expense, despite it being a truly beautiful part of Victoria.

“Sudden unaffordability has dried demand while a small glut of vacant blocks for sale have increased supply, leading to a sudden drop in demand relative to supply.”

Mr Sheppard said Daylesford and Wonthaggi’s scores were comparable to “one industry towns where that industry went belly up and the only reason for many to live there disappeared”.

McQueen Real Estate’s director Kim McQueen said a big reason there were so many properties for sale in Daylesford was because some sellers were still trying to attract the high prices homes were selling for in Covid.

“It’s been an incredibly fickle market … people were worried and were waiting for the bottom of the market; the doors just shut,” Ms McQueen said.

“There’s definitely been a reduction in prices but there had to be … I believe what happened (with home prices) in Covid was a once in a generation experience, people were paying anything.”

In Wonthaggi, Nika Real Estate director Victoria Wolk said there was a standoff between buyers and sellers with buyers scared of spending too much, and sellers overpricing their properties.

“I think there are some unrealistic expectations from sellers, but properties priced to market are selling,” Ms Wolk said.

“If that gap can close between buyers and sellers, conditions will get strong.”

But Cate Bakos Property director Cate Bakos said conditions were likely to worsen in holiday home hot spots like Wonthaggi and Daylesford.

“If we continue to have rising interest rates, people will be reluctant to sell a family home but they will sell a surplus property; they are the first to go when times bite,” Ms Bakos.

“If we don’t have sustained interest rate increases, we can anticipate that people who own holiday homes will probably settle down and sit tight.

“But for anyone who bought in those locations to live in as principal place of residence, I think social pressures and demands, and particularly commutes, will see a few of them sell and return to the city.”

MORE: Desperate renters turn to driveway portables