Victorian budget hikes debt to build big in rail, road spree

Daniel Andrews has spent the morning talking up the budget’s big infrastructure agenda, and defending a surge in borrowing, possible public service cuts and taxes. Here’s what opposition is saying about it, and what it means for you.

VIC News

Don't miss out on the headlines from VIC News. Followed categories will be added to My News.

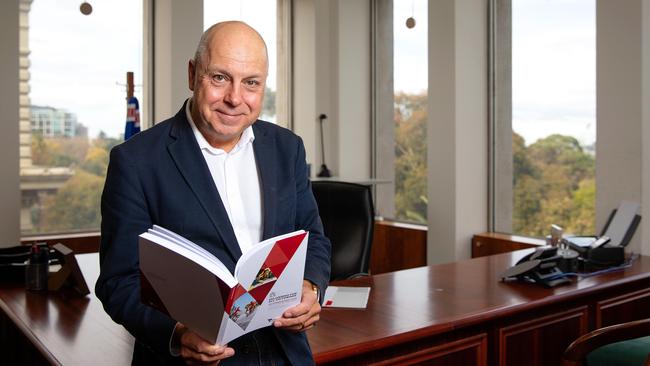

Treasurer Tim Pallas has refused to rule out future tax increases on Victorians, saying he will not “handcuff” the state’s budget.

Mr Pallas and Premier Daniel Andrews this morning blitzed a businesses breakfast and radio to talk up their big infrastructure agenda, and defend a surge in borrowing, possible public service cuts and taxes.

On the back of a suite of new and increased charges, the Treasurer said it would be

“irresponsible to suggest you would handcuff your budgetary settings”.

“I will continue to adjust the tax system to make sure it is fairer, progressive and efficiently delivered,” he said.

The budget yesterday confirmed a new duty on gold, an increased tax on foreign property buyers and a hit on luxury cars powered by petrol and diesel.

Mr Andrews dismissed Opposition claims that the tax blitz amounted to a broken pre-election promise, and said it was “a fair and balanced approach”.

“We made it clear that we were not imposing any new taxes or making changes to taxes to pay for the promises we made,” he said.

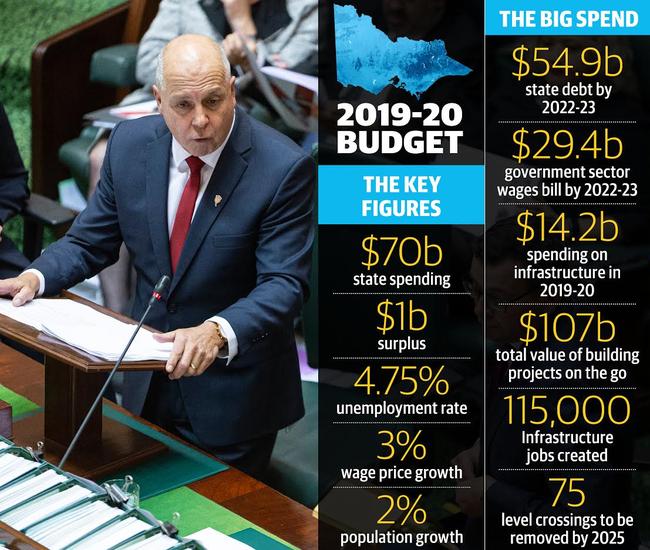

The Andrews Government will borrow an extra $32 billion over the next four years to supercharge Victoria’s road and rail building spree and create jobs.

The budget followed through on Labor ’s pledge — unveiled days before the state election in November — to hike debt to build big.

Forecasting total debt would hit $55 billion within four years, the borrowing will be used to bankroll major projects, including the North East Link and 25 additional level crossing removals.

Mr Pallas said the investments would make a substantial contribution to the state’s economy and help the building industry ride out the property slump, which saw a $5.2 billion write down in taxes.

“Some timid souls would say now is the time to wind back on your infrastructure investment, I couldn’t think of a worse thing that a government could do in these circumstances it would actual leave the market down,” he said.

“We suspect there will be a slow correction back to the normal growth we would suspect to be seeing our housing market, which I think is still 12 worth of growing in the correction going on but largely we believe it will moderate from here.”

Both Mr Andrews and Mr Pallas also defended the government’s increasing wage bill, saying it mostly covered frontline workers like nurses, police and teachers.

But a quarter of the 4 per cent rise in public sector workers went to “support services.”

The government has demanded public servant chiefs slash $1.8 billion from their programs and plan to reign in the public sector bill with its 2 per cent cap on wage increases.

“Some projects, some programs — just because they have occurred forever doesn’t mean they should continue to,” Mr Andrews said.

“The notion of redundancies is always the last thing we do. It doesn’t mean we will avoid them completely but it is always the last resort.”

Opposition leader Michael O’Brien hit out at what he dubbed a “phantom surplus” propped up by taking $890 million out of Transport Accident Commission reserves.

It was part of a plan, announced ahead of the November election, to redirect special dividends totalling $2.3 billion over four years to a new Delivering for All Victorians Infrastructure Fund.

MORE: 5-MINUTE BUDGET GUIDE

SUNBURY, CRANBOURNE LINES WIN BIG IN BUDGET

ANDREWS DOUBLES DOWN ON WINNING FORMULA

The government said at the time that the funds were bigger than needed for the insurers to payout claims, and could instead be used to bankroll infrastructure projects.

But Mr O’Brien described it as a “raid” on the TAC and the Victorian Managed Insurance Agency.

“This is a Budget that would be in deficit today if the Labor Party was not taking money out of the TAC that has been put there by motorists,” he said.

“I don’t think that is fair, it is not sustainable and you can’t argue that is good economic management.”

WHAT THE BUDGET SHOWED

The Andrews Government will borrow an extra $32 billion over the next four years to supercharge Victoria’s road and rail building spree and create jobs.

Forecasting total debt would hit $55 billion within four years, Treasurer Tim Pallas said the $15.8 billion North East Link to connect the Eastern Freeway to the M80 in Greensborough would be “fully funded” under debt changes.

With population predicted to continue to grow strongly, the state’s credit card will also be used to pay for the removal of an extra 25 level crossings, and the $8-13 billion Airport Rail Link.

“Rather than sitting idle, we believe in using our balance sheet to build, grow and leave a positive legacy,” he said.

In total, the government says there are now $107 billion of infrastructure projects on the go or set to commence by 2022.

Other big ticket items detailed in the Budget include:

UPGRADES to the Sunbury line in Melbourne’s west worth $2.1 billion;

$1.5 billion for the new Footscray Hospital to open in 2025;

$882 million for three-year-old kindergarten subsidies;

PRISON expansions costing $1.8 billion;

$209 million for new public housing in Geelong, Ballarat and Melbourne.

Solid economic growth of 2.75 per cent a year is forecast by Treasury, helped by an average infrastructure spend of $13.4 billion a year and stronger consumption fuelled by rising wages.

Coffers are brimming with $104 billion in state taxes, while after years of rampant public sector growth a harsher efficiency dividend will be introduced to claw back $1.8 billion.

As payroll tax grows strongly to $6.5 billion next year, some relief is being offered for regional businesses.

There will also be new stamp duty discounts of 50 per cent introduced for regional businesses.

Mr Pallas said Victoria was “punching above its weight, setting the national pace and laying the foundations for sustained, long-term growth”.

“In a people-powered economy, there’s no better economic barometer than jobs,” he said.

This includes 115,000 Victorians now working, or set to work, on infrastructure projects in this state.

He said that this success story was despite continual roadblocks from the Commonwealth, which meant the proportion of infrastructure money given to Victoria was 17.7 per cent compared to the 26 per cent it should be getting.

Spending will grow at a slower rate than revenue despite a recent slowdown in the property sector, Mr Pallas said.

“We are not spending more than we earn,” Mr Pallas said.

He said the writedown of stamp duty revenue of $5.2 billion was the biggest on record, but that there were “green shoots” emerging in the property sector.

Mr Pallas defended the suite of new taxes introduced in this budget, saying it was only right and fair that those who could “afford to pay” were hit by changes.

WHAT THE BUDGET MEANS FOR EDUCATION

Every child in Victoria will have access to five hours of three-year-old kindergarten per week by 2022, following a record investment in early childhood education.

More than $882 million will be spent to fund the kindergarten initiative across the state, with an increase to 15 hours of subsidised programs over the next decade.

Families struggling with the cost of living are expected to save up to $5000 a year in fees, with about a quarter of Victorian families paying nothing at all by 2029.

The initiative will be rolled out in six regional areas from next year before being extended across the entire state by 2022.

Almost $100 million has also been committed for supporting early learning educators through scholarships, mentoring and free TAFE certificates and diplomas.

It comes as part of a $4 billion education investment, which will include the construction of 17 new schools.

More than $670 million has been allocated for 13 new school sites that are set to open by 2021, with the remaining schools expected to be up and running the year after.

A further 109 schools will receive funding for major upgrades.

The Andrews Government will also fund in-school initiatives which include:

— Extending a breakfast club program to an extra 500 schools, at a cost of $58 million.

— Free tampons and pads for girls at all government schools.

— $5.8 million for anti-bullying programs.

More free TAFE courses will be offered following the success of last year’s funding boost that saw enrolments more than double for priority courses.

Apprentices and social services workers will be able to “earn while they learn” by completing on-the-job training while qualifying for higher education advanced diplomas and degrees.

And $231 million will fund the upgrade and rebuild of TAFE campuses.

Minister for Education James Merlino said: “Whether it’s new schools for our growing communities, better classrooms or basic but vital support so kids can be their best … we’re investing in what matters to students, teachers and parents.”

WHAT THE BUDGET MEANS FOR HEALTH

A massive new Footscray Hospital is expected to be completed within six years after gaining full funding from the state government.

However, money to redevelop Frankston Hospital is yet to be allocated despite both key hospital building projects forming the basis of the Andrews Government health election commitments.

With more than two million more patients expected to need care in Victoria’s public hospitals over the next year alone, the government has announced $3.8 billion in new hospital building projects but little preventive health funding to reduce people requiring acute care.

The new $1.5 billion Footscray Hospital has been fully funded by the state, with final plans to be completed within the next year.

Building of the 504-bed hospital could begin mid next year at the site next to Victoria University, however, the extensive project is not due for completion until mid 2025.

The government is also pledging to redevelop Frankston Hospital by the end of 2024, but the $592 million needed for the build is yet to be identified. A $6 million planning phase for the Frankston project will be finished by mid next year.

A $31 million expansion of the Royal Children’s Hospital is slated to open in 2022, while children-specific emergency departments will be incorporated into the Northern, Frankston, Casey, Maroondah and Geelong University hospitals.

“Whether it’s building a new Footscray Hospital, upgrading the Royal Children’s or getting the planning right for the next big projects, we’re keeping our promises and delivering the very best care for Victorians,” Health Minister Jenny Mikakos said.

The Victorian Heart Hospital has again increased in cost, this time by $21 million, to be met by project partner Monash University in line with changes to its requirements.

An expansion of the nearby Monash Medical Centre has jumped from $63.2 million to $71 million, while the Royal Eye and Ear Hospital project has become more expensive.

Free dental care will be rolled out for all government school students later this year when the first of the Andrews Government’s promised dental vans hit the road under a $322 million “Smile Squad” program, which could save families up to $400.

Plans to offer bulk-billed public IVF for low-income Victorian families are being investigated and a business case developed.

But Australian Medical Association Victorian president, Associate Professor Julian Rait said the government failed to invest in community and GP-based health programs to prevent chronic diseases such as obesity and diabetes, which can prevent decades of illness and the need for more expensive hospital care.

REGIONAL BUSINESS PAYROLL TAX CUT

Victoria’s “robust” jobs market has paved the way for another payroll tax cut for regional businesses.

The state will pocket more than $28 billion in payroll tax over four years, including $6.5 billion next financial year — up 4.1 per cent.

But it will sacrifice $260 million to cut the regional payroll tax rate to 1.21 per cent — a quarter of that of metro businesses — by 2022-23.

About 1400 regional and metro businesses will no longer pay payroll tax with the threshold to rise to $675,000 in July 2021 and to $700,000 the following year.

And commercial and industrial properties sold in regional Victoria will receive a 50 per cent discount by 2023-24.

Treasurer Tim Pallas said the tax cuts had eased the burden on country businesses, helping them to “expand and hire”.

“For the fourth Budget in a row, we are providing payroll tax relief for regional Victorian business,” he said.

As promised ahead of the November election, payroll tax exemptions for maternity and adoption leave will be extended to cover about 9000 dads and “second parents” from July 1.

The payroll tax changes come amid a blitz foreshadowed by the Andrews Government at the weekend.

Confirmed in yesterday’s Budget, it included a new duty on gold, an increased tax on foreign property buyers and a hit on luxury cars powered by petrol or diesel.

SPLASH FOR SPORT, RECREATION

Australian basketball will find its home in Victoria with more than $100 million in upgrades and redevelopments of key stadiums, including the State Basketball Centre and Melbourne Arena.

Seven high-performance hubs at metro and regional sites will also be established to help foster players and attract tourists to major sporting events.

Mars Stadium will receive further upgrades to the tune of $11.8 million, and $1 million has been earmarked for plans to redesign the Western Bulldogs’ Whitten Oval.

Local sporting clubs will also receive a $175 million funding boost to help rebuild and redevelop community infrastructure and encourage participation.

More than $100 million worth of new and improved campsites will attract visitors to Victoria’s great outdoors and new parklands on the Bass Coast.

And keen fishers and boaters will be encouraged to cast a line and get on the water with $47.5 million towards the Better Boating Fund, abolishing boat ramp parking fees and boosting safety across the state.