Victorians facing a decade of new tax pain to pay down record debt

State debt is set to skyrocket to $171bn – almost $70,000 for every household – even though Victorians face a decade of tax pain.

Victoria

Don't miss out on the headlines from Victoria. Followed categories will be added to My News.

State debt is set to skyrocket to $171bn – almost $70,000 for every household – even though Victorians face a decade of tax pain through new Covid-19 levies that will target property owners and big employers.

Budget forecasts predict interest payments to service the staggering debt will hit $22m a day by 2026-27 while tax revenue will climb to $40bn – double what it was in 2015-16.

New Covid-19 debt levies are expected to raise $8.6bn but just $3bn will be wiped from the forecast debt levels.

The Andrews government’s “responsible” ninth budget was described by the Opposition as “nasty”, and industry bodies slammed it, fearing it would worsen the state’s rental crisis and increase cost-of-living pressures.

Ratings agencies said the budget did little to improve Victoria’s credit score, which remains the lowest of any state. And employer groups warned Victoria was now the worst state in the country in which to do business.

UNSW economics professor Richard Holden said the government failed to make tough choices given debt would continue to grow. And he said the government was wrong to blame its debt predicament on Covid-19, saying cost blowouts on major projects and big spending had contributed.

“There was actually a lot of debt accumulation prior to Covid,” he said. “Framing it all as this is paying back Covid is maybe a bit too clever by half.”

As for Covid-related debt, Mr Holden said failures such as hotel quarantine had led to Victoria’s “bad situation”.

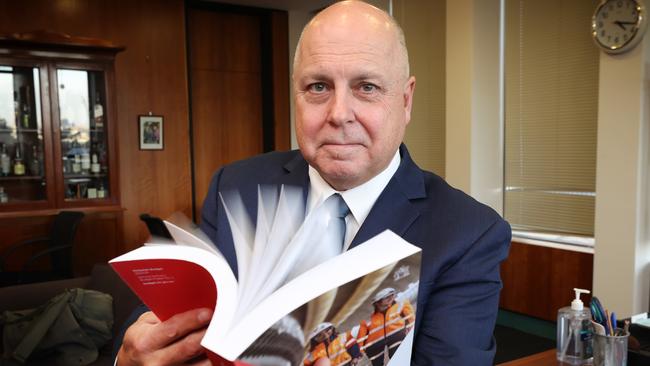

Treasurer Tim Pallas said the new debt levies would allow $30bn of Covid debt to be paid off by 2033, when the levies were due to end.

“This has been the most difficult budget that I’ve had to frame,” he said. “This is the start of a new era, the post-Covid era for the state and its finances. While our kids will of course have memories of the trauma that was the Covid years, they won’t necessarily have to be paying for that trauma for the rest of their lives.

“These measures are temporary, they are targeted, and above all they are responsible.”

Prior to the November state election, Mr Pallas said the government’s promises had been fully funded without increasing net debt or introducing new taxes.

Victorians with more than one property will pay a minimum $5000 over the next decade, with a new $500 annual tax for investment properties with a land value between $50,000 and $100,000.

The payment will increase to $975 for properties with site values between $100,000 and $300,000, while a further 0.1 per cent of the land value will be applied to properties worth more than $300,000. The changes are expected to net the government $4.7bn.

A Covid levy targeting big employers is expected to raise $3.9bn, with payroll tax to increase for companies with wages bills of more than $10m. It will affect the same businesses that have been subjected to a mental health levy since 2021.

Businesses have also been hit with 42 per cent hikes in WorkCover premiums, making the scheme one of the most expensive in the country.

Overall, the government will rake in an estimated $40.3bn in tax by 2026-27, up from $30.5bn in 2021-22.

Mr Pallas said the government was committed to cutting back spending with $2.1bn to be wiped from corporate and back office functions, and consultancy expenditure across government departments.

It will axe up to 4000 public sector jobs. However, the state’s wages bill will continue to rise, increasing by $5bn over the forward estimates.

Investment in infrastructure has also been slashed, falling from an expected average of $22.5bn to $16.9bn by 2026-27, a sign of the slowdown in the state’s major projects.

Victoria’s growth will slow to 2.75 per cent this financial year and 1.5 per cent in 2023-24.

Mr Pallas said all the government’s election commitments had been provided for and would be honoured.

But the government will keep spending more money than it brings in for at least another year, before returning to a promised operational surplus. The budget forecasts a return to an operational surplus of $1bn in 2025-26.

S&P Global Ratings analyst Anthony Walker said the budget provided some headroom for the state’s AA rating.

“We consider fiscal recovery will be a slow and long process,” he said. “Despite some positive developments, Victoria’s fiscal outlook remains weak compared with other Australian states.’’

CPA Australia senior tax policy manager Elinor Kasapidis said Victoria was now Australia’s “least attractive state to run a business or buy an investment property”.

“Victorians are being forced to pay for decisions made by their own government during Covid,” she said. “This budget threatens to make a bad situation worse. Victoria used to be the place to be, now it’s the place not to be.”

Victorian Chamber of Commerce and Industry chief executive Paul Guerra said: “Today’s state budget takes Victoria from the most locked-down state in Australia to one of the highest taxing, as the government continues to hit business with the bill for the debt incurred throughout the pandemic and cost blowouts in the WorkCover scheme.”

Opposition Leader John Pesutto said the budget showed Victoria was “broke”.

“Life is getting harder under Labor,” he said. “This is a budget that is mean. It is nasty. It visits pain on every Victorian.

“Every Victorian will pay some part of the price for Labor’s incompetence.”