Uni students tricked into moving money for international organised criminals

Cash-strapped university students have become prime targets for organised crime networks needing their dirty cash washed. Here’s how they lure innocent students into their major illegal operations.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Cash-strapped university students are unknowingly becoming money laundering mules for organised criminals who lure them in with ads for high-paying side hustles and the promise of making thousands.

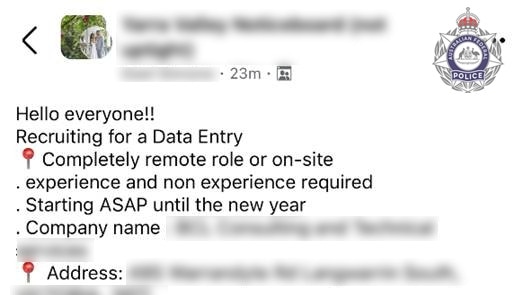

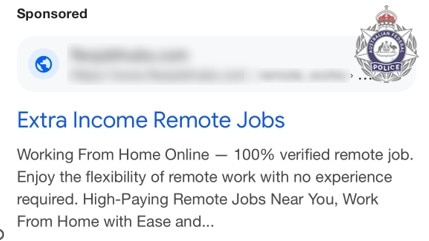

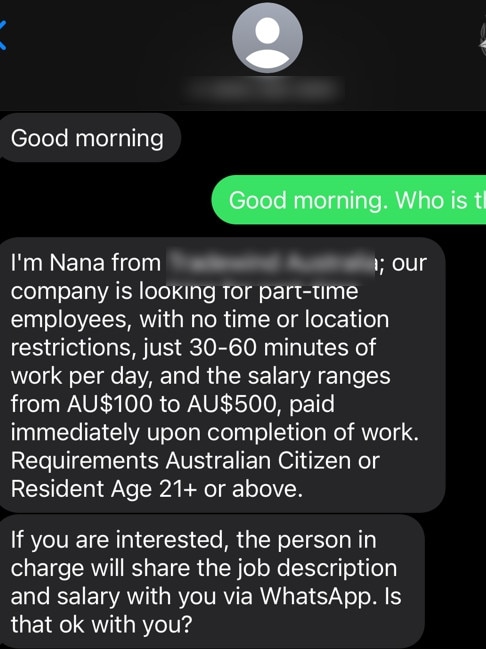

Criminal networks are posting job listings on social media to scam Australian and international university students into laundering funds on their behalf.

Simple data entry jobs with little to no experience required have become some of the most common deceptive listings, with claims recruits can make up to $300 a day.

As part of one scheme, criminals deposit illicit cash into a student’s bank account before instructing them to transfer the money somewhere else in return for a commission.

In potentially “catastrophic” outcomes, students who fall victim to the scams can face up to 20 years’ jail for money laundering.

Australian Federal Police Commander of Cybercrime Operations Graeme Marshall said international students faced the risk of having their visas cancelled.

“Imagine moving to another country to build your career and future, only to have it all taken away because you were scammed by criminals to help them move their dirty money around,” he said.

In other scams, victims are first asked to invest some of their own cash that will be returned once they start work, along with a commission, and are promised higher commissions for larger investments.

In more brazen cases, criminals have paid students to approach their friends on campus to try to rope them into illegal ventures.

The AFP-led Joint Policing Cybercrime Coordination Centre found the most recent listings in Facebook group posts and sponsored ads that appear in Google searches.

Potential victims have also received text messages promoting easy, remote work with generous leave entitlements.

Authorities say students can also have their identities stolen after handing over personal details such as their tax file and passport numbers and bank details.

Authorities believe domestic and international students desperate for cash, who speak English as a second language or who are looking for casual work are most at risk of falling victim to the risky scam.

A report published by the Australian Transaction Reports and Analysis Centre last year found that criminal groups often paid “money mules” – people who move cash on behalf of criminals – between $200 and $500 to move money using their bank accounts.

Police in 2021 busted one of the country’s biggest money laundering syndicates, which was accused of buying hundreds of foreign students’ identities on the dark web to move at least $62m offshore.

Seven Victorians were last year charged with being alleged “money mules” for a $14m international investment scam.

That same year, a Melbourne woman was scammed out of $300,000 in an “elaborate” scheme involving almost a dozen mules.

NAB Financial Crime Investigations head Georgia Brookes said victims were often asked to sell or rent out their bank accounts.

“We need everyone to be alert to the red flags of scams. It’s illegal to rent, buy or sell a bank

account,” she said.

CommBank General Manager of Group Fraud James Roberts said: “If something sounds too good to be true, it often is”.