Smaller businesses linked to building giant fear same fate after Grocon collapse

Fears are growing that the collapse of the Grocon empire could cause small companies — who have provided work and services to the construction giant — to go broke after not being paid.

Victoria

Don't miss out on the headlines from Victoria. Followed categories will be added to My News.

Angry business owners have hit out at the Grocon empire amid fears the collapse of the building giant could cause smaller companies to go broke.

The company, which has been behind skyscrapers throughout Australia, is expected to appoint administrators to take control this weekend after plunging into $60m worth of debt.

A Melbourne-based building products supplier said the collapse of Grocon risked setting off insolvencies among smaller businesses that had provided work and services to the construction giant.

The business owner, who asked not to be named, estimated he was owed between $1.5m to $2m for work on the Northumberland project in Collingwood.

“There are a lot of us tied up in this and we are talking about a lot of money — big, big numbers,” he said.

One creditor, who asked not to be identified and is owed tens-of-thousands of dollars, said tradespeople had difficulty being paid for the past 12 months. “The only trades that were getting paid were the ones needed on site.”

The creditor said he believed some small businesses would collapse as a result of what they were owed.

“It’s a sad one. I know of mum and dad companies that are owed over $200,000.”

He expected the final creditors bill could be greater than the $5m Grocon is believed to owe to as many as 100 subcontractors.

Work on the $111m Northumberland development has ground to a halt.

Grocon last year put two of its subsidiaries into administration amid a dispute with commercial property major Dexus Property Group.

Creditors who were owed more than $28m eventually signed off on a deal which returned them between 7.9c to 10.6c on the dollar.

Administrator FTI Consulting noted in its report to creditors that Grocon may have traded while insolvent but said the company would be able to call upon a number of defences against any charge.

Grocon is locked in a $270m dispute with Infrastructure NSW over a development in Sydney’s Barangaroo precinct.

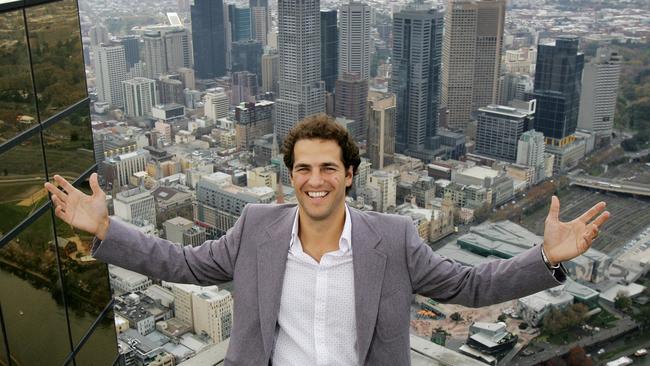

Grocon executive chairman Daniel Grollo saidthe Infrastructure NSW deal sank the company, claiming that previous assurances he could build without height limits in Sydney were stripped away.

“I find it unconscionable,” he said. “We tried to do as best as possible with Infrastructure NSW. Scheme after scheme, we supported them in their court case with Crown and Lend Lease.

“Then they did a deal with Crown and Lend Lease.”

Mr Grollo said he wanted creditors to be paid “in full”.

“I believe we will ultimately win the case against Infrastructure NSW and when we do so, the creditors will be the first in line to be compensated,” he said.

MORE NEWS

MOBILE SEIZED IN BID TO TRACK CELESTE’S KILLER

PARTYGOERS SPARK CHAOS AT ST KILDA BEACH