Push for the GST no-worse-off guarantee to become a permanent fixture

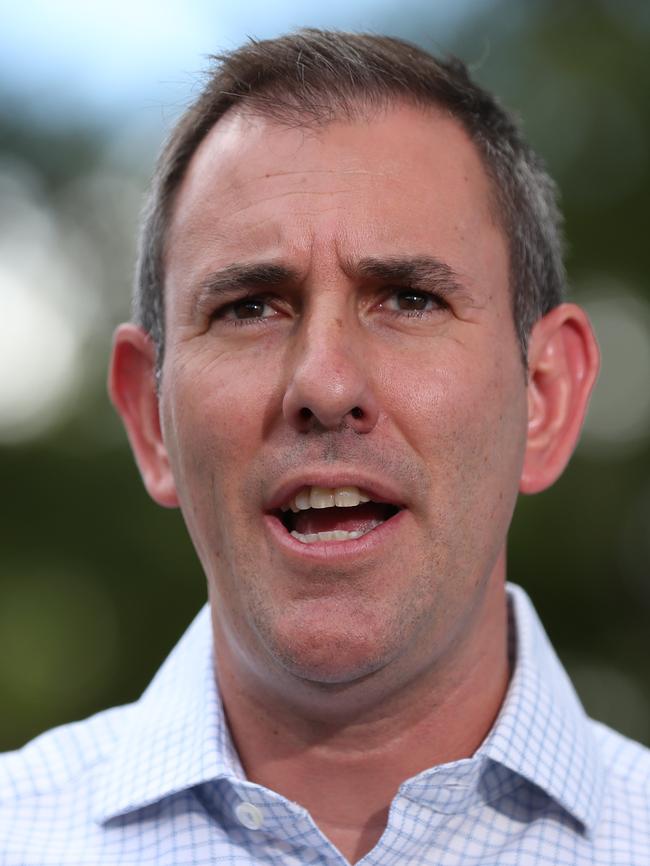

Treasurer Tim Pallas has put the heat on the feds to change the GST system, arguing it is unfair to Victoria and inflates payments to WA, which was “barely touched by Covid-19”.

Victoria

Don't miss out on the headlines from Victoria. Followed categories will be added to My News.

Pressure is mounting on the federal government to make changes to the GST system with Victoria facing a $1.4bn shortfall next year.

State Treasurer Tim Pallas has reignited demands that the top-up provision, which ensures states are “no-worse-off”, become a permanent feature in a bid to create certainty in state budgets.

The call to extend the safety net beyond its 2026-27 expiry comes as the Commonwealth Grants Commission will on Tuesday reveal how more than $80bn in GST revenue will be divided.

“We need certainty on the money we get from the GST that help pay for the things we all need, like schools and hospitals, roads and railways,” Mr Pallas writes in the Herald Sun.

“That’s why Victoria and every other state – even including Western Australia – is calling on the Commonwealth to make the GST no-worse-off guarantee a permanent fixture.”

The Commonwealth Grants Commission has advised Victoria’s recommended GST share in 2023-24 is $18.8bn, with a top up of $1.4bn.

This is up from $1.2bn in 2022-23.

Mr Pallas says next year’s shortfall was “jaw-dropping”, adding it was enough to pay 10,000 nurses, police and teachers for a year.

“If this is not resolved within the next 12 months it will start impacting state budgets and make it hard for us to plan infrastructure investment and service delivery into the future,” he writes.

The Morrison government changed the GST formula in 2018 to enshrine a floor of 70 cents per dollar of GST in 2021-22, which will rise to 75 cents per dollar in 2024-25.

The move aimed to protect WA’s share from crashing to the mining boom lows of less than 30 cents in the dollar, while linking the benchmark to the fiscally stronger of NSW or Victoria.

The “no-worse-off” guarantee, paid by the federal government outside of the GST pool, is due to end in 2026-27 when the transition between the old and new formulas ends.

Victoria’s per person GST share will be 0.85 in 2023-24, down from 0.92 under the former system.

“The GST formula inflates payments to WA, a mining-rich state barely touched by Covid-19 and the only state to maintain a budget surplus throughout the pandemic,” Mr Pallas writes.

“The system is increasingly stacked. It’s an affront to fairness – and to Victorians.”

Anthony Albanese last month said his government had “no intention of changing the current system”.

Federal Treasurer Jim Chalmers will consult with state treasurers prior to formally making a determination on the GST before the end of June.

The Productivity Commission will conduct a review of the system at the end of 2026.