Mums and dads among hundreds to lose life savings as Evans Dixon investment advice turns sour

Tens of millions of dollars in investments controlled by former Essendon football club chairman David Evans have been lost, and now investors are considering a class action against his company, Evans Dixon.

VIC News

Don't miss out on the headlines from VIC News. Followed categories will be added to My News.

Hundreds of mum-and-dad investors and a who’s who of Australia’s business and sporting elite have lost tens of millions of dollars in investments controlled by former Essendon football club chairman David Evans.

Almost 100 of them have now approached a law firm about a potential class action against the company Evans Dixon, complaining of losses totalling around $100 million.

Those hit include a roll call of big names in business and sports, including Kerry Stokes, who invested $10 million, billionaire investor Robert Millner, who also tipped in $10 million, and Australian golfing legend Greg Norman, who stumped up $400,000.

A spokeswoman for Evans Dixon said the company had appointed a new CEO, Peter Anderson, and had launched an operational review.

She said the company stood by the advice provided by its financial advisers and the disclosures they made.

The Australian Securities and Investments Commission is monitoring the situation, which has seen some people lose their life savings after they accepted advice from the company’s financial planners to invest in wholly owned subsidiaries of Evans Dixon in the United States.

“We don’t confirm or deny particular investigations, but we are certainly aware of the concerns that have been raised,’’ an ASIC spokesman told the Herald Sun.

The Australian Financial Complaints Authority is also understood to be investigating complaints from investors who say they did not fully understand they were investing in a high-risk, high-fee real estate venture wholly owned by the company giving them advice.

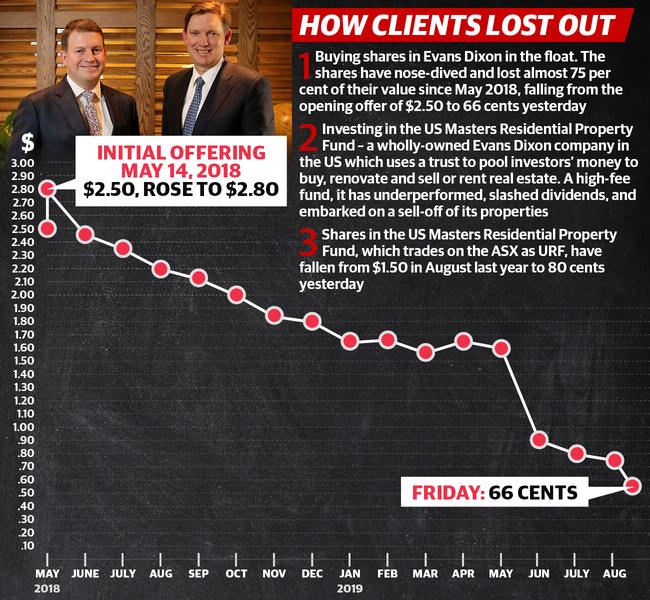

Shares in the $18 billion wealth management firm Evans Dixon, launched on the ASX last year by Mr Evans and his partner Alan Dixon, have fallen by about 75 per cent, with investors losing millions.

The shares hit the ASX in May 2018 at $2.50, opened at $2.80, but last night closed at just 66c. Its subsidiary company, known as the US Masters Residential Property Fund and listed on the ASX as the URF, has seen its value halved in the past year, falling from $1.50 in August 2018 to 80c at close of business on Friday.

Mum-and-dad investors, part of Evans Dixon’s 9000-strong client list, were sold packages of 8000 shares for $20,000. Those packages are now worth just over $5000.

Despite the performance of the stocks, Mr Evans, 55, and Mr Dixon, 45, both pocketed extra payments of more than $10 million each when they floated their merged company — a $5.1 million bonus in recognition of their efforts in the merger and $5 million in non-compete compensation.

They also raked in salaries of more than $500,000 each and bonuses of $660,000 every six months — taking their final packages in the 2017-2018 financial year to more than $12 million each.

Shine Lawyers, which is exploring a class action, said it had been contacted by almost 100 Evans Dixon clients, who had lost, on average, between $750,000 and $1.5 million.

Shine’s NSW principal for class action, Vicky Antzoulatos, said they were investigating concerns about advice provided by Evans Dixon since the company floated on the stock exchange, and from both the separate Evans and Dixon companies, in some cases going back to 2011.

The key complaint was that people were advised by Evans Dixon financial advisers to invest heavily in Dixon companies and products operating in the United States, she said. Those businesses charged high management fees, which were sent back to the parent company in Australia, despite investments performing badly.

Ms Antzoulatos said: “The client base is mostly professional people, middle-aged to older. For these people to lose this much money, on this scale, is a disaster for them.

“They (clients) relied on the financial advisers to put them in investments that were the most appropriate for their needs, and to act in their best interests. That’s what they’re obliged to do under the Corporations Act. It doesn’t appear that has happened,’’ she said.

The Herald Sun is not suggesting the allegations are true, only that they have been made.

The Evans Dixon spokeswoman said there was no basis for any legal action.

“Dixon Advisory is in the business of providing personal advice — it considers the risk tolerance, relevant personal circumstances, objectives and needs particular to each client when providing a recommendation. This is what the best-interest obligation requires, and we do it well,’’ she said.

HOW BOYS’ CLUB HIT THE ROUGH

As Essendon barnstormed its way to the 2000 AFL premiership, an ambitious young stockbroker named David Evans organised a lunch for some of Melbourne’s biggest business names.

A lifelong Essendon tragic, Evans booked Bombers star James Hird to speak in the 17th floor boardroom of Collins St investment firm JBWere, where he worked.

Evans, son of Spotless catering founder and then AFL Commission chairman Ron Evans, hit it off with Hird.

He raised eyebrows with his colleagues several months later by putting him on the JBWere payroll — on a $200,000 salary.

Hird was charged with luring investments from sports and media identities and the pair became inseparable. It was Evans’ entree into the exclusive Melbourne boys’ club.

His new buddies included Eddie McGuire and Toll transport billionaire Paul Little, before

Hird gave the stockbroking game away in early 2004 to join sports consultancy firm, Gemba.

Evans moved to Sydney for a stint running his firm’s equities division and returned home in 2006 as chief of staff.

He decided to leave and set up a rival investment shop, Evans & Partners.

Around this time his father Ron was diagnosed with cancer, and he died in March 2007.

This brought David closer to many of his dad’s friends, including AFL boss Andrew Demetriou, union chief and long-serving AFL commissioner Bill Kelty and trucking tycoon Lindsay Fox.

With the backing of Hird, Evans joined the board of the Essendon Football Club, becoming chairman in late 2009. He sacked coach Matthew Knights, hired Hird and poached Mark Thompson from Geelong as Hird’s senior assistant coach.

In an interview at the time, Evans said he was spending two days a week at the club in the “role of governance”.

Always a man in a hurry, he set up the high-powered Evans & Partners advisory board, appointing McGuire, Kelty and wealthy Melbourne financier John Wylie.

Dons players Jobe Watson and Mark McVeigh also began working for the firm.

Evans’ ascension to Melbourne’s ruling elite was strengthened when he joined the board of Kerry Stokes’ Seven West Media, and sat alongside McGuire and Wylie on the board of the Melbourne Stars T20 cricket team.

He also followed McGuire on to the board of the Shane Warne Foundation, which later closed amid controversy over its low returns to charity.

In February 2013, the Essendon drugs scandal erupted. Governance failings obliterated Evans’ club. He collapsed in the Docklands Stadium changing rooms in July, resigned, and handed the chairmanship to Little.

“My last six months at Essendon I saw what I thought was a breakdown in … I suppose governance is the word,” ex-Bombers director Beverly Knight later reflected of her departure in 2010.

“I think the chairman (Evans) was in a hurry to get to a premiership and then maybe take his rightful position on the (AFL) Commission.”

Evans has never spoken publicly about his role in the drugs saga or of allegations he betrayed the club by siding with Demetriou. His friendship with Hird fractured and the pair have not spoken since.

Evans disappeared from public view and spent time in the US where he and wife Sonya restored his business network by building private golf course Cathedral Lodge at Thornton, two hours northeast of Melbourne.

He approached his idol, Greg Norman, whom he first met at the 2013 Anzac Day MCG lunch, to design it. Norman also joined the Evans & Partners advisory board.

The course was opened by Norman and Premier Daniel Andrews in October 2017.

Members are slugged a $50,000 entrance fee and a $12,000 annual fee. Celebrities who have played the course include Ricky Ponting, Shane Warne and Brendon Goddard.

Evans also announced in September 2016 a merger with Dixon Advisory, another wealth management business run by US-based Australian Alan Dixon.

A new firm with $18 billion of money under advice, Evans Dixon, was born a year later.

Despite warnings about the reputational risk of their business model, they pushed ahead with a public float in 2018.

Kerry Stokes backed his mate and invested heavily, buying four million shares worth $10 million.

Sydney corporate tycoon Robert Millner did the same through two of his businesses. The advisory committee which included McGuire and co was disbanded as the Evans and Dixon companies merged.

Norman, through Great White Shark Enterprises, reportedly bought $400,000 worth of shares.

AFL Commission chairman Richard Goyder also reportedly invested $1 million. He and fellow commissioner Paul Bassatt were invited to sit on a “global disruption fund’’ also chaired by Evans.

MORE NEWS:

HUNDREDS OF METRO TRUCKS TO CLOG STREETS

HEAL HITS OUT AT CROWE OVER BASKETBALL

TV FIGURE EMERGES AMID BARTEL SPLIT

Things looked rosy for a day. The shares, offered at $2.50, opened at $2.80, and closed that night at $2.71, but it never got ahead again.

From that day on, the shares have steadily declined, closing at 66c on Friday.

In June, Alan Dixon stood aside as CEO of the Australian business, with the company saying he would focus on turning around the largest of the troubled funds in the United States, the URF. On August 1, it was announced he was taking indefinite leave from the URF for “personal reasons”.

Evans remains managing director in Australia, but is once again laying low.

It’s been a ride that mirrors the stock exchange — soaring highs and now, a crashing low.