How once dominant menswear brand Roger David collapsed

It’s been five years since the menswear brand that once dressed Don Bradman collapsed. Go inside the frantic efforts to find a rescue buyer for Roger David and how a customer database of more than 600,000 emails ended up in foreign hands.

Victoria

Don't miss out on the headlines from Victoria. Followed categories will be added to My News.

Was it the death of the tie in the office? Greedy landlords charging exorbitant rents? An influx of international competitors?

It’s been five years since Roger David collapsed.

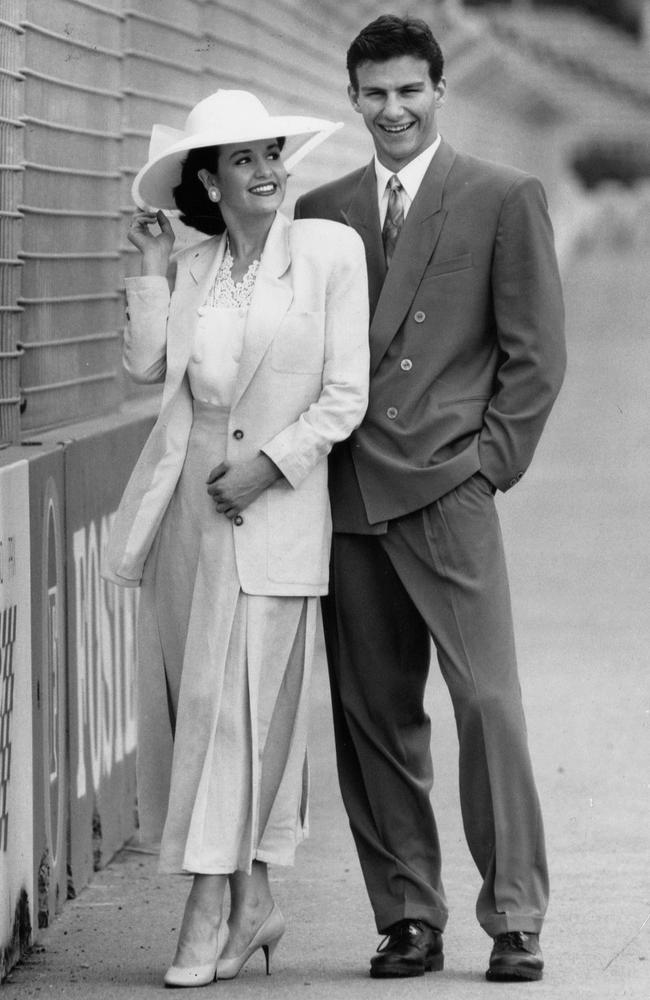

After 76 years in business, which included dressing an Australian cricket team led by Don Bradman, the menswear brand ended its working life in a fire sale.

It was an ignoble end for what had been the nation’s third largest menswear retailer.

“The Roger David story was a great story of success for many, many years,” veteran retail consultant Martin Ginnane told the Herald Sun.

“The company served Australia exceptionally well as we moved from blue collar to white collar work. Every public servant, law student doing their articles went to Roger David for their first suit.”

So how did it all come crashing down?

Company documents lodged with the corporate regulator throw light on the demise of what for many years, says Ginnane, was the “golden child” of Australian retail.

They detail how Roger David’s owners, the Melbourne-based Rogers family, desperately tried to sell the business ahead of its collapse and fell back on a key line of credit from National Australia Bank to stay afloat.

They also reveal Michael and Joseph Rogers – third generation owners of the business – knocked back a buyout offer a week before they placed the business into administration, and that its customer database spanning more than 600,000 emails wound up in foreign hands.

“Roger David gave many Australians their first opportunity to buy a suit,” Ginnane said.

“The problem is they didn’t adjust and if you don’t do that you don’t last.”

IMMIGRANT SUCCESS STORY

Roger David – ‘Makers of Men’s Fine Clothes’ – was launched in Melbourne by Polish migrant and tailor Kalman Rogers in 1942.

It quickly secured a place at the cutting edge of Australian men’s fashion, dressing the 1946 men’s cricket team as they defended The Ashes against a visiting England.

A suit made by Kalman in the 1950s is part of the National Gallery of Victoria’s fashion collection.

From a single store in Melbourne, the retailer built a retail network that at its peak in the mid 2010s spanned more than 100 stores selling both the Roger David suit brand and also the more casual RDX label.

Company documents shows Roger David’s owners identified they were facing serious headwinds in 2017, launching a deep cost-cutting drive and moving to sell the business.

Management headcount was culled, underperforming stores were identified for closure and the company tried to negotiate lower rents with landlords.

KPMG was hired to find a buyer and the retailer became dependent on a $2.8m overdraft facility with National Australia Bank to stay afloat.

The company began shutting stores in April 2017 and by November has closed about 25, around a quarter of its network.

The cutbacks didn’t stop the acute pressure on the bottom line and Roger David’s auditor expressed “material uncertainty about the company’s ability to continue as a going concern” in late 2017.

Translation: The retailer at imminent risk of going bust.

As the all-important Christmas trading season hit high gear in December 2017, Roger David’s directors sought legal advice around newly introduced “safe harbour” provisions.

These rules provide exemptions to directors from insolvent trading charges.

A safe harbour adviser was hired and company documents show Roger David’s directors, Michael and Joseph Rogers, were continually updated on their legal exposure, receiving specific advice in January, May and again in September of 2018.

In August 2018 Roger David was forced to sign a payment agreement with the Australian Taxation Office to cover outstanding debts.

It was around this time the retailer became entangled in a dispute which its owners say was the straw that broke its back.

A third-party disagreement prevented Roger David from being able to access its warehouse in Melbourne, stifling the flow of stock to stores and further shrinking its sales a base.

The end of Roger David appeared imminent but, company documents reveal, a possible Christmas miracle emerged.

An October 11 report from KordaMentha reveals the Rogers family received an offer to buy the business.

They knocked it back.

“The revised offer was not accepted due to various conditions of the offer,” the KordaMentha report says.

A week later Roger David’s owners placed the business into voluntary administration.

HUNT FOR A RESCUE BUYER

Insolvency experts KordaMentha took control of the retailer on October 18.

It started looking for a rescue buyer, targeting parties that had previously shown interest in buying the business.

“Immediately following our appointment we contacted parties directly and received expression of interest generated from the extensive media coverage,” a KordaMentha report to creditors notes.

The document reveals KordaMentha received two offers serious enough for it to sign confidentiality agreements with the parties to carry out due diligence.

That happened on October 26, while another prospective buyer emerged in early November.

Again, a potential sale came to nothing.

“Everyone recognised the strength and the affection for the brand but it did not pass the viability test,” administrator Craig Shepard said at the time.

With no firm bids, KordaMentha called time on the sales process and instead moved raises as much money as it could by selling off its assets.

It ramped up its fire sale across 57 remaining stores, with the final trading day occurring on December 2.

It also struck a deal to sell Roger David’s customer database spanning 660,000 email addresses.

Four parties bid for the database.

New-Zealand’s Retail Apparel Group, whose stable of brands includes Tarocash, Connor, Yd. and Johnny Bigg, emerging with the valuable customer contracts.

END OF AN ERA

KordaMentha lodged its final administration report in July 2020.

During its administration it raised $8.3m via the sale of stock, other business assets and chasing up outstanding debts.

Creditors also voted to accept a Deed of Company Arrangement from the Rogers family which saw them tip in $400,000 to walk away from the business.

Employees, owned around $2m in entitlements such as super and long-service leave, were paid in full.

Unsecured creditors such as landlords and suppliers, owned $25.6m, had to make do with getting 13c back for every dollar of debt they were owed.

Roger David’s owners pointed to “an influx of multinational retailers and the rapid, global evolution of online shopping” for its demise.

Retail expert Ginnane doesn’t buy this, arguing suit specialists MJ Bale and Peter Jackson have both found success in a tough retail environment.

Rather, Ginnane says Roger David’s inability to pivot towards more casual work wear and a business model that focused on selling complete suits rather than separate jackets and trousers culled the brand.

“They couldn’t get their offer right,” Ginnane says.

“They tried but they never got it right.”

Far more than fast fashion, Ginnane also points the finger at a host of expensive and long-term leases for Roger David’s demise.

This not only gave the retailer an unsupportable cost base, but scared off potential buyers.

“They were locked into some incredibly expensive leases in some very high-profile shopping centres and that is what made it very difficult for anyone to try to take them over,” he says.

“They had prime spaces, they took big stores, they carried a lot of stock and that is part of the reason why they couldn’t be flexible or quick.”

Roger David’s demise came amid a tsunami of retail collapses – David Lawrence, Pumpkin Patch, Payless Shoes, Herringbone, Rhodes & Beckett, Esprit, Marcs, Oroton, Katies, Millers and Rivers to name a few.

So is the worst over for homegrown retailers? Don’t be so sure, cautions Ginnane.

“I don’t think you can say we are through the worst – the market has changed even more dramatically since Roger David closed,” he says.

“There are still luxury brands who have entered Australia via their well-known tier one brands but they have other tiers – second and third tier ‘masstige brands – which are yet to be introduced The problem for them is getting the right space.

“There are still quite a few businesses under pressure. You are still going to see the big get bigger and the small get smaller.”