High-profile barrister stepping in to limit damage from Ivanhoe Ponzi scheme

A high-profile barrister – who has worked on some serious criminal cases – is coming out of retirement to help fellow investors caught up in the Ivanhoe Ponzi scheme.

Victoria

Don't miss out on the headlines from Victoria. Followed categories will be added to My News.

One of Melbourne’s most respected criminal defence barristers has stepped out of retirement to help fellow investors with millions of dollars at risk in the Ponzi scheme promoted by the Iate Ivanhoe lawyer John Adams.

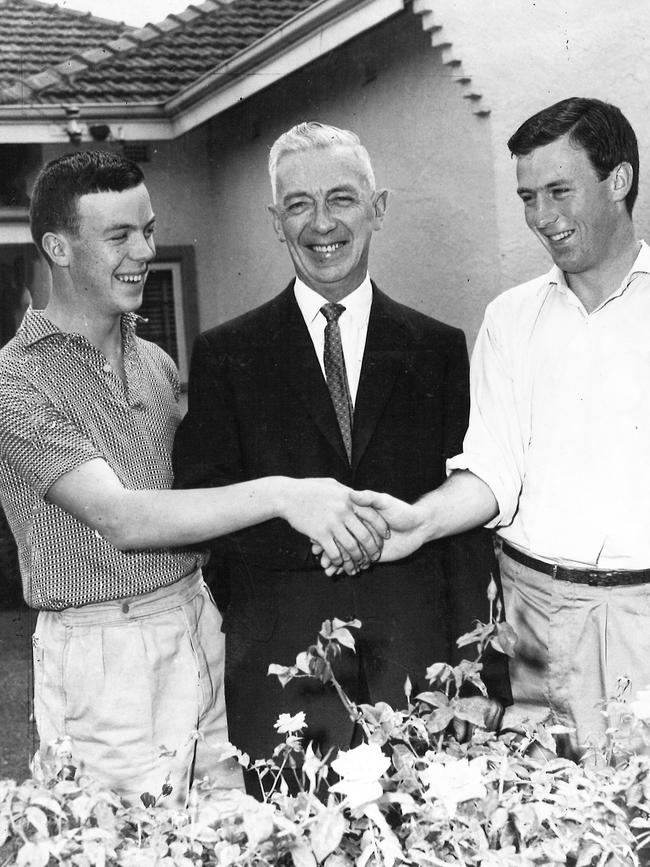

Graham Thomas KC has avoided the limelight throughout a long and distinguished career despite working such notorious cases as the trial of serial killer Peter Dupas.

He has kept his name out of the Adams Ponzi scandal until now, along with those of some other high-profile investors.

But Mr Thomas is understood to be making not only his own claims for a large sum but to be representing several other investors who fear they face losing multi-millions in the Adams scandal.

The Thomas cluster of investors includes a well-known former football administrator and represents some $20m of investment.

It is one of at least three potential legal moves by aggrieved investors.

International class action specialist Gordon Legal is recruiting potential plaintiffs through its ace litigation lawyer James Naughton, who has previously succeeded in actions against Australia’s largest banks, stockbrokers and financial institutions.

And Ivanhoe solicitor Andrew Woolfe, a local rival of Adams’ firm AMS Law, is representing a group of investors who fear they have lost their life savings — and are worried about their homes.

A troubling aspect of the case is that many investors have found their properties mortgaged and remortgaged without their knowledge or consent, making them fear they could be evicted and sold up.

One former AFL figure has told the Herald Sun he discovered two of his properties had been mortgaged.

And investigations by a prominent bookmaking family with $5.5m at stake have uncovered multiple examples of mortgage malpractice.

John Bernard Adams, 82, died suddenly at his family’s valuable Lorne beachside hideaway Saturday, October 21.

By 9am the next morning, people close to the family and to the law firm, AMS Law, were calling clients to tell them of his death.

Longtime AMS partner Shane Maguire vehemently denied claims that anyone from within the firm had made calls warning clients of problems that would emerge following Adams’s death.

It has not been confirmed whether or not Adams died of natural causes or suicided and left a note.

But it was remarkable that a man who had been such a big operator in football administration for decades would have a tiny funeral held in virtual secrecy with only a handful of family members and friends in attendance.

Adams was a longtime North Melbourne powerbroker, an architect of the AFL national competition, and served as a director of the West Coast Eagles.

He had close connections with Carlton and led the abortive move to merge his club with the Blues to form the “Carlton Kangaroos”.

His partner, Mr Maguire, came from the same football and school background, notably the North Old Boys club in the amateurs.

In the week since news of the scandal leaked on Cox Plate Day, the big question has been “What happened to the money?”

The Victorian Bookmakers Association, which has $1.8m unaccounted for in the Adams mortgage scheme, has been investing money with Adams since 1985.

This suggests the scheme goes back at least 40 years.

It appears that Adams recruited investors in his mortgage loan scheme from among those who regarded him as a friend or at least as a trustworthy family lawyer.

Many of those people feel deeply betrayed and now some are repaying the “favour” by revealing snippets of information.

One Adams associate recalls that Adams’ oldest son Nick regularly had holidays at a resort at Mission Beach which he described as “owned by his father”.

This leads to speculation that such a resort could become a financial black hole requiring constant cash injections to stay afloat.

Others wonder about the circumstances under which the third member of the legal partnership, Vin Siers, left the firm about five years ago.

It has been suggested that at the time, investors lost big money in a stalled development project in High St, Preston.

There is no suggestion Mr Siers had any involvement with Adams’s wrongdoing.

The scandal has placed Mr Maguire under enormous pressure.

So far, the firm has issued a statement stressing that its trust funds are entirely separate from the mortgage loan business that Adams apparently ran on the side.

The statement said “no other person … within our practice is suspected of any wrongdoing in this matter”.

“We hold ourselves to the highest ethical and professional standards and we are committed to co-operating fully with the authorities to ensure a thorough investigation takes place,” the statement said.