Grieving families to cop ‘death tax by stealth’ under proposed Supreme Court probate fee hike

The cost of dying is set to skyrocket in Victoria as the Allan government draws up plans to slug grieving families with fee hikes of up to 650 per cent to process wills.

Victoria

Don't miss out on the headlines from Victoria. Followed categories will be added to My News.

The cost of dying is set to skyrocket in Victoria with the Allan government considering introducing what has been panned as a “death tax by stealth”.

The move will see grieving families slugged thousands of dollars more to enact the wills of loved ones with probate fees set to face massive increases.

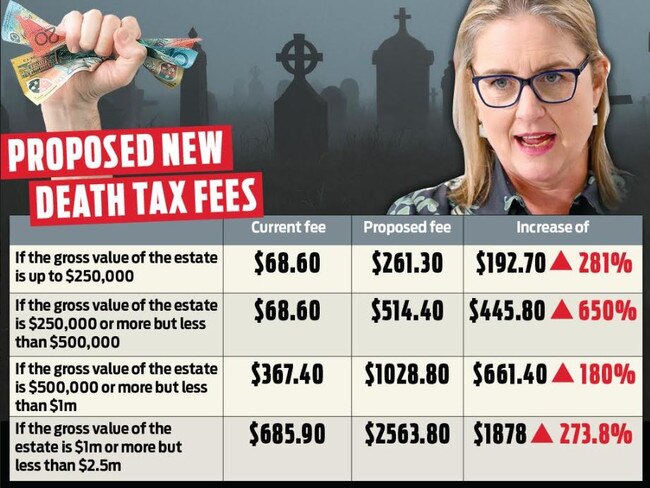

The government has fast-tracked a review of the Supreme Court’s probate fees by three years with increases of up to 650 per cent being considered.

Under a favoured model being considered by the government, some fees would move from a fixed rate to a tiered system for the first time.

It would bring in an additional $33.6m in revenue for the Supreme Court, 1086 per cent more than it costs to operate the probate office.

The rest of the funds would be used to cover other court costs.

On Thursday morning, Premier Jacinta Allan said the government was currently looking at the fee arrangements for probate.

“The preferred option that is being considered would actually see probate fees become substantially cheaper for a large number of people needing the service,” she said.

“There’s a bit of fear mongering and scare mongering and frankly just ridiculous commentary that’s coming from the Liberal opposition on this.”

But Ms Allan said no final decision has been made and refused to say whether the revised probate fees will actually come in cheaper than the current $68.60 fee.

“Let the final decision be made first,” she said.

Fees across other Victorian courts and tribunals are also set to come under review.

It comes after the government cut $19.1m in funding from Court Services Victoria over the next year in last month’s state budget.

Shadow Attorney-General Michael O’Brien panned the proposal saying it was reminiscent of death duties which were abolished in Victorian in the 1980s.

He said the model would see Victorian families forced to pay a probate fee based on a sliding scale up to $15,407.40.

In New South Wales, the maximum probate fee is just $6652.

For lower value estates, valued between $250,000 and $500,000, fees would increase 650 per cent to $514.40.

“This massive probate fee hike is nothing less than Labor reintroducing death duties by stealth,” Mr O’Brien said.

“Not even dying is enough to save Victorians from Labor’s desperation for new taxes.”

Mr O’Brien said grieving families would be financially punished at their most vulnerable time because of the government’s financial mismanagement.

“Death duties were abolished in 1981 because they are unfair,” he said.

“People work hard and pay taxes all their life; they shouldn’t have to pay again after they die.

“This Labor Government should be ashamed of itself, but it shows just how badly they have mismanaged Victoria’s finances.

“With current probate fees scheduled to continue until 2028, this is nothing more than a grubby cash grab by a broke Labor Government.”

A regulatory impact statement of the proposed changes, published by the Department of Justice and Community Safety, found increasing fees would improve the overall cost recovery of the Supreme Court.

A government spokesperson said no final decisions had been made, with the review into proposed changes still underway and open for public submissions.

“Victorian probate fees are considerably lower than other states, they don’t cover the costs of hearings in the Supreme Court adequately and any change would still see average fees lower than the fees charged in New South Wales or South Australia,” she said.

“The preferred option would also make it cheaper for many people – especially when the proceeds from an estate are less than $500,000.”