True cost of landlord tax grab revealed

Property owners have savaged the Andrews government’s tax hikes, with many investors saying they will have no choice but to pass on costs to renters if they can’t absorb extra payments.

Victoria

Don't miss out on the headlines from Victoria. Followed categories will be added to My News.

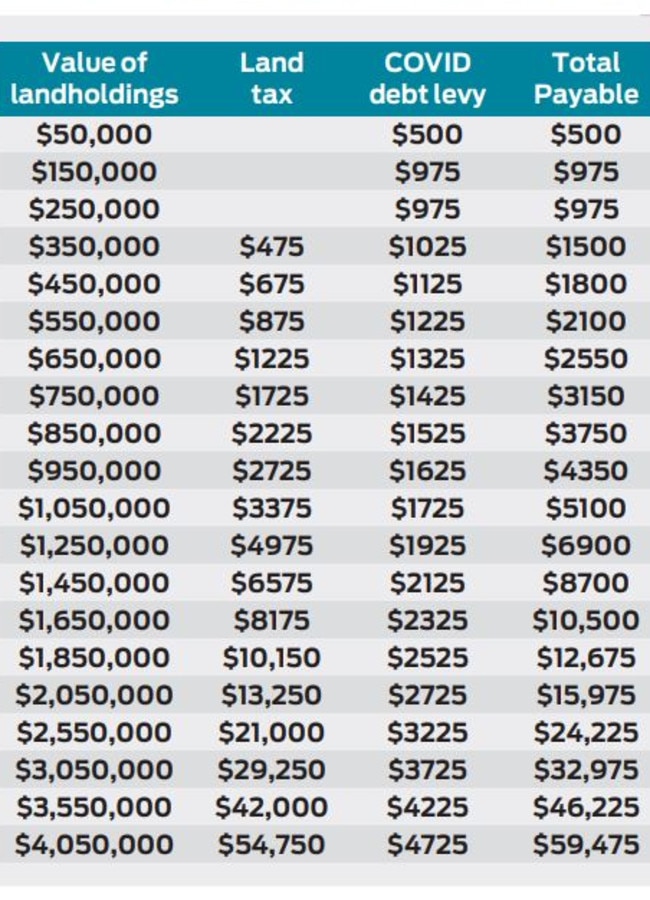

The true cost of the Andrews government’s new landlord tax grab can be revealed, with investors who own a $550,000 parcel of land facing a total bill of $2100 next year.

Land worth $850,000 – such as a medium-sized block in a middle ring suburb – will now be hit with an annual tax bill of $3750.

The total charges take into account existing land tax rates in place for investors, commercial property owners and holiday home owners, plus a new debt levy the State Government will introduce on January 1 to help pay down $31.5bn in state debt.

Land worth $850,000 will attract a charge of $2225 under existing land tax scales, plus a new hit of $1525 from the debt levy, resulting in the total $3750 bill.

Property owners have savaged the new slug, with many saying they will have no choice but to pass on costs to renters if they can’t absorb extra payments.

Investment property owners with apartments are likely to face land tax for the first time if their unit allocation — a portion of the total site value — is worth more than $50,000.

The Real Estate Institute of Victoria said many small-scale investors would have no choice but to pass that on to renters.

One investor, Niddrie resident Marie-Claire Gemmell, said she had scrimped and saved for a modest 2-bedroom unit that is leased to a husband and wife. “I need to do some maths to see what I can absorb. There’s that moral balance,” she said. “Then if it’s a squeeze and affecting my ability to pay loans, I would have to pass some on.”

The business analyst, 48, bought her first home, the two-bedroom unit she still lives in, in 2006 after years of disciplined saving, and hasn’t even settled on the new investment property she sourced through Frank Valentic at Advantage Property Consulting.

PropTrack executive manager of economic research Cameron Kusher said the policies had the potential to reduce rental stock even further at a time when the market desperately needed more properties.

Premier Daniel Andrews tried to hose down the furore on Wednesday, suggesting some landholders would be able to use federal tax laws to deduct the extra costs. “Any land tax is fully tax deductible depending on the way in which they have their affairs arranged,” he said.

“I’d encourage anybody who can legally make claims against that federal tax system to do so.

“It does depend on the individual circumstances, how you have things structured, but those costs are tax deductible. That’s the advice I have.”

AMP’s chief economist, Shane Oliver, said this meant the Victorian government was shifting some of the burden of the land tax increase to the federal government.

He suggested about a third of the $4.7bn in extra revenue forecast over the next four years may be claimed back at a federal level, which would cost the Commonwealth $400m a year in revenue.

“It’s not something that’s going to make or break the federal budget deficit, but it does make the job a little bit harder.”

Australian Taxation Office figures show almost 304,000 Victorians reported a net loss on their properties in 2019-20.

Greens leader Adam Bandt said: “Dan Andrews crossing his fingers and hoping landlords will pass the cost on to the Federal Government leaves renters exposed”.

A spokesman for Treasurer Jim Chalmers said state governments were responsible for their own revenue decisions. “Any impact on the Commonwealth – whether positive or negative – will be considered as part of updates to our budget forecasts in the usual way,” he said.

Opposition housing spokesman Michael Sukkar said the tax would “hurt Victorians”.