Average family needs more than $50,000 a year to pay for basic bills

AS households juggle big mortgages and other bills, university researchers have calculated how much money is needed for basic living costs.

VIC News

Don't miss out on the headlines from VIC News. Followed categories will be added to My News.

AN average family needs more than $50,000 a year just to get by.

The bill for basic living costs has been revealed in analysis for the Sunday Herald Sun.

University of Melbourne experts crunched the numbers for a Victorian couple with two children aged under 15.

Average modest annual spending for key necessities hit an estimated $50,669.

Housing takes the biggest bite out of budgets, with home loans, rates, utilities and maintenance racking up $30,392 a year.

Food is the next largest hip-pocket hit, swallowing $8745.

Car costs such as petrol, compulsory insurance and registration plus public transport fares motored through a further $4972.

RELATED: HOW TO SAVE ON GROCERY BILLS

The “survival spending” estimates are for a couple with a mortgage or who own their own home, have a single vehicle, and children attending a public school.

It comes as households feel the pinch from massive home loans and soaring gas and electricity prices while wages growth is stalling.

“Even though the general inflation rate in Australia is low at the moment, households have noticed increases in costs for essentials over time that they can’t escape,” said Professor Guyonne Kalb, head of labour, economic and social policy at the university’s Melbourne Institute.

“This hits hardest for low-income people who don’t buy luxury goods and devote most of their spending to essentials.

“Rising property prices are also putting pressure on families who have had to take out large mortgages.”

The calculations, updated for inflation, were based on Australian Bureau of Statistics household expenditure survey data; car ownership cost for a best-value medium car; and cheapest internet, mobile and landline phone deals.

Combined gas and electricity bills have surged 88 per cent in Victoria over the past decade, with households now paying $3270 a year on average, according to separate Australian National University modelling.

The annual slug for property ratepayers doubled to an average $1060.

Overall education costs have jumped 81 per cent in a decade, and health bills are up 59 per cent. Mortgage repayments and rent have risen 40 per cent.

Communications bills, such as phone fees, increased 9 per cent.

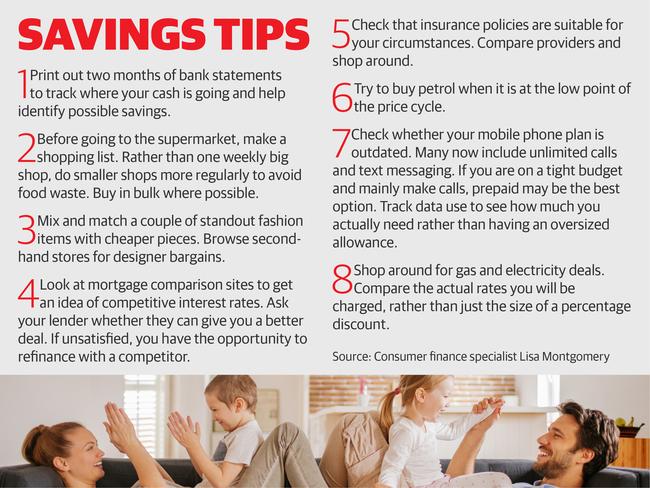

Consumer finance specialist Lisa Montgomery said checking whether you are on a competitive variable home loan interest rate, and asking for a reduction if not, was one of the best ways to save money.

“Fifteen minutes of your time might result in a reduction in the vicinity of 20 basis points which can save you hundreds to thousands of dollars a year,” Ms Montgomery said.

“Most lenders ... have retention teams in place to take these types of calls.”

Reviewing transaction accounts every six months to a year could identify other potential savings.

“People hate budgeting but there is one practical thing you can do. Print out two months’ worth of statements and you might find things you didn’t realise you were paying for.

“It might be a gym membership you are no longer using and there’s a debit taken out, for example. We are a ‘set and forget’ nation that sets up accounts and then don’t review them.”

Cash payment instead of “tap and go” cards could discourage overspending.

“Cash is a much more emotional way of making purchases than just tapping a piece of plastic. You have a bit more control over it. It’s a tangible way of understanding expenditure.”

HOW FAMILIES ARE MAKING ENDS MEET

GLADSTONE PARK mum of two Melissa Giuffrida-Isgro keeps a keen eye on her household budget.

“It’s not just the utilities like water, gas and electricity that homeowners have to think about,” she said.

“When you have kids you’ve got school, insurance costs and payments for extra curriculum activities like swimming and football. We don’t want to deny our boys an opportunity because we have to pay the bills.”

The fortnightly grocery shop also has the potential to break the budget, said Mrs Giuffrida-Isgro, which costs her and her husband Nick, 32, over $400.

“As much as I shop for things like meat and frozen foods in bulk, Jonah, 3, and Julian, 5, are our two growing boys,” she said.

“They’re going through growth spurts and eat everything in the kitchen, so I find myself going to the shops every day to keep the fridge full.”

The family notice a dramatic price rise of bills in the colder months, paying around $500 more on gas to the keep the house heated in winter.

“Bills around this time of year are definitely more expensive, especially if you pay quarterly,” Mr Giuffrida-Isgro, 33, said.

“Electricity can cost us up to $350, and with young kids at home, the water price also fluctuates around the hundreds. We BPAY our bills fortnightly, that way we never fall behind.”

The ultimate goal for the family was saving money to pay off the mortgage.

“We do our best to save as much as we can,” Mrs Giuffrida-Isgro said.

“The figure doesn’t surprise me. Families could easily spend $50,000 a year on household bills, maybe more.”

- JULIA SANSONE