Melbourne will suffer shortage of family-friendly housing amid glut of small apartments, report claims

BEING forced to live in outer suburbia, or stuck ina lifetime of rental bondage is the reality for many Melbourne families thanks to a number of factors that are now difficult to fix.

News

Don't miss out on the headlines from News . Followed categories will be added to My News.

MELBOURNE has been condemned to a shortage of family-friendly housing under failed government policies that will lead to a glut of unwanted inner city apartments, says a damning new report.

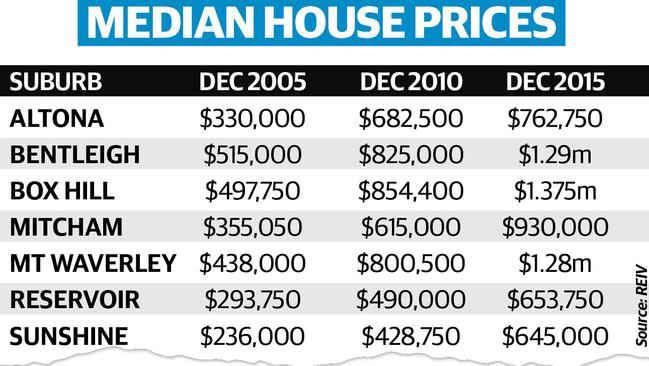

It reveals that rampant house prices have created an increasing army of renters in major cities while those Australians able to buy have racked up an incredible $1.45 trillion in mortgage loan debt.

MORE: STATE NEEDS TO TAKE CONTROL OF HOUSING MARKET

The Australian Population Research Institute study said that the result of years of misguided planning policies, coupled with massive migrant intakes, had produced a social catastrophe for ordinary people.

“It has disenfranchised the younger generation from home ownership and consigned the less affluent to remote outer suburbia and to a lifetime of rental bondage,” it said.

The report has accused Prime Minister Malcolm Turnbull of “monumental insensitivity” to first home buyers for complaining that house prices would be “smashed” if negative gearing concessions were abolished.

Previously unpublished figures show that by 2011, more than a third of Melbourne couples aged 30-34 and a quarter of those aged 35-39 were renting units or houses, according to census data.

A decade earlier the respective figures were much lower — 21 per cent and 17 per cent.

To be released today, the report, Sydney and Melbourne’s Housing Affordability Crisis: No End in Sight, said that while inner city apartment construction was booming, Melbourne was facing a grave shortage of affordable family-friendly housing in the suburbs.

In 2009, about 4000 mainly high-rise units were finished in Melbourne, but this grew to 13,100 by 2015 and is expected to reach at least 20,000 this year and a similar number in 2017.

With about 60,000 apartments in the construction and marketing pipeline over the next few years, report authors Dr Bob Birrell and David McCloskey are predicting the glut will lead to a bust in the high-rise unit market.

“The reason is that there is a restricted market for small apartments. It is limited to temporary migrants, especially students, and young singles and couples, almost all of whom move to family-friendly dwellings when they begin to raise a family,” they said.

But the report said there was a shortage of suitable “infill” accommodation, which comprised detached houses or units, town houses or low-rise apartment blocks built on separate housing sites in the suburbs.

Based on current trends, the authors expect that by 2022, Melbourne will have a deficit of about 19,000 houses, but a surplus of 123,000 mainly high-rise units.

They said that while successive governments had advocated increasing urban density to promote infill, the policy had failed.

“Not because municipal councils and resident action groups have impeded infill but because the housing bubble has escalated detached housing prices to the point that the site costs for infill make town houses and units unaffordable in established suburbs for all but the affluent,” the report said.

The authors blame the Federal Government for boosting house prices over the years by leaving intact tax incentives like negative gearing, and running huge annual net overseas migrant intakes of 240,000, with about half of the new arrivals settling in Melbourne and Sydney.

“Over the last few years there has been a speculative boom in housing prices in Sydney and Melbourne that has worsened the affordability crisis,” they said.

“Most of the huge increase in investor purchases has been on established houses — investors are in effect transforming potential owner occupiers into renters.”

The report was very critical of Malcolm Turnbull’s view that Labor’s policy to abolish some negative gearing concessions would drive house prices down.

“The PM’s stance reveals a monumental insensitivity to the social catastrophe flowing from record high housing prices for the next generation of home seekers in Sydney and Melbourne,” it said.

“Prices have to drop if the consequences are to be dealt with.”

Report link: www.tapri.org.au

Twitter: @JMasanauskas

INNER CITY HOME AN EXPENSIVE DREAM

IT didn’t take long for first-home buyer Taylor van der Chys to abandon the goal of buying a family home in inner Melbourne.

A brief look at listings for houses around Brunswick East, where the 24-year-old rents with girlfriend Evie Cromer-Cherry, told him all he needed to know.

“It would have been great to be close to the city. But everything within 10km was way too expensive,” Mr van der Chys said.

The business analyst said he could have bought an apartment in established Melbourne.

But after renting one for several months, he had decided he wanted “a home with a bit of a backyard”.

He eventually opted to buy a block of land at Tarneit on the city fringe in a development called “Habitat on Davis Creek”.

Mr and Ms Cromer-Cherry will build a three-bedroom house there by year’s end.

“Long-term, I think it’s more beneficial to buy a house,” he said.

“Tarneit suited because it was well priced, only 20 to 30 minutes from the CBD.

“This way, we get to build our dream home.”