Federal Budget 2018: Treasurer Scott Morrison unveils tax relief for the so-called ‘Howard battlers’

EVERY Australian has been promised more cash in their pocket under an ambitious seven-year income tax overhaul in a Budget laden with sweeteners aimed at winning wavering voters.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

- FIVE-MINUTE GUIDE: The Federal Budget... fast.

- THE STATE: How South Australia fared in ScoMo’s Budget?

- CALCULATOR: What does the Federal Budget mean for you?

- INFRASTRUCTURE: The big ticket items explained.

- DEFENCE: Subs, warships bob up on Budget radar for first time

- TREASURER’S SPEECH: What he said. What he really meant.

EVERY Australian has been promised more cash in their pocket under an ambitious seven-year income tax overhaul in a Budget laden with sweeteners aimed at winning wavering voters.

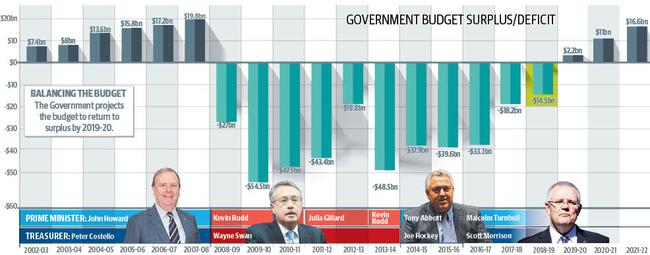

Treasurer Scott Morrison declared his third Budget — and likely his last before the next election — to be the strongest since the Howard Government’s final effort in 2007.

In a key pitches aimed at winning back the so-called Howard battlers and older Australians who have deserted the Coalition, 4.4 million middle-income earners will pay up to $530 less tax, while seniors will benefit from a $1.6 billion package to support them living in their own homes longer.

Aged care, income tax reform and a $24.5 billion infrastructure investment were the centrepiece items of the Budget.

Despite forecasting a $2.2 billion surplus a year early and strong growth thereafter, the Budget lacked any surprise cash splashes, which Mr Morrison told The Advertiser reflected his “calm, conservative nature”.

The tax plan included promises to raise the threshold of the 32.5 per cent tax bracket from $87,000 to $90,000 from July, before abolishing the entire 37 per cent tax rate in 2024.

“We will go to a situation where 94 per cent of Australians will face a marginal tax rate of no higher than 32.5 cents in the dollar,” Mr Morrison said last night.

“They (Australians) could go through their entire working life never facing bracket creep, ever.

“Every extra dollar they earn, it’s the same tax rate. Every extra shift they take, every wage rise they get, we don’t take any more.”

OFF THE RECORD: THE SA POLITICS PODCAST

Mr Morrison said the Government would ask Parliament to endorse the seven-year plan as soon as possible, in an apparent attempt to wedge Labor.

Substantial savings measures include hunting down tax cheats, a package of measures to clamp down on the “black economy” and forcing migrants to wait longer for welfare.

The Budget also flags a review of the public sector which could signal future job cuts.

Disappointingly for South Australia, there were scant details on the new space agency, in which the state hopes to play a major role.

But Mr Morrison renewed commitments to implement company tax cuts in full and eventually raise the pension age to 70.

Other key measures include:

■ INCREASING the number of home care packages for older Australians by 14,000 at a cost of $1.6 billion with the majority being handed to seniors with high care needs.

■ PROVIDING wage subsidies of up to $10,000 for employers who take on older Australians, matching similar programs for young unemployed people.

■ AIRPORT security would get a $294 million boost with plans to enhance air cargo screening and increase police and border force presence at nine of the country’s major airports.

■ EASING road congestion through a $1 billion urban congestion fund.

■ A 21ST Century medical industry plan to create more jobs in the sector by supporting research, scientific collaboration and developing new technology.

Treasury forecasts show the Budget surplus increasing to $11 billion in 2020/21 before hitting more than 1 per cent of gross domestic product over the medium term, when the Government plans to make the most substantial tax cuts.

The Government axed a half a percentage point rise to the Medicare Levy that was supposed to fund the National Disability Insurance Scheme, in favour of using increased revenue to pay for the plan.

Mr Morrison was criticised for the decision to save hip-pocket pain instead of using the extra cash to pay down the Government debt has peaked this year at 18.6 per cent of GDP, a measure of the total size of the economy.

But he insisted yesterday that net debt would drop by about $30 billion over the forward estimates before falling to just 3.8 per cent of GDP by 2028/29 based on conservative estimates.

“Our forecasts and everything we’ve done has been about credibility,” he said.

He branded the Government’s decision to limit tax revenue at 23.9 per cent of GDP “very responsible”, saying this provided “a backstop on spending growth”.

Seeking to frame a stark contrast with Labor’s expected big-spending plans, Mr Morrison said: “You can’t give governments blank cheques, and we’re not asking for one.”

“In fact we’re demanding one not be given, and I don’t think others in politics should be seeking one as well.”

Originally published as Federal Budget 2018: Treasurer Scott Morrison unveils tax relief for the so-called ‘Howard battlers’