Mid-year federal Budget update 2017: New migrants face three-year welfare wait

NEW migrants will now face a three-year wait before becoming eligible for a range of welfare payments under a bid to shave $1.3 billion from the federal Budget.

News

Don't miss out on the headlines from News . Followed categories will be added to My News.

NEW migrants will now face a three-year wait before becoming eligible for a range of welfare payments under a bid to shave $1.3 billion from the federal Budget.

A push to “encourage self-sufficiency” among new Australians will lead to an additional year for qualification before they can receive Newstart or family tax benefits, paid parental leave or carer allowances.

JAMES CAMPBELL: GOOD NEWS FOR JOBSEEKERS COMES WITH STING IN POCKET

TERRY MCCRANN: HAPPY NEW YEAR FOR PM AND YOU

AUSTRALIA’S THREAT TO TRIPLE-A CREDIT RATING SUBSIDES

MID-YEAR BUDGET UPDATE 2017: FAMILY PAYOUTS AND UNI FUNDING FREEZES

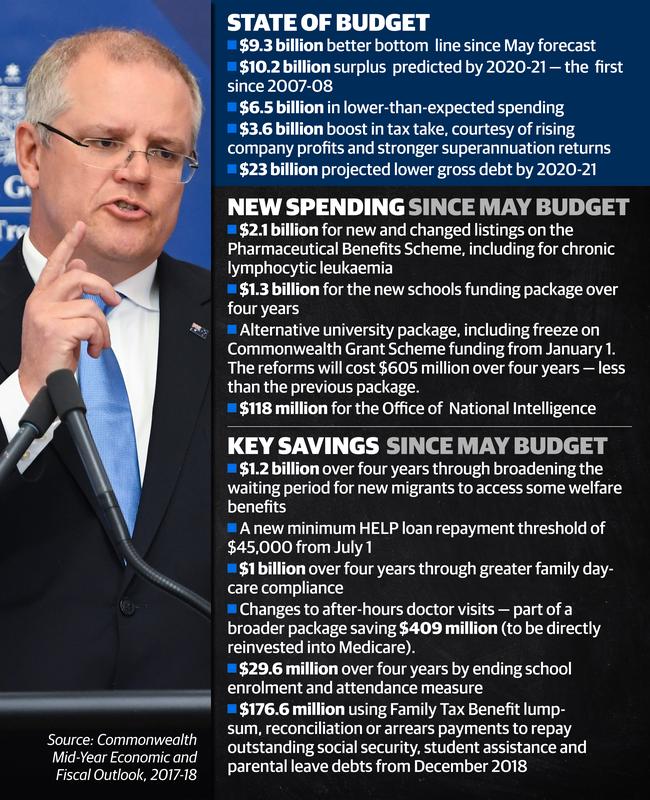

The new measures — along with more than $2 billion in changes to the university system — enabled Treasurer Scott Morrison to outline drastic improvement in the government’s book since May, with the bottom line is more than $9 billion better off than forecast earlier this year.

The Turnbull Government’s mid-year economic update is now predicting it can reach a $10.2 billion surplus in 2020-21, which would be enough to cover an income-tax cut for low and middle salary earners.

.

Mr Morrison said the government was “turning the debt ship around”, and reduced the growth of debt by more than two-thirds since 2013.

“We have ensured that the debt that we expect at the end of the forward estimates to be $23 billion less, $40 billion over the next 10 years,” he said.

“That means lesser interest payments, which means we can continue to make progress on balancing the Budget in line with what we said at the last election, and you put this all down to the jobs and growth plan of the government.”

The $9.3 billion improvement over the four years to 2020-21, is helped by $6.5 billion in lower-than-expected spending. The update shows while unemployment was falling faster than forecast at Budget time, wage growth has been downgraded.

This financial year, wage growth was downgraded from 2.5 per cent to 2.25 per cent and, next year, from 3 per cent to 2.75 per cent.

The jobless rate is expected to fall from 5.5 per cent this year to 5.25 per cent next year.

Economic growth for this year has been downgraded from 2.75 per cent to 2.5 per cent but will return to the Budget’s forecasts of 3 per cent for the next three years.

Weaker wages and unincorporated small business income has wiped $8 billion from the income tax take over the four years but has been more than offset by a surge in company profits and super fund returns, which have added almost $11 billion combined.

The government has been forced to abandon many of its tertiary education reforms, but will slash funding by $2.1 billion over four years to help maintain the surplus trajectory. It dumped all but one of the $2.8 billion in cuts in the May Budget because it could not pass the Senate