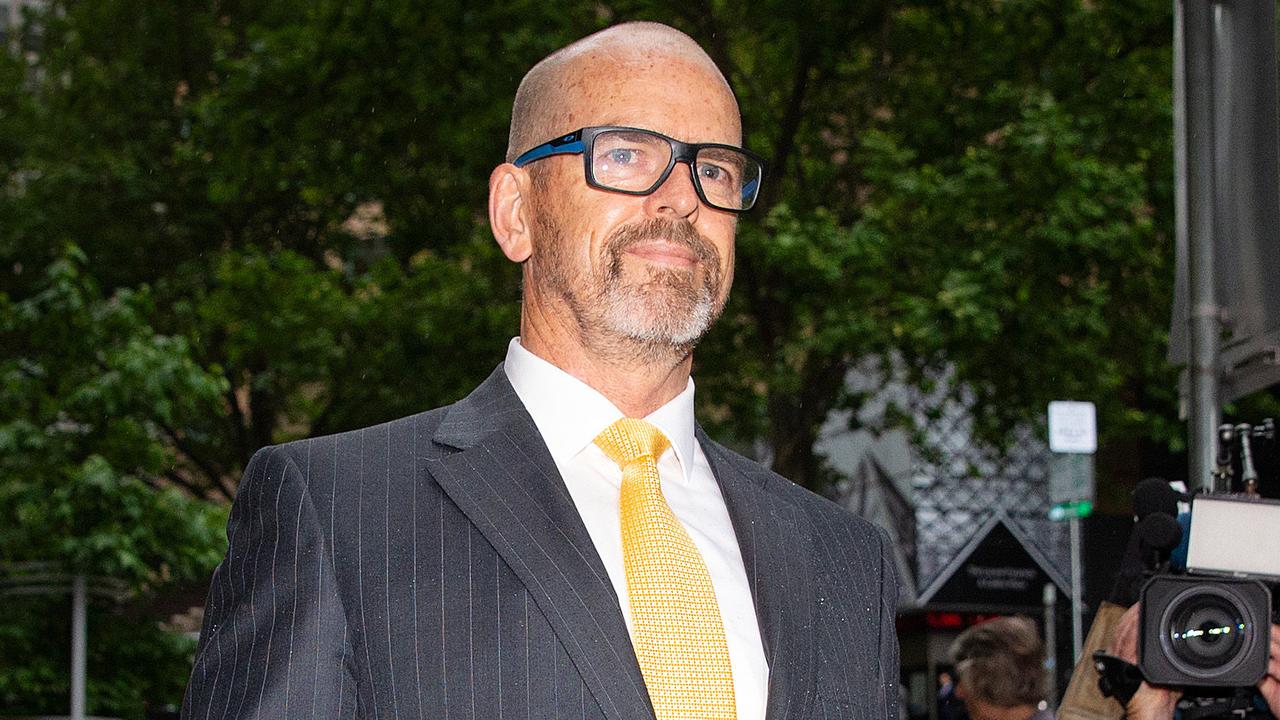

Australia’s ‘worst ever’ insider trader Lukas Kamay jailed

THE mastermind behind Australia’s biggest-ever insider trading scam — which netted more than $8m and an apartment on The Block — has been jailed.

True Crime Scene

Don't miss out on the headlines from True Crime Scene. Followed categories will be added to My News.

THE mastermind behind Australia’s biggest-ever insider trading scam will spend at least four and a half years behind bars.

Former NAB banker Lukas Kamay’s nine-month scam netted him more than $8 million before his suspicious activity was detected by authorities.

Supreme Court judge Justice Elizabeth Hollingworth said today it was the worst case of insider trading in Australian history.

The sole motivation behind the offending “was personal greed’ pure and simple,” she said.

Kamay, 26, used the windfall to by a car, investments and a $2.3 million apartment from hit TV series The Block.

Kamay had only ever planned to make $200,000 from the scheme that he dreamt up with Monash University mate Christopher Hill over a beer at a Fitzroy pub. But greed took over and he couldn’t stop himself.

Using sensitive market information obtained by 25-year-old Hill, a former Australian Bureau of Statistics analyst, Kamay made dozens of profit-earning moves trading the Australian dollar between 2013 and 2014.

The first modest move was a $1000 trade but after a few successes Kamay quickly escalated to punting sums of tens of thousands of dollars, and eventually netted millions.

The biggest single-day profit of $2,509,776, on March 13 last year, followed the release of employment statistics.

The largest single-day loss, of about $779,995, occurred a day before his arrest.

“I’ve let down my family, my friends, my work colleagues, who all

trusted me. I’m deeply apologetic,” he said later.

“I understand that my actions were illegal. The money really consumed me.”

Kamay and Hill had planned to make $200,000, split the profits, then end the scam.

But unknown to Hill, he began his own operation, keeping accounts from Hill, later telling police he didn’t want Hill asking for his share.

In the end, Hill saw just $19,500 of a net profit of more than $8 million, reaped during 45 separate transactions.

The pair pleaded guilty to charges of insider trading, money laundering, abuse in public office and identity theft.

Jailing them today Justice Hollingworth said while Kamay had masterminded the scheme Hill was far from an innocent bystander.

She said he was solely motivated by money, and had breached his trust as a government employee.

Neither of the pair were driven by gambling or other financial pressures.

“Insider trading is not a victimless crime. By its very nature insider trading is particularly difficult to detect, investigate and prosecute,” Justice Hollingworth said.

“These are very serious examples of (insider trading). The gross profit that you made ... is by a very considerable margin the largest insider trading profit to come before an Australian court.

“You both had promising careers in front of you which you’ve both almost certainly thrown away because of your actions.”

Justice Hollingworth said neither of the men had ever been in trouble before and had excellent prospects of rehabilitation.

But she said general deterrence had a central role to play in the sentencing of perpetrators of complex white collar crime.

Kamay was jailed for a maximum term of 7 years and three months.

Hill was jailed for thee years and three months. He must serve two years before becoming eligible for parole.