It’s the $7bn mega tax that makes buying a home harder – but the government can’t afford to axe it

It makes buying a home much harder and costs about half a year’s salary to fund, but the government can’t afford to do away with this “unfair” tax.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

A mammoth tax slapped on property buyers is one of the biggest barriers to homeownership, but Premier Chris Minns admits New South Wales can’t afford to axe it.

The state raked in a whopping $7.6 billion in stamp duty revenue in the 2022-23 financial year, making it the second biggest source of income for the government.

Economists and lobby groups alike say the tax is unfair, inefficient and makes buying a home incredibly hard – especially amid the current cost-of-living and housing crises.

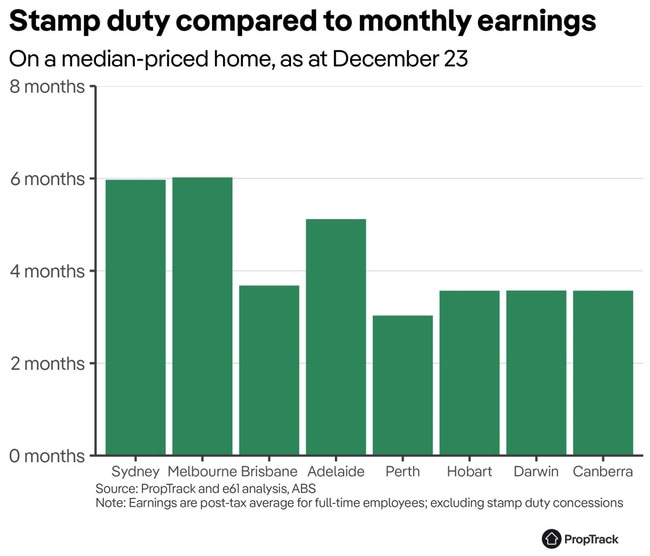

“To buy a median-priced home, stamp duty costs half a year’s worth of income in Sydney,” PropTrack economist Angus Moore said. “It’s a significant cost.”

The Grattan Institute described it as a “bad tax” that can cost up to $50,000 for an average buyer in Sydney – a figure big enough “to dissuade people from moving for a better job or to a bigger or smaller home when they have children, or their children move out”.

Analysis by the Centre for Policy Studies at Victoria University found ditching stamp duty and replacing it with a land tax could save homebuyers about 4.7 per cent.

And the Grattan Institute conducted research in 2018 found such a move could add $17 billion per year to the country’s economy.

In an exclusive sit-down interview with news.com.au, Mr Minns was asked whether moving away from stamp duty was a possibility at some stage down the track.

“Look, I’d love to say that, but it’s our second biggest source of revenue, and I need that money for the enabling infrastructure to grow communities – water, sewerage, roads, public transport, schools, hospitals,” Mr Minns said.

“It’s just incredibly expensive, and I don’t want to be in a situation that we’ve been in New South Wales for a long time where we’ve had housing (but) no infrastructure, and then families buy that house and then say, where’s the school, where’s the emergency department?

“I need the revenue stream.”

The state’s brief land tax experiment

The last State Government introduced a policy that was seen as the beginning of the end for stamp duty in NSW.

Then-premier Dominic Perrottet announced first-home buyers would be able to choose between taking a big hit on stamp duty or opting for a small annual land tax for the duration of their tenure.

When elected, Mr Minns wound back the policy, much to the dismay of housing groups.

“We had a better plan,” he told news.com.au.

The government replaced it with a tax-free incentive for first-time buyers on homes valued up to $800,000, saving about $31,000, and discounting stamp duty on purchases up to $1 million.

Since the changes came into effect, some 13,800 first-time buyers received a full exemption while 4600 benefited from a discounted rate.

“We introduced the largest tax cut for first-home buyers in many, many years – the largest tax cut the state’s seen for a long time,” he said.

“Now, housing is expensive in New South Wales, but the median home price is still $1 million, so 50 per cent of the market is available for either no land tax or a discounted amount.

“For a first-home buyer, it’s an opportunity to get that foot on the ladder. I just thought that it was far better for people to pay no tax, rather than a land tax forever.”

But a research paper written by a senior NSW Treasury official in the wake of the land tax alternative being dumped found it could’ve increased home ownership by 6.6 per cent.

The share of all homes in the state owned by owner-occupiers would’ve risen to 71 per cent from 67.5 per cent, according to the analysis published in the academic journal Economic Record.

Stamp duty hurts all buyers

It’s not just first-time buyers impacted by big stamp duty bills, concessions or not, Mr Moore pointed out.

“Higher stamp duty makes people less likely to move within their local area or move interstate. This means people are less likely to move for jobs, which may hamper productivity,” he said.

Joint research by e61 Institute and PropTrack found stamp duty on a median priced home in Sydney costs half a year’s worth of income.

“This wasn’t always the case,” Mr Moore said. “Stamp duty relative to incomes is four-and-a-half to six times higher than a generation ago.”

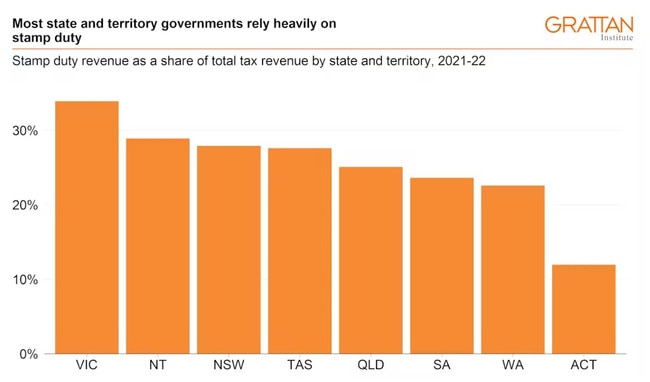

He described the tax as one of the “least-efficient ways to raise revenue” but governments across the country have become increasingly reliant on it to boost their coffers.

“In 2021, 5.5 per cent of government revenue – across all levels of government – came from stamp duty. That is second only to South Korea.”

Part of the reason stamp duty revenue has increased so much is that home price growth has been faster that income growth.

But Mr Moore said that “bracket creep” – a scenario where rising values push people into higher taxation – has been “a key driver”.

“Nearly all buyers today pay stamp duty equivalent to three per cent or more of a property’s purchase price. In the early 1990s as few as 12 per cent did.”

With each percentage increase in stamp duty, the number of home sales is reduced by as much as seven per cent, the e61 Institute and PropTrack research found.

In NSW, stamp duty thresholds that determine how much a buyer must pay are adjusted each year in line with state-level inflation, CoreLogic research director Tim Lawless explained.

“Over the past 10 years (to 2022), Sydney’s consumer price index has increased by a total of 21.8 per cent while housing values more than doubled, up 109.5 per cent over the same period,” Mr Lawless said.

“The result is a significant amount of bracket creep that has pushed roughly half of Sydney dwelling sales over the past year into the highest stamp duty bracket.

“Homebuyers are lumped with a minimum of $42,240 plus $5.50 for every $100 over the upper threshold amount of $1.04 million.

“Ten years ago, only 11 per cent of Sydney properties were selling for $1 million or more.”

According to CoreLogic data, the current median home price in Sydney is a staggering $1.12 million, delivering buyers a stamp duty bill of about $48,000.

Time to turn off the tap?

Housing groups and a growing list of economists have repeatedly called for stamp duty reform in previous years.

Mr Moore said replacing it with a broad-based land tax “would be fairer and more efficient”.

“Broad-based land taxes are a more efficient way to raise revenue. They are also fairer because they spread the burden of taxation, and, unlike stamp duty, do not differentially tax households of otherwise similar income and wealth simply because one moves home more often.”

There would be real benefits from reform, but he conceded “the transition will be challenging” because of how much money the tax brings in.

In the lead-up to the next federal budget, the Real Estate Institute of Australia has called on the Commonwealth to take a role in bringing stamp duty to an end.

“While we acknowledge stamp duty is state tax, the Federal Government has a role in taking a co-ordinated approach across jurisdictions,” REIA president Leanne Pilkington said.

“The removal of stamp duty could introduce an additional four per cent of property listings into the sales market.

“REIA advocates for a broader national perspective, presenting various options for stamp duty reforms, including big picture and smaller scale reforms, broadbased tax replacement, and innovative payment structures.

“What we should see in this Budget is funding put aside to fund a task force to look at tax reform generally, and stamp duty phase out in particular.”

An inquiry into housing affordability by the Federal Government in 2022 made a number of recommendations, including moving away from stamp duty.

The federal Labor Party, then in Opposition, did not support the final report.

Given how many Labor state governments were in power across Australia at the time, the stance is perhaps unsurprising.

“Through the 2019-20 financial year, stamp duty on conveyances comprised 18.1 per cent of all state and local government revenue,” Mr Lawless said.

In the years since, that proportion has likely “increased substantially” due to surging home prices and a record level of transactions.

Originally published as It’s the $7bn mega tax that makes buying a home harder – but the government can’t afford to axe it