ATO deputy commissioner Michael Cranston charged with abusing position as public official

UPDATE: Adam Cranston, the son of the Australian Taxation Office deputy commissioner, has been released on $300,000 bail after being charged in relation to an alleged $165 million tax scam.

News

Don't miss out on the headlines from News . Followed categories will be added to My News.

MICHAEL Cranston, the deputy commissioner of the Australian Taxation Office, has been charged with abusing his position as a public official.

It comes after The Daily Telegraph today revealed Cranston’s son, Adam, was charged over his alleged role in a fraud syndicate that police claim stole more than $165 million — one of the biggest white-collar crimes in Australia’s history.

Australian Federal Police yesterday arrested Adam Cranston at his Bondi flat in one of 27 raids on homes and businesses across Sydney.

He was charged last night with conspiracy to defraud the Commonwealth and faced Central Local Court today.

Adam Cranston, Daniel Rostankovski and Chris Guillan were today granted bail under strict conditions, including that they surrender passports and not contact the alleged directors of the so-called second-tier companies that enabled the alleged fraud.

Mr Cranston was charged with conspiracy offences, with a total bail of $300,000, while his co-accused Rostankovski was also charged with blackmail, with a $100,000 bail.

Fellow accused Daniel Hausman was granted $75,000 bail today with a range of conditions, and so too was Jason Onley, with similar conditions and a $75,000 bail.

This comes as a veteran TV journalist and Eddie Obeid’s former lawyer are accused of blackmailing the syndicate.

Sevag Chalabian, a former lawyer for Obeid, and Stephen Barrett, who has worked for 60 Minutes, were named in police documents which allege they made “unwarranted demands” between February and the present date.

Neither Mr Barrett or Mr Chalabian have been charged.

Chalabian is a Partner at Lands Legal, which he founded more than a decade ago.

He was the lawyer for Obeid and his sons since they started being investigated by the NSW Independent Commission Against Corruption.

Adam’s younger sister Lauren Cranston was also arrested with the 24-year-old given the same charge as her brother when she was arrested in Picton, southwest of Sydney yesterday. She was granted conditional bail to face court on June 13.

So far, six people have been charged with conspiracy to defraud the Commonwealth, two with money laundering and another with extortion.

Acting Commissioner of Taxation Andrew Mills told reporters in Sydney today Mr Cranston had “up until this point ... held an illustrious career”.

Police will allege, Mr Cranston, 58, who will appear in a Sydney court on June 13, was asked by his son to access “some information”.

Mr Mills tried to reassure taxpayers its systems hadn’t been compromised, after launching an internal investigation into a “small number of employees”.

“The people being investigated have been suspended without pay,” he told reporters.

The employees reportedly tried to access ATO information at the behest of Mr Cranston.

“If you are an officer within the ATO, you have access to those matters only to which you actually are required for the purposes of your job. If you seek to obtain information which is outside that scope, you actually are in breach of the code of conduct,” he said.

Australian Federal Police Deputy Commissioner Operations Leanne Close said the scale of the alleged fraud was unprecedented.

“It is a significant financial fraud criminal investigation that the AFP has led since 2016,” she said.

Ms Close said it appears Mr Cranston’s son has asked him to access some information.

“We don’t believe that at this point that he had any knowledge of the actual conspiracy and the defrauding,” she said.

Assets seized in the past two days by the AFP include 25 motor vehicles — luxury, vintage and racing vehicles — 18 residential properties, 12 motorbikes, more than 100 bank accounts and share trading accounts, two aircraft, firearms, jewellery, artwork, vintage wines and at least $1 million located in a safety deposit box.

Sources close to the investigation claim Adam was a “co-conspirator” in a group that used an elaborate tax scam to fund a celebrity lifestyle that included prime Sydney real estate, boats — and even a racing car team.

“This investigation has uncovered high-level organised activity; it is complex (and) sophisticated,” the source last night told The Daily Telegraph.

“I think it will take the police a long time to figure out exactly how much money (is involved).”

It is believed police will allege the fraud is one of the largest ever seen in Australia.

Investigators allege Sydney financial services firm SYNEP, of which Adam is co-chairman and managing director, was part of the operation.

Treasurer Scott Morrison this morning said: “Those who think they can defraud Australian taxpayers — today’s events show that they have another thing coming.

“We’ll find you, we’ll track you down and we’ll make sure you’re brought to justice.”

Mr Morrison said the latest bust shows the cross-agency crackdown on tax cheats is working.

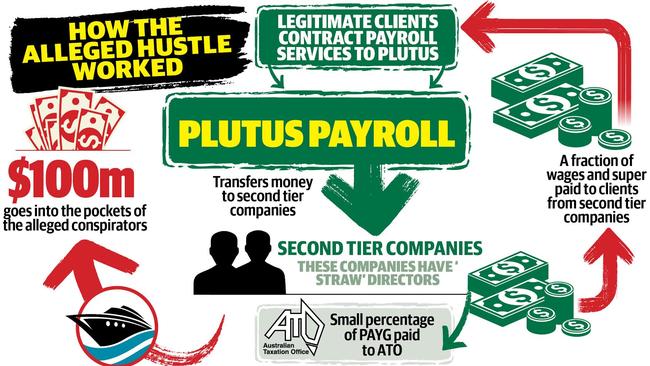

Payroll contractor Plutus Payroll, controlled by SYNEP, was the centrepiece of the alleged hustle.

Police will claim it would allegedly funnel wage payments through a series of “second tier” companies, which then paid the ATO only a fraction of the required income tax.

The remaining withheld tax would then allegedly flow into the pockets of syndicate operators.

The scammers believed they had struck a sweet spot where each individual fraud was too small to prompt action from the ATO.

One source said it was “like saying to your schoolteacher, ‘I’ve done most of my homework, I’ll bring the rest next week’,”.

The net tightened when both the AFP and ATO noticed alleged discrepancies in parallel investigations.

The sum of the frauds is understood to be more than $165 million, with the extent of Cranston’s own alleged profits expected to be revealed in court.

Investigators said their probe focused on a 12-month snapshot of the group’s alleged activities.

Sources also allege the scheme had another sinister angle.

Police will claim the syndicate would pay struggling people a regular fee so they could set up the second tier companies in their names. However, the syndicate had total control of the companies.

Plutus Payroll hit the headlines earlier this month when the ATO froze its bank accounts over unpaid tax debts, meaning its clients’ staff could not be paid.

In a statement earlier this month, Plutus apologised to its customers “continuing distress caused by our inability to process your pay since 27 April”.

“Our dispute is with the Australian Taxation Office who believe that Plutus owes the ATO money,” the statement said.

“Acting in a draconian and unfair manner, the ATO froze Plutus’ bank accounts on 27 April without prior warning or any consultation.

“We received no notice of intention to audit, no complaint and no other advance warning of non-compliance from the ATO.

OTHER NEWS: PM CONFIDENT IN US ALLIANCE

“When the ATO acted, without notice, they froze our bank accounts and we became unable to pay our contractors the money owed to them.”

On May 10, the company announced the ATO had allowed the release of the money.

With more than 35 years at ATO, Michael Cranston has spearheaded many public campaigns to catch tax cheats.

“I am responsible for increasing compliance and willing participation in our tax and super system,” one of his social media accounts states.

“I recently chaired the OECD Task Force on Tax Crimes.”

The ATO last night refused to comment on the investigation.

And Michael Cranston did not respond to questions put to him through the ATO.

The ATO said it “will not comment on ongoing investigations at this time”.

“Due to privacy considerations the ATO is unable to comment on individual employees,” it said.

A CASE OF LIVE FAST AND FRY YOUNG

POLICE claim assets linked to an alleged $165 million tax fraud case include sports cars, expensive properties, boats and even a race team.

Cars were a particular passion for one of the alleged “co-conspirators” of the crime. Adam Cranston loved them so much there’s even a wedding day photo of the now 30-year-old with his wife and a slick race car.

There is no suggestion Cranston’s wife had any knowledge of or involvement in the alleged fraud.

A source said that among the property seized by police is an orange and blue Ford GT in Cranston’s possession.

Cranston started a race car team last year. And he named it after the financial services firm now at the centre of the alleged crime, SYNEP. The team competed in the Australian Prototype Series and in February celebrated a podium finish at Mount Panorama.