The three big themes (and risks) of China’s reopening

A post-Covid rebound in China might stop the global economy from tipping into a recession this year with the US and Europe both facing a sharp slowdown. But it’s down to the country’s consumers.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The fate of the global economy this year could be in the hands of China’s consumers.

There is still a stream of bad news coming out of China right now with infections spreading and reported deaths fast-rising following the move away from last year’s tough zero Covid policy. But like other countries in the west that have come out of long lockdowns – an economic boom is on the horizon.

For the world’s second biggest economy and Australia’s largest trading partner a rebound in China is significant as it provides crucial support for commodities prices. It might just be the thing that stops the global economy from tipping into a recession this year with the US and Europe both facing a sharp slowdown.

On markets at least, the China reopening trade is already well underway, propelling mining giants from BHP to Rio Tinto higher on expectation the rebound will fuel demand for steelmaking. BHP shares on Thursday hit a record high, after stripping out the impact of the demerger of its energy arm last year.

UBS’s Hong Kong-based China economist Ning Zhang has sketched out the three big themes of the reopening: Covid transmission rates; pent-up demand from locked up consumers and finally the property rebound.

After China’s zero Covid easing measures accelerated quickly over December with the removal of most controls including citywide lockdowns and quarantine. Since then Covid infections have been rising sharply but progress has been uneven across different regions and cities.

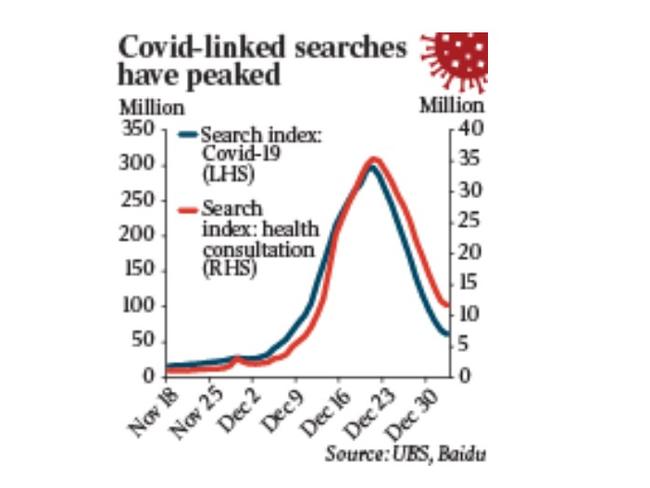

Covid peak

While there are no solid figures tracking Covid measures, Zhang has used a proxy indicator of pandemic-linked keywords used for Baidu that overwhelmingly dominates internet search in China. Here he believes that daily Covid infections may have already peaked at the end of December or earlier this month. There are still Chinese New Year celebrations to come from January 22, but Zhang expects the major wave to pass by the end of this month or early February.

“Basically this year the Chinese story will be a rebound post-Covid shock and property downturn,” Zhang says in an interview. “This will underpin a very rapid and strong reopening story”.

Here the focus will be on the Chinese consumer, rather than property or infrastructure investment that has been the driver of previous China megabooms. While spending on goods is expected to increase – like others, the experience in other economies demand for services such as domestic tourism, entertainment or eating out will play a big part in the recovery. All up Zhang tips consumption growth to surge ahead between 6 per cent and 7 per cent, although he expects this will take several quarters to hit top speed.

Even leading into the Covid pandemic China’s property sector was on shaky footing suffering one of the sharpest downturns in its history. Construction and sales had been the thing driving the previous supercharged economic growth cycle from 2016 before debt heavy developers started faltering as Beijing attempted to cool the property bubble.

Zhang, who was a presenter at this week’s UBS Greater China Conference held in Hong Kong and to the investment bank’s clients through China. believes there is a shift among policymakers who now see the sector as too big to fail.

Already some measures such as November’s easing around restrictions on developer financing are seen as a recognition of support for the sector. The upcoming National People’s Congress in March is expected to also see more support around the demand side. This could range from lowering down payment requirements as well as easing restrictions around home purchases. There is still a long way to go, Zhang adds, with property sales down 22 per cent in December year on year across key cities. Last year national property investment was down more than 10 per cent, but UBS expects this year it could settle at single-digit percentage decline or at best flat.

Inflation

Even with slowing, but still positive, infrastructure investment across the country this means that property won’t be so much of a drag on the economy as in the past two years.

This means steelmaking commodities and final stage commodities such as copper and aluminium will be supported, subdued property markets mean there won’t be another super cycle.

So far there hasn’t been any official targets put down for GDP growth this year, these are expected to come at the meeting of the National People’s Congress.

Nonetheless some market watchers including Zhang, expect growth of at least 5 per cent with room for some upside. This is well up from last year’s growth which, while starting strong, is expected to settle at 2.8 per cent once the December quarter figures are finalised.

For much of the world – including Australia – the race out of Covid lockdowns has coincided with rampant inflation. And this is spurring on aggressive interest rate rises, the cause of much of the global economic heartburn.

Zhang believes inflation won’t represent such a problem for the Chinese economy, peaking at around 3 per cent at the start of the year particularly as high unemployment means there is surplus capacity. New figures show China’s inflation met expectations for a 1.8 per cent annualised in December. Meanwhile the peak of supply chain disruptions that hobbled the rest of the world early last year and surging commodity prices are coming off, particularly for oil and gas.

Risks

Zhang ranks the number one risk to the outlook as being Covid related. He points out that with such a big population there’s still a big infection wave to work through the community and this can put more stress on the health system.

And there is also the prospect of new variants emerging. Added to this uncertainty is the prospect that Chinese authorities reinstate lockdowns or revert to the zero Covid policy, although Zhang puts this at a low likelihood.

A second major risk is the global slowdown is worse than expected. UBS’ current view is almost zero growth for the US and Europe this year, but any deterioration from that outlook could see a hit to China’s exports that remain a big part of its growth story. Capital flows are starting to return. This is supporting China’s share market, which has already been one of the best performers in the world. The MSCI China Index that tracks a broad basket of shares, is up more than 10 per cent since the start of the year.

Third and finally, the strained property sector may not come back as strong as anticipated, but the key will be the National People’s Congress and the political will to support the sector.

“The new leadership is now focusing on growth again and trying to gain some confidence back and try to support the economy to put China’s growth on track again,” Zhang says.

johnstone@theaustralian.com.au

Originally published as The three big themes (and risks) of China’s reopening