Hold on for a wild ride into 2023

The Australian and Wall St sharemarkets have bounced back over recent months but we won’t know until next year whether investors made the correct call about the economic outlook.

The Australian and Wall St sharemarkets have bounced back over recent months but we won’t know until next year whether investors made the correct call about the economic outlook.

Daniel Andrews has no real intention of bringing back the SEC as we knew it but what he’s promising will plunge us into huge debt.

RBA governor Philip Lowe doesn’t seem to realise that it’s entirely on his shoulders to head off a wages spiral by getting rates up faster than he’s been doing.

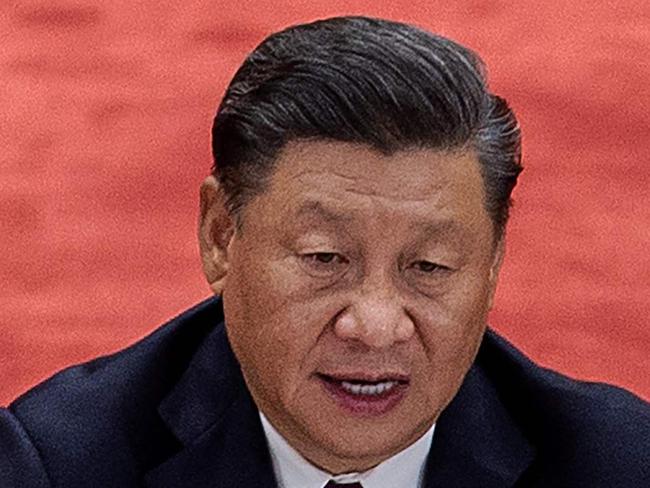

What’s happening in and around Russia and China will really determine your financial and indeed broader wellbeing through 2023 and beyond.

Scott Morrison’s attack on Australia Post’s chief executive Christine Holgate was not only hysteria on steroids, he also announced he is so disconnected that he does not understand how businesses work, writes Terry McCrann.

Shareholders in the Myer department store group should be asking if this is really be a good time to be throwing the whole management and leadership of the battered company into chaos by voting to sack the chairman, asks Terry McCrann.

Victoria is dragging down the rest of the country’s jobs recovery from the pandemic. But when we are back on track Australia can’t return to the old way of doing things, writes Terry McCrann.

The nation’s financial crimes watchdog has worked out where the money is. But AUSTRAC’s case against Crown Resorts is unlikely to generate CBA or Westpac type fines, write Terry McCrann.

Philip Lowe’s announcement about interest rates was not only bad news for savers, but unintentionally sent a strong message to federal treasurer Josh Frydenberg, writes Terry McCrann.

The race is on, with the JobKeeper end date rapidly approaching yet no end to lockdown in sight. Unless Daniel Andrews loosens his stranglehold on the economy, more Victorians will become officially unemployed, writes Terry McCrann.

The honeymoon is over for Virgin and its new buyer, with the harsh reality of its new union setting in and some tough decisions looming in the near future, writes Terry McCrann.

Josh Frydenberg’s industrial strength hosing of money to just about everyone in the budget has raised consumer confidence in Australia, and yes, even in Melbourne, writes Terry McCrann.

When China makes decision that affect us, all sorts of games could be in play that have absolutely nothing to do specifically with Australia; then again, they could be very precisely aimed at us, writes Terry McCrann.

The $2.8bn bid for the Link investment services group is an entirely opportunistic and completely predictable undervalue opening gambit by the always avaricious private equity bottom feeders, writes Terry McCrann.

Original URL: https://www.heraldsun.com.au/business/terry-mccrann/page/76