Whitlam-flavoured coal plan won’t work

Despite trainee treasurer Jim Chalmers’ slavish adoration of Paul Keating, the Albanese government is shaping up far more like a replay of Whitlam than of Hawke-Keating.

Despite trainee treasurer Jim Chalmers’ slavish adoration of Paul Keating, the Albanese government is shaping up far more like a replay of Whitlam than of Hawke-Keating.

The good news in the GDP figures was also the bad news. That is to say, bad news for borrowers.

RBA Governor Philip Lowe has moved too little, too late. Now we play the waiting game to see what happens next.

The reborn State Electricity Commission has even less financial metrics than the NBN. There probably isn’t even a drinks coaster.

It’s official. Australia’s three biggest states will all soon be wallowing in more than $100bn of debt each – on top of $1 trillion in federal debt. But does it matter? Terry McCrann answers.

What can the PM expect our shiny new international trade deal to get us when China ignores the free-trade deal we already have, asks Terry McCrann.

The people who govern us – both the politicians and the central bankers – are making a universal one-way bet. Here’s why it’s disturbing and very dangerous.

In corporate life, former federal treasurer Peter Costello is notching up a remarkable record that is probably unrivalled in the developed world, says Terry McCrann.

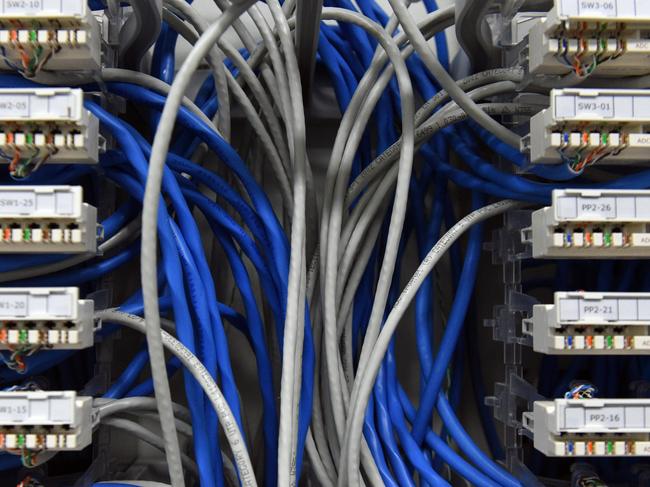

Any suggestion the NBN should be privatised is simply madness. It must stay in public hands, and to do otherwise would be vandalism on a national scale, writes Terry McCrann.

Official figures tell us inflation is all-but non-existent, but in the real world — especially for one big group of Australians — nothing could be further from the truth, says Terry McCrann.

Sure, there may well be a coronavirus vaccine in the pipeline, but let’s not get ahead of ourselves. The benefit, at least economically, will take months to play out, writes Terry McCrann.

Global share markets are on the march but its expectations of further central bank stimulus, rather than the US election result, which is the key driver, writes Terry McCrann.

After an extraordinary week, home loan borrowers and investors have to decide if they should grab the closest thing to “free money” they are ever going to see and lock it in for four years, writes Terry McCrann.

The big profit plunges reported by the big four banks do not give an accurate guide to how they actually performed through the year — they’ve come through the pandemic pretty well, writes Terry McCrann.

Original URL: https://www.heraldsun.com.au/business/terry-mccrann/page/74