Shamed Big Four banks pocket $19b in share market surge, NAB chief confident his job is safe

Under-siege NAB chief Andrew Thorburn has defended his position, saying he felt safe in his job the day after disgrace was heaped upon the bank at the finance sector royal commission. It comes as the Big Four followed up the darkest day in their history with a share-price rebound worth more than $19 billion.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s big banks defied the disgrace heaped upon them at the finance sector royal commission with a share-price rebound worth more than $19 billion.

The Big Four followed up the darkest day in their history by on Tuesday tracking their biggest share-price boosts since the Global Financial Crisis.

HEARTS BROKEN, DIGNITY ROBBED BY BANKS’ GREED

THE BANKING ROYAL COMMISSION’S DAMNING FINDINGS

The rally came on the back of investors judging that the Commonwealth Bank, Westpac, the National Australia Bank and the ANZ were not whacked as hard by Commissioner Kenneth Hayne’s final report as many thought they would be.

Under-siege NAB chief Andrew Thorburn went public on Tuesday to defend his position after Mr Hayne singled out NAB for heavy criticism in his final report, saying he was “not confident” that the “lessons of the past have been learned”.

Mr Thorburn said he believed his position was not discussed at a NAB board meeting in Sydney on Tuesday.

“I don’t think so, no,” he said in Melbourne where he was responding to the findings. “I don’t feel that I have any less support and commitment today from our leaders and our people than I had six or nine or 12 months ago.”

WHAT BANKING REPORT MEANS FOR HOME BUYERS

The commission’s scathing final report examined a decade of bank scandals, including hitting customers with hundreds of millions of dollars in fees but offering no service in return, and even charging fees to dead people.

Mr Thorburn said he felt safe in his job, despite shareholder grumblings and the damning report.

SOPHIE ELSWORTH: ANDREW THORNBURN CANNOT BE SERIOUS

CEOS NEED HOLIDAYS TOO: NAB BOSS

NAB was found to be one of the worst performers at the commission, with revelations of scandals including wrongly taking $100 million from superannuation customers.

Mr Thorburn said he would continue the reform of the business — which includes thousands of jobs being cut — just as his own leadership was being questioned.

“We have to face into the reality there are pressures … you have to work through that,” he said.

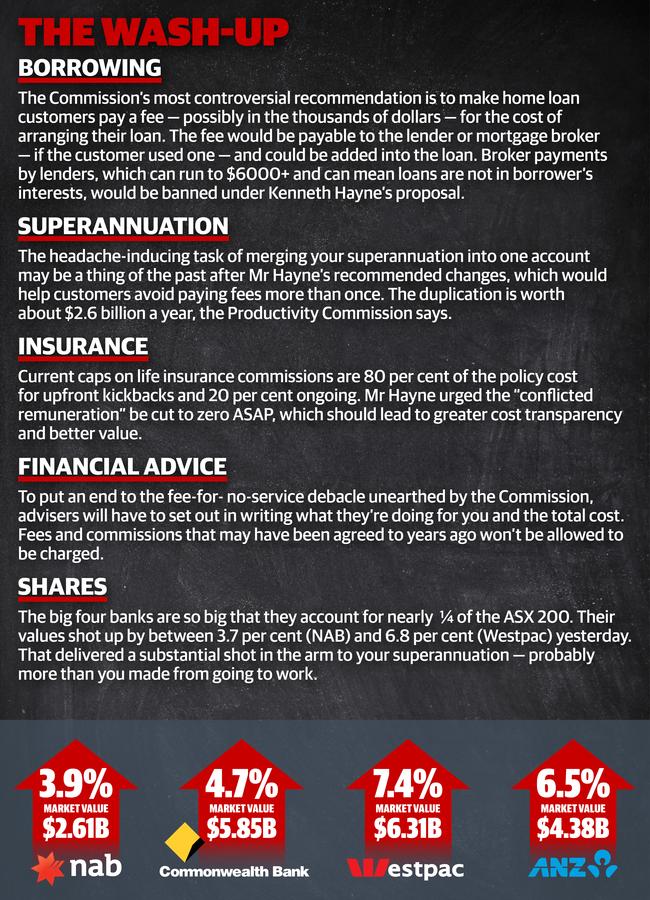

Mr Hayne has called for wholesale changes to the way consumers access everything from mortgages, insurance, financial advice and superannuation. The commissioner says there could be criminal charges against three unnamed financial institutions

Mr Thorburn said he did not know if NAB was one of the big lenders referred to the corporate cop. “We don’t know … it is up to the regulator to inform us of that,” he said.

The share market judgment of the commission report was clear, with top UBS banking analyst Jonathan Mott saying the royal commission contained “tough talk” but “soft recommendations”.

Powerful ratings agency Moody’s Investors Service said the royal commission’s recommendations were “likely to preserve bank profitability”.

The rally, which added $19.2 billion to the value of the Big Four, pushed the ASX 200 through the 6000-point mark for the first time since early October.

Shares in the Commonwealth Bank — the nation’s biggest lender — jumped $3.30 to $73.60 in its biggest one-day gain since May 2010.

Westpac’s share price surged $1.83 to $26.70. That was its best one-day gain since December 2008 during the thick of the GFC.

Shares in ANZ put on $1.64 to $26.86, the biggest rise since April 2009.

NAB, whose leadership was savaged by Mr Hayne, was the worst performer among the big four but its share price still rose 94c to $24.97, the biggest gain since November 2016.

In a report for investors, UBS’s Mr Mott said: “There was much discussion around misconduct within the banks and the need to change culture; however, the final recommendations fell well short of market expectations.

TEN NEW JUDGES FOR CRIMINAL BANKING CASES

FIVE-MINUTE GUIDE TO DAMNING BANKING REPORT

“It is possible that the banks may face criminal proceedings, but we do not believe that any of the 76 recommendations by themselves will have a material financial impact on the banks.”

Moody’s senior credit officer, Frank Mirenzi, said the royal commission had chosen not to tighten lending laws, reducing the risk of a deepening credit contraction.

“The final report did not make any recommendations that would materially alter the concentrated structure of Australia’s banking system, which, in our view, supports the sector’s strong and stable profitability,” he said.