Banking Royal Commission findings: How it affects home loans

Home loan customers will be forced to pay a mortgage broker an upfront fee in a drastic Royal Commission overhaul aimed at wiping out conflicted commissions.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

HOME loan customers will be forced to pay a mortgage broker an upfront fee in a drastic overhaul aimed at wiping out conflicted commissions.

Every second mortgage written in Australia goes through a broker, with thousands of dollars of fees being reaped from the lender on every loan in a combination of one-off and ongoing trail payments.

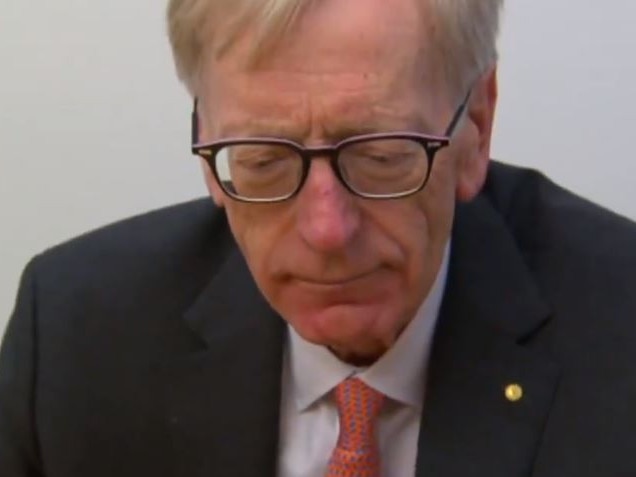

Commissioner Kenneth Hayne said all this had to stop.

He said making customers paying an upfront fee and abolishing commissions from lenders would “create a level playing field” between banks and brokers.

In the report, once the changes are implemented the broker would charge a fee direct to customers while banks potentially could charge the borrower a fee.

MORE: Banking royal commission findings revealed

MORE: Your 5-minute guide to the royal commission findings

BAREFOOT INVESTOR: Greed won’t go away

MORE: How the Commission findings affect financial planners

MORE: Major superannuation shake-up ahead from report

EXPLAINED: How the Commission will affect home buyers

OPINION: Don’t believe the banks’ promises to do better

Mr Hayne expects it to take two or three years to implement the changes including:

— Firstly, within 18 months prohibit lenders from paying trailing commissions to mortgage brokers on new loans.

— Secondly, in the following 18 months prohibit lenders from paying other commissions to mortgage brokers.

A Treasury-led group should be established to oversee the remuneration model and fees lenders charge to ensure there is a level playing field, he said.

Treasurer Josh Frydenberg said the Government would act on the advice to ban trail commissions then have a review “on the implications of removing upfront commissions and moving to a borrower pays remuneration structure”.

Labor’s treasury spokesman Chris Bowen said it would simply adopt the measure as recommended.

For decades the lender has paid the broker when a customers signs a loan with a bank, but the commission heard seemingly endless tales of conflicted advice and brokers failing to act in customers’ best interests.

This included concerns around brokers being incentivised to write larger mortgages under the current structure because it delivered bigger financial kickbacks.

“It is an incentive to brokers to have the borrower take as large a loan as the borrower can afford regardless of whether the borrower needs to borrow, or is wise to borrow, that sum,” Mr Hayne said in the report.

Currently the lender pays the broker both an upfront and trail commission when they sign up a customer to their bank.

In the report, Mr Hayne said the nation’s largest lender, the Commonwealth Bank, under existing arrangements estimated a fee charged by a broker on an average loan is about $6600.

This is nearly triple what a consumer would pay for complex financial advice.

But for home loans already being taken out existing trail commissions will not be impacted.

Mr Hayne slammed trail commissions and described it as “money for nothing” for brokers.

“Why should a broker whose work is complete when the loan is arranged continue to benefit from the loan for years to come?” he asked in the report.

He also said under the existing arrangements trail commissions acted as a deterrent for brokers to “switch borrowers in and out of different mortgage arrangements.”

As the commission hearings discovered, an Aussie Home Loans broker’s misconduct showed “brokers are astute to do nothing that will interfere with the continued flow of trail commissions.”

Mr Hayne considers the changes recommended will encourage brokers to give borrowers better value for money.

“Brokers will also have the incentive to offer or continue to offer services that borrowers cannot derive from the direct lending channel and for which borrowers are willing to pay,” he said.

“I acknowledge that the changes I propose are significant.”

My Hayne said the Australian Competition and Consumer Commission should be responsible for monitoring the fees set by banks and ensuring the cost is no more than if the customer signed up via a broker.

The Commission also examined the use of the Household Expenditure Measurement — a controversial benchmark to approve loans.

Under the HEM banks assess mortgage applications based on broad demographic information such as typical incomes in the suburb of the property being purchased, instead of assessing each borrower’s specific financial circumstances.

The Commission revealed the HEM had led to borrowers getting loans they probably could not service.

Mr Hayne said banks have already started to reduce their reliance on the HEM.

Instead banks’ have already started improving the processes for inquiries and verification of a customers’ financial situation instead of relying on HEM.