Petrol prices look set to skyrocket as three key factors combine

Fuel prices are under control – at the moment. But three key factors are about to combine and the impact on Aussie households could be devastating.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

When it comes to the impact of inflation on our daily lives, there are few things that can elicit such immediate frustration as the cost of the price of petrol and diesel.

With the price up in lights at least every few kilometres in most of our major cities, it’s a constant reminder of how our purchasing power is faring in the face of the rising cost of living.

Yet despite 95 octane unleaded averaging around $2 a litre nationally in recent weeks, fuel prices are actually currently enjoying the impact of three major factors that are keeping them lower than they otherwise would be.

But all good things must eventually come to an end, and it is the cessation of these same three things which could spell disaster for our wallets at the bowser.

A tax cut at home

Since the Morrison government’s halving of the federal government’s fuel excise tax went into effect on the March 30, petrol and diesel prices have been 22 cents per litre lower than they otherwise would have been.

On the March 17, 95 octane unleaded hit a peak of $2.19 per litre in the nation’s capital cities. Since the fuel excise tax cut, the highest capital city average price recorded has been $2.08 per litre for 95 octane unleaded.

Without the fuel excise tax cut, we would have seen a record high national average of $2.30 per litre for 95 octane unleaded.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

But as Australia enjoys a small respite from rising fuel costs, it’s quite a different story throughout the vast majority of the rest of the world. In recent weeks, the US and UK have both hit all-time record highs for the price of petrol and diesel, despite oil prices sitting significantly below their March peak of $129 a barrel.

While there are a number of reasons for this historic divergence between fuel and oil prices, a major factor is arguably the world attempting to adapt to fewer Russian oil and fuel exports.

But like all good things, the fuel excise tax cut will end on September 28, at which time fuel prices will jump by 22 cents per litre. Depending on the state of global oil markets at the time, Australians may see another record high in the cost of fuel at the pump.

The release of oil reserves

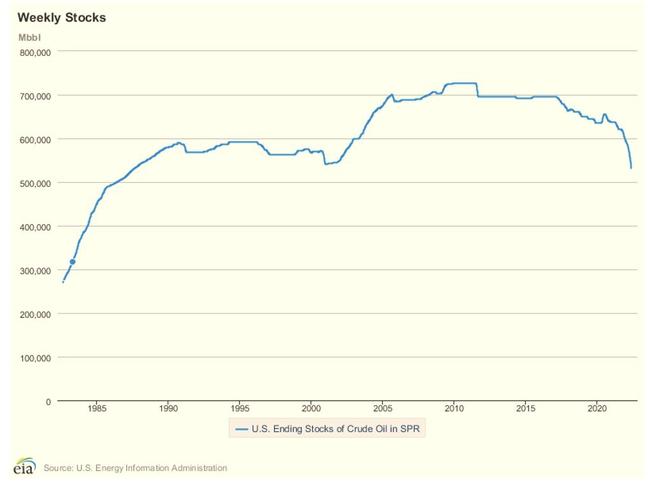

Around the same time that the Morrison government cut the fuel excise tax, the Biden administration embarked on its own attempt at solving high fuel costs in the US – with a release of oil from the US Strategic Petroleum Reserve.

The idea was that releasing one million barrels a day from the reserve, or around 1 per cent of normal global consumption, would help put downward pressure on oil prices. The current release of reserves is scheduled to end on the September 27.

While the impact of the release of reserves in a vacuum was not expected to have a game-changing impact on oil prices, when combined with other market headwinds it has helped in keeping prices lower than they otherwise would have been.

The impact of Covid

Since China entered its latest and most protracted round of Covid driven lockdowns and movement restrictions, its demand for oil has fallen significantly, helping to put downward pressure on prices globally.

According to figures from the Chinese government’s National Bureau of Statistics, the output of distillates (petrol, diesel, jet fuel etc) from Chinese oil refineries was down almost two million barrels a day since the peak in refining activity in the middle of last year.

A reopening in China is a double edged sword for the global economy.

— Avid Commentator 🇦🇺 (@AvidCommentator) May 17, 2022

Good news things could return to normal before the next round of lockdowns.

Bad news that the world needs to find ~1.8 million barrels of oil a day, when gasoline/diesel prices are at all time highs. https://t.co/iy10WDLdeIpic.twitter.com/0hl985bdlV

Currently the Chinese government is attempting to reboot its economy, with a 33-point revival plan and a great deal of rhetoric on how the economy will bounce back from lockdown. Whether this plan will actually be successful in returning China to normal is questionable, but it’s worth exploring a scenario in which their efforts are effective.

A full resumption of the Chinese economy would conservatively boost oil consumption by around 1.5 million barrels a day. Put that together with the end of the American releases of strategic oil reserves and that is 2.5 million barrels or roughly 2.5 per cent of global consumption that needs to be found.

An already challenging Aussie outlook

As news.com.au reported earlier in the week, parts of the nation are already facing serious challenges with energy prices. Australian gas prices generally sit around $3 per gigajoule (GJ), but that skyrocketed to more than $380/GJ this week.

During 2022, wholesale electricity has risen by more than 140 per cent and if gas prices continue to remain high, they may go even higher again.

In the midst of this already challenging backdrop, the conclusion of the fuel excise tax cut and releases of strategic American oil reserves may present another hurdle for Australian households, unless the issue of high global oil prices is addressed by the end of September.

A potential reopening of the Chinese economy and its impact on global energy demand is also a wildcard that could place further upward pressure on energy prices, but whether or not it will occur remains under a major question mark.

Despite paying more than $2 a litre for regular unleaded in recent weeks, Australians have actually enjoyed a bit of the Lucky Country’s good fortune in dodging record high petrol prices, at least for now.

Ultimately, in time, the factors supporting lower fuel prices for Australians will come to a conclusion, but where fuel prices will sit when that time comes is well and truly an open question.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as Petrol prices look set to skyrocket as three key factors combine