‘Punching itself in the face’: RBA cops more heat from former Treasurer Wayne Swan

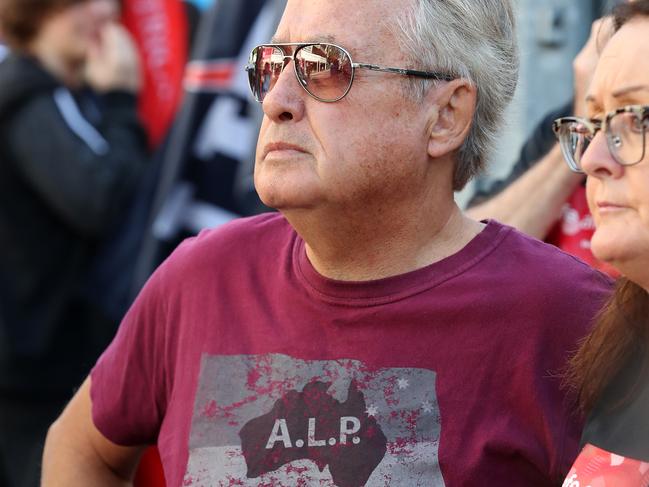

A former federal treasurer and current Labor Party national president has come out swinging against the Reserve Bank, saying the RBA is ‘punching itself in the face’.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

The Reserve Bank of Australia has been dealt more criticism, with a colourful attack by former Treasurer Wayne Swan.

Australia’s central bank is “punching itself in the face” and “putting economic dogma over rational economic decision making”, Mr Swan told Channel 9 on Friday.

The RBA holding interest rates high was “hammering households, hammering mums and dads with higher rates, causing a collapse in spending and driving the economy backwards”, he said.

Prime Minister Anthony Albanese was quick to affirm his respect for the independent RBA.

“They are in charge of monetary policy, we are in charge of fiscal policy … The fight against inflation is one we are all engaged with,” the Prime Minister said when asked about Mr Swan’s comments.

Mr Swan was Treasurer for six years in the Rudd and Gillard governments, and his comments amplify a broadside blow the current Treasurer threw at the RBA on Sunday.

“With all this global uncertainty on top of the impact of rate rises which are smashing the economy it would be no surprise at all if the national accounts on Wednesday show growth is soft and subdued,” Mr Chalmers said last weekend.

He later clarified that while the Reserve Bank and the government had different roles, they were working together to combat inflation.

But that prediction on data released Wednesday came to fruition.

Gross Domestic Product data shows the economy grew by 0.2 per cent in the June quarter, and 1 per cent over the last year. It is the slowest growth in more than 30 years, excluding the first year of the Covid-19 pandemic.

“The government is doing a lot to bring down inflation, but the Reserve Bank is simply punching itself in the face,” Mr Swan said.

“It’s counter-productive and it’s not good economic policy. And I’m incredibly disappointed with what they’re doing.”

“I’m very, very disappointed in what the Reserve Bank is doing at the moment. And if you look at (share) markets, they’re all forecasting rate drops. They’re going down around the world,” Mr Swan said.

The former deputy Prime Minister is the current national Labor Party president. While there had been speculation earlier in the year Anthony Albanese would call an election before the New Year should the RBA cut rates before then, the chance of a rate cut this year seems to have evaporated.

Originally published as ‘Punching itself in the face’: RBA cops more heat from former Treasurer Wayne Swan