‘Peak AI hype’: Barefoot Investor’s verdict on Nvidia

Barefoot Investor Scott Pape has delivered his verdict on investing in Nvidia and the artificial intelligence frenzy.

Investing

Don't miss out on the headlines from Investing. Followed categories will be added to My News.

Barefoot Investor Scott Pape has delivered his verdict on investing in Nvidia.

The US tech firm, which briefly soared in value to overtake Microsoft as the world’s most valuable company last month before shedding a whopping $646 billion in subsequent days, is one of the key manufacturers of chips and graphics processors used in artificial intelligence (AI) data centres.

Surging hype among investors about the future of generative AI has seen Nvidia’s stock soar by more than 150 per cent in the first six months of 2024, but the company’s dizzying rise and subsequent sell-off sparked fears of another dotcom-style bubble.

Pape was asked by a reader in his email newsletter this week about investing in the company. Nvidia’s share price closed at $US124.30 on Monday, down more than 8 per cent from its peak last month.

But the firm, which now has a market cap of $US3.07 trillion ($4.6 trillion), is still up more than 200 per cent in value compared with this time last year.

“Given that artificial intelligence is going to change the world, up-end entire industries and render millions of people unemployed (hopefully not me!), I am thinking about investing a large part of my superannuation into Nvidia, the AI chip maker that is dominating the industry,” the reader wrote.

“But I just wanted your thoughts first. Do you invest in it?”

Pape responded that “we’re currently at peak AI hype”.

“Investors are obsessed with the potential of artificial intelligence, and the chance of making a quick buck has got them treating Nvidia like a casino chip,” he wrote.

“Last week Nvidia became the world’s most valuable company. This week it suffered the biggest three-day loss of any company in history, according to Bloomberg. Something tells me that the croupier hasn’t yet called ‘no more bets’.”

But Pape said he would invest in Nvidia.

“In fact I do,” he wrote. “I own Nvidia (among hundreds of other stocks) through my international index funds, and that’s enough for me.

“But would I go balls and all into Nvidia at it these prices? Well, you could ask ChatGPT … but I’m a strong no.”

Australia’s largest superannuation funds have reaped an $8 billion windfall from their Nvidia holdings over the past four months, The Australian reported, while casino mogul James Packer, the country’s largest individual investor, now has a stake worth nearly $1 billion.

Nvidia has seen record revenue as tech giants like Microsoft, Apple, Amazon, Meta and X engage in an AI arms race, building enormous, power-hungry data centres packed with tens or hundreds of thousands of its flagship H100 processors.

Meta founder Mark Zuckerberg said in January his company was spending billions of dollars on AI chips this year, including 350,000 H100s.

In March, The Information reported that Microsoft and OpenAI were working on plans for a $US100 billion ($151 billion) data centre project — 100 times more costly than some of the biggest existing data centres — to launch in 2028 alongside a new AI supercomputer called “Stargate”.

The same month, Amazon spent $US650 million ($980 million) to acquire a 960 megawatt data centre campus next to a nuclear power station in Pennsylvania.

The H100 is effectively a more powerful version of the kind of graphics processing unit (GPU) normally used to power gaming PCs, with the powerful data processing capability now turned to the resource-intensive calculations required for generative AI.

Estimated to cost between $US25,000 and $US30,000 each, the H100s have become so valuable to tech firms that they are now transported to data centres via armoured car.

Nvidia controls about 92 per cent of the market for data centre GPUs, according to Bloomberg, citing market research firm IDC.

Chipmaker rivals including AMD and Intel, as well as cloud computing firms owned by Amazon, Alphabet and Microsoft, have so far made little headway in challenging Nvidia’s dominant position.

The California-based tech firm stunned the market in May with first-quarter financial results showing record data centre revenue of $US22.6 billion ($34.1 billion), up 427 per cent from a year ago.

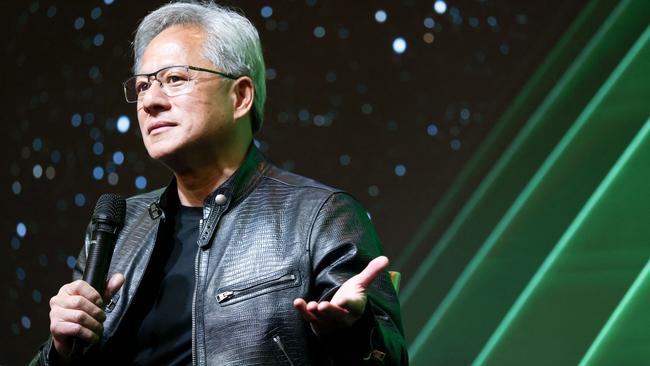

“The next industrial revolution has begun — companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centres to accelerated computing and build a new type of data centre — AI factories — to produce a new commodity: artificial intelligence,” Nvidia founder and chief executive Jensen Huang said in the announcement.

“AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities.”

The Taiwanese-born tech whiz — who moved to Kentucky at age nine — took his business from a mostly obscure entity selling GPU devices to gamers, to a massive business after branching out into AI and enjoying unprecedented growth.

But some think Nvidia has flown too high, too fast, and that last month’s crash was a precursor of more to come.

“Nvidia’s rich valuation is ludicrous — its market cap now exceeds that of the entire FTSE 100, yet its sales are less than 4 per cent of that index,” said Emily Bowersock Hill, chief executive and founding partner of Bowersock Capital Partners.

Other experts have weighed with similarly sobering views.

Goldman Sachs head of global equity research Jim Covello likened Nvidia’s situation to the dotcom bubble in the 1990s and early 2000s.

“The bursting of today’s AI bubble may not prove as problematic as the bursting of the dotcom bubble simply because many companies spending money today are better capitalised than the companies spending money back then,” he said.

“But if AI technology ends up having fewer use cases and lower adoption than consensus currently expects, it’s hard to imagine that won’t be problematic for many companies spending on the technology today.”

Jim Reid, financial research strategist at Deutsche Bank, also said there were “signs of over-exuberance” about Nvidia.

Robert Arnott, US investor and chairman of Research Affiliates, wrote in September that Nvidia is “a textbook story of a Big Market Delusion”.

Mr Arnott pointed out that Nvidia’s shares were trading at around 110 times its earnings, which is not viable in the long run.

“Overconfident markets paradoxically transform brilliant future business prospects into even more brilliant current stock price levels,” he said.

“Nvidia is today’s exemplar of that genre: a great company priced beyond perfection.”

— with Alex Turner-Cohen

More Coverage

Originally published as ‘Peak AI hype’: Barefoot Investor’s verdict on Nvidia