One thing you can do to save your superannuation

As the uncertainty unleashed by Donald Trump’s trade wars continues to echo around the globe, many Australians are taking this step.

Super

Don't miss out on the headlines from Super. Followed categories will be added to My News.

As the uncertainty and disorder unleashed by US President Donald Trump’s various trade wars continue to echo around the globe, many Australians have been left looking at their superannuation balances and wondering where things go from here.

But for Australians who hold their superannuation in a self-managed fund, there is an additional layer of choice, empowerment and risk. Since being officially introduced in 1999, more than 1.14 million Australians have chosen to manage their own retirement savings across more than 619,000 self-managed super funds.

Since the lockdown and pandemic impacted days of 2019-20, the net number of new self-managed super funds being registered each year has risen by more than fourfold, from 3504 in 2019-20 to 21,630 in the latest figures which cover the year to June 2024.

For some it’s a pathway to more tangible control over one’s retirement, for other’s it provides the ability to invest in assets otherwise inaccessible through a normal every day super fund.

The property angle

The affinity of many Australians for property investment also extends to the world of self-managed super, where account holders can choose to borrow against their super to buy investment properties. For some it’s the means to buy a commercial property that they or someone close to them uses for work purposes, effectively becoming their own landlord. For others, it provides the means to invest in residential properties.

In total, self-managed super funds own 6.5 per cent of the nation’s $1.7 trillion commercial real estate market by value, holding almost $110 billion worth of this type of asset.

When it comes to residential property, a still sizeable $58.3 billion is held by self-managed super funds, but the proportion of the overall of the residential housing market held by value held is much lower at 0.53 per cent of the total.

Bitcoin and crypto

For some Australians, their self-managed super fund is a pathway to investing their retirement savings in cryptocurrency. In the last five years of data, the total amount of cryptocurrency held by self-managed super funds has risen by 639 per cent, from $199 million in December 2019 to $1.67 billion in December 2024.

While there is some degree of cryptocurrency exposure in self-managed super funds worth more than $500,000, the heaviest allocation by the proportion of total assets dedicated to crypto occurs in funds with balances of $100,000 or under.

Overall, the largest allocation to cryptocurrency is held by accounts with a total balance of $100,000 or less.

In 2018-19, cryptocurrency made up 1.6 per cent of total assets for self-managed super funds in aggregate with under $50,000 in assets and 1.5 per cent for funds with $100,000 or less in assets. By 2022-23, 10.2 per cent of total assets for self managed super funds in aggregate with assets under $50,000 were held in cryptocurrency, followed by 7.9 per cent of funds with $50,000 to $100,000 and 4.2 per cent of funds with $100,000 to $200,000.

The numbers

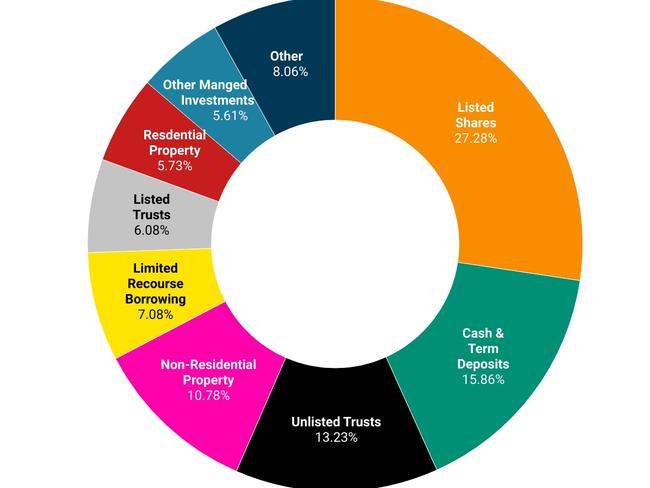

As of the latest data from the ATO which covers up to the end of last year, self-managed super funds hold net assets of $981 billion. Of that total the largest share of the pie by asset allocation goes to listed shares with 27.3 per cent, cash and term deposits with 15.9 per cent and unlisted trusts with 13.2 per cent.

As one might imagine with a tax advantaged environment like superannuation, the distribution of balances is far from equal. Funds with balances of under half a million dollars account for 31.1 per cent of the overall total, yet account for 4.6 per cent of overall balances.

At the other end of the spectrum, 4.9 per cent of self-managed super funds hold balances of $5 million or more, yet this cohort holds 30.9 per cent of all overall balances.

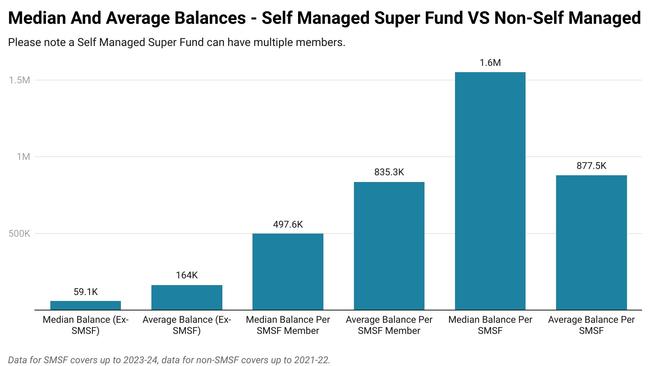

As of the conclusion of the 2022-23 financial year, the average self managed super fund balance across its various members is $1.55 million, with the average for each individual member $835,200.

Meanwhile, the median balance for each self managed fund is $877,500 and the median for each individual member is $497,600.

While the presence of funds with extremely large balances skews the average, even at the median the figure is still more than seven times higher than the median male superannuation balance outside of self managed funds and more than nine times for women in the same cohort.

The takeaway

On one hand a self-managed super fund provides a great deal of freedom and the ability to allocate one’s retirement savings to a wide array of assets. On the other, it comes with the risk and challenge of having to manage those assets and ensure that everything is conducted correctly from a regulatory perspective.

Despite the rise of lower cost options, self-managed super funds remain a relatively rare thing, with fewer than one member account for every 20 Australian residents and the proportion of accounts per capita rising by 0.08 percentage points in the last five years.

In time that may change, particularly if market volatility is here to stay. But for now, the self-managed pathway is one that is largely favoured by those who desire a significantly different approach to traditional funds and those who have the means to make the additional challenges present by the self-managed approach worth their while.

Originally published as One thing you can do to save your superannuation